يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At St. Joe (JOE) Valuation As Fairholme Trims Its Highly Concentrated Position

St. Joe Company JOE | 71.52 | +0.83% |

Fairholme Fund’s latest N-PORT filing shows it trimmed its stake in St. Joe (JOE) by 104,100 shares, yet the stock still represents 87.04% of the portfolio. This raises questions about concentration and risk.

At a share price of $68.56, St. Joe has seen a 10.99% 1 month share price return and a 17.16% 3 month share price return, while its 1 year total shareholder return stands at 48.10%, suggesting momentum has been building even as Fairholme trims its position.

If this concentration story has you thinking about diversification, it could be a good moment to broaden your search with our 22 top founder-led companies.

With St. Joe trading at $68.56 and an estimated intrinsic discount of 19.62%, the key question is whether investors are looking at a genuine value gap or at a market that already expects stronger growth ahead.

Preferred P/E of 37.8x: Is it justified?

St. Joe is trading at $68.56 and sits on a P/E of 37.8x, which the data suggests is cheaper than close peers but more expensive than the broader US Real Estate industry.

The P/E ratio compares the share price with earnings per share and is a quick way of seeing how much investors are paying for each dollar of profit. For a real estate development and hospitality group like St. Joe, a higher P/E can reflect expectations that current earnings are being supported by a growing project pipeline and operating footprint rather than one off profits.

Against its direct peer set, St. Joe is flagged as "good value" on a 37.8x P/E compared with a 44.2x peer average. This points to a lower earnings multiple than similar companies. At the same time, that 37.8x P/E is described as "expensive" versus the US Real Estate industry average of 28.2x. This is a clear signal that the market is currently willing to ascribe a richer earnings multiple than the sector as a whole.

Result: Price-to-Earnings of 37.8x (ABOUT RIGHT)

However, that story can shift quickly if real estate demand cools or if hospitality and commercial assets underperform, given St. Joe’s highly concentrated business mix.

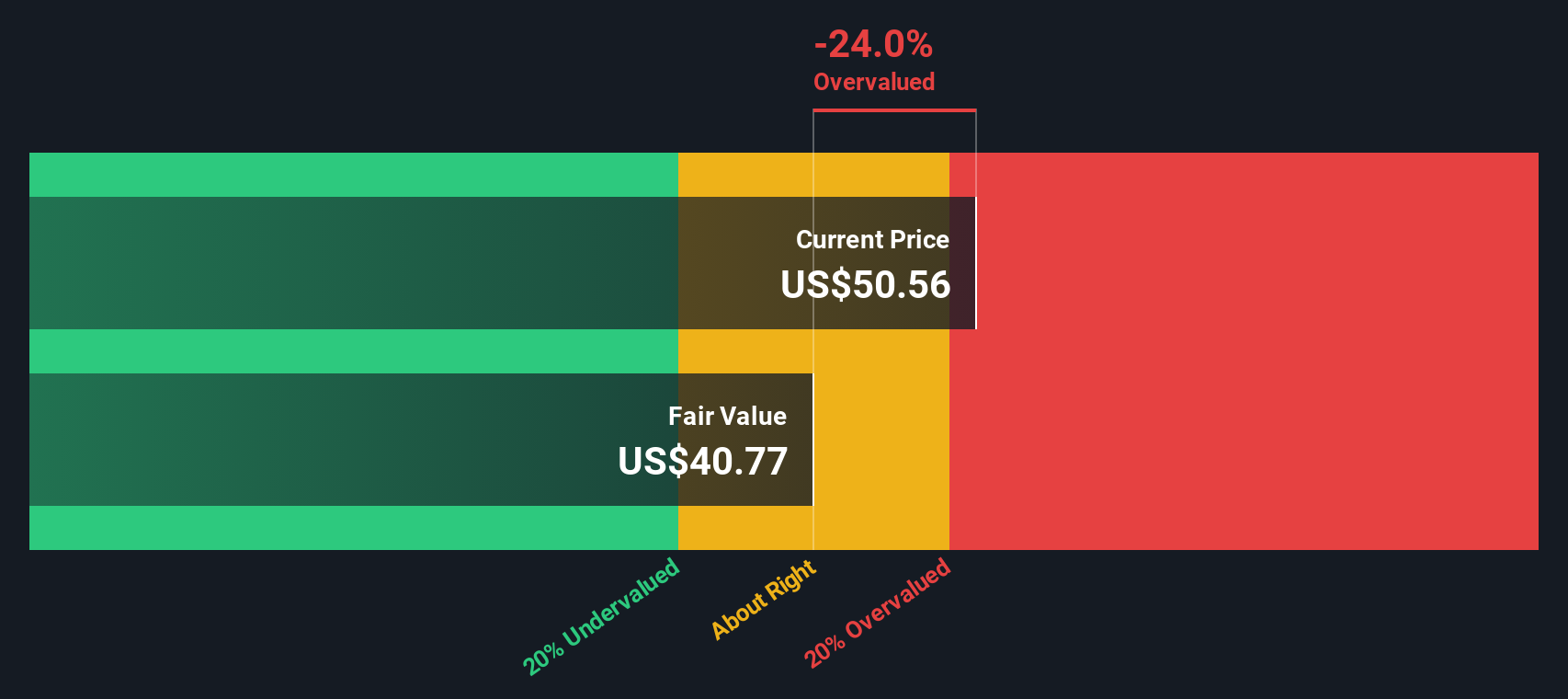

Another View: DCF Points To A Different Price

While the P/E of 37.8x presents St. Joe as valued more highly than the wider US real estate group, our DCF model estimates a fair value of $85.29 per share, around 19.6% above the current $68.56 price. It is not clear which signal the market will favor next.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out St. Joe for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own St. Joe Narrative

If you think the data tells a different story, or you simply prefer to test your own assumptions, you can build a full view in just a few minutes, starting with Do it your way.

A great starting point for your St. Joe research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one stock. Use the tools available and give yourself more options to compare.

- Spot potential turnaround stories early by scanning 25 elite penny stocks with strong financials, which pair lower share prices with stronger underlying financials.

- Hunt for quality at a sensible price by checking our 53 high quality undervalued stocks, highlighting companies with solid fundamentals that the market may be overlooking.

- Prioritise resilience by reviewing the 86 resilient stocks with low risk scores, focused on businesses with lower risk scores that may better suit cautious capital.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.