يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At SiteOne (SITE) Valuation As New USL And MLS Partnership Expands Brand Reach

SiteOne Landscape Supply, Inc. SITE | 151.40 | +0.65% |

USL and MLS partnership brings SiteOne into the soccer spotlight

SiteOne Landscape Supply (SITE) is drawing fresh attention after becoming the Official Landscape Supply Partner of the United Soccer League, with a multi year agreement that also extends across major MLS properties.

The partnership blends broad media exposure, club level activations and community field refurbishment programs. This gives investors a new angle on how SiteOne is positioning its brand with sports organizations and local communities.

Investors seem to be weighing the upcoming February 11 earnings release and the new USL and MLS agreement against a mixed track record, with a 17.79% 1 month share price return and an 18.70% year to date share price return. This contrasts with a more muted 1 year total shareholder return of 1.21% and a 5 year total shareholder return decline of 6.63%, which suggests recent momentum has picked up after a softer multi year experience.

If this kind of brand driven story interests you, it could be a good moment to widen your research and check out fast growing stocks with high insider ownership.

So with SiteOne’s recent share price gains, modest 1 year total return and current price sitting close to analyst targets, should you see the stock as overlooked value, or as a name where the market already prices in future growth?

Most Popular Narrative: 5.1% Undervalued

Compared with the last close at $148.45, the most followed narrative pegs SiteOne Landscape Supply’s fair value a little higher, which frames the recent soccer partnership in the context of broader growth and margin expectations.

Ongoing acquisition of smaller, high margin businesses in a fragmented market allows SiteOne to consolidate market share, introduce higher margin products, and leverage operational synergies, leading to long term revenue growth and potential margin expansion.

Curious how that acquisition push, plus private label mix and digital tools, is built into the forecast playbook? The full narrative spells out the revenue glide path, margin lift and earnings power that sit behind this fair value call.

Result: Fair Value of $156.40 (UNDERVALUED)

However, there are still pressure points to watch, including exposure to cyclical construction markets and the risk that acquisitions or integrations do not deliver the expected margin gains.

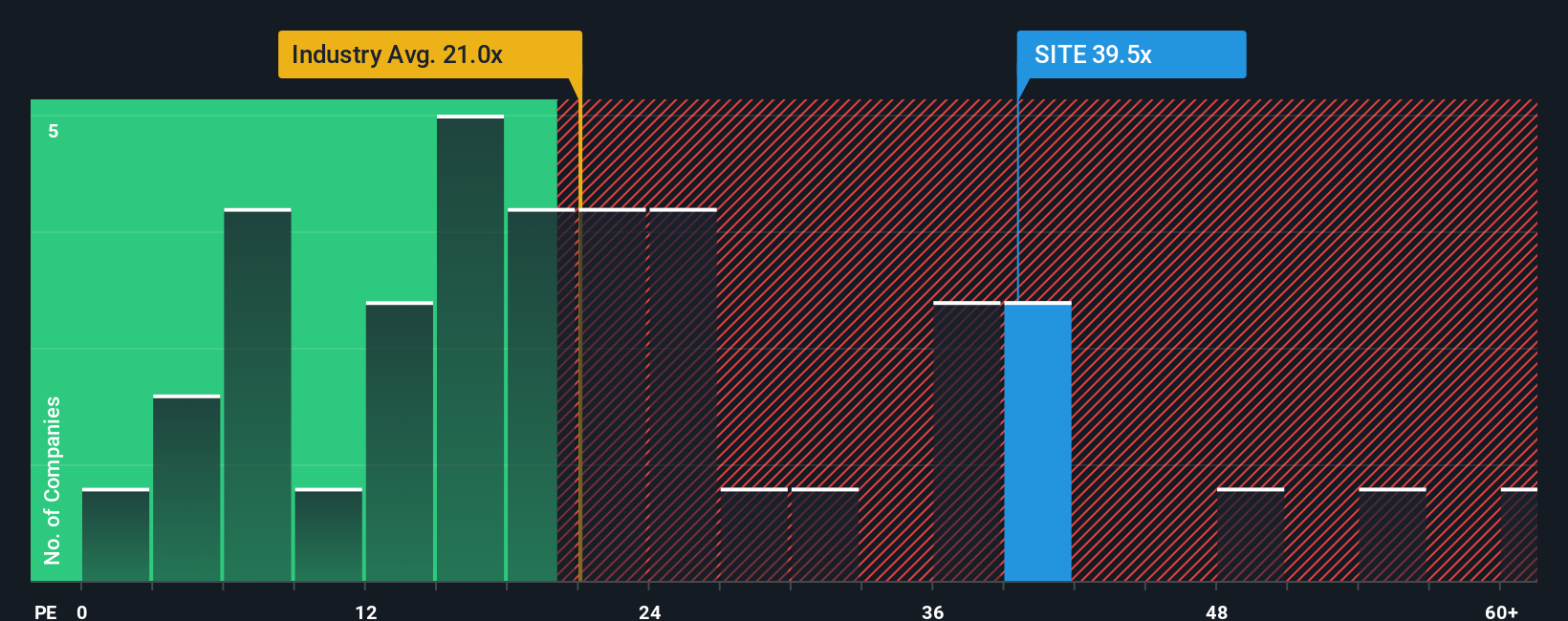

Another View: Rich P/E Puts the Story Under Pressure

Our DCF model is not the only lens you can use here. On earnings, SiteOne trades on a P/E of 47.3x versus 23.3x for the US Trade Distributors industry and a fair ratio of 28.4x. This implies a lot of good news is already priced in. If the market shifts closer to that fair ratio, how much of the soccer fueled optimism would still feel comfortable to you?

Build Your Own SiteOne Landscape Supply Narrative

If you see the numbers differently, or prefer to test the assumptions yourself, you can build your own view in a few minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding SiteOne Landscape Supply.

Looking for more investment ideas?

If you like what you are learning about SiteOne, do not stop there. Broaden your watchlist with fresh ideas that fit your style and goals.

- Spot potential mispricings by checking out these 878 undervalued stocks based on cash flows that might offer more compelling entry points than widely followed names.

- Ride major technology shifts by scanning these 24 AI penny stocks for companies tied to artificial intelligence themes that interest you.

- Add income focused names by reviewing these 12 dividend stocks with yields > 3% that provide yields above 3% alongside stock market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.