يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Targa Resources’ Valuation After Recent Share Price Momentum

Targa Resources Corp. TRGP | 231.35 | +3.21% |

What Targa Resources’ Recent Performance Tells You

Targa Resources (TRGP) has drawn fresh attention after a solid run in its shares, with the stock last closing at $203.64 and showing positive returns over the past week, month, and past 3 months.

That recent move comes alongside reported annual revenue of $17.4b and net income of $1.6b, with both revenue and net income growth rates in the mid to low double digits. This gives investors more concrete financial context for the price action.

Beyond the recent move, the stock has shown building momentum, with a 30-day share price return of 9.03% and a 90-day share price return of 25.17%, alongside a very large 5-year total shareholder return.

If you are looking for other energy names benefiting from investor interest in infrastructure and resources, it could be a good moment to scan aerospace and defense stocks as a starting point for fresh ideas.

So with TRGP trading near $203.64, annual revenue of about $17.4b, net income of $1.6b, and an indicated intrinsic discount of roughly 25%, is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 4% Undervalued

With Targa Resources last closing at $203.64 against a widely followed fair value of $212.05, the leading narrative frames this as a modest discount anchored in cash flow expectations and capital returns.

Targa's strategic focus on long-term, fee-based contracts with blue-chip producers and end-users has driven resilience in cash flows, even amid commodity price volatility, and sets the stage for more predictable, higher free cash flow available for shareholder returns and potential deleveraging. The company's ongoing share repurchase program and growing dividend, backed by a strong balance sheet and flexible capital allocation, signal confidence in intrinsic value and suggest an undervaluation if fundamentals remain robust, directly benefiting per-share earnings and supporting total shareholder return.

Curious what sits behind that cash flow confidence, the assumed growth in throughput, and the earnings multiple used to reach $212.05? The full narrative lays out the revenue ramp, margin expectations, and valuation bridge that underpin this fair value, so you can decide how those inputs line up with your own view.

Result: Fair Value of $212.05 (UNDERVALUED)

However, you also need to weigh risks, such as midstream overbuild pressuring fees or tighter environmental rules raising costs and affecting long term project economics.

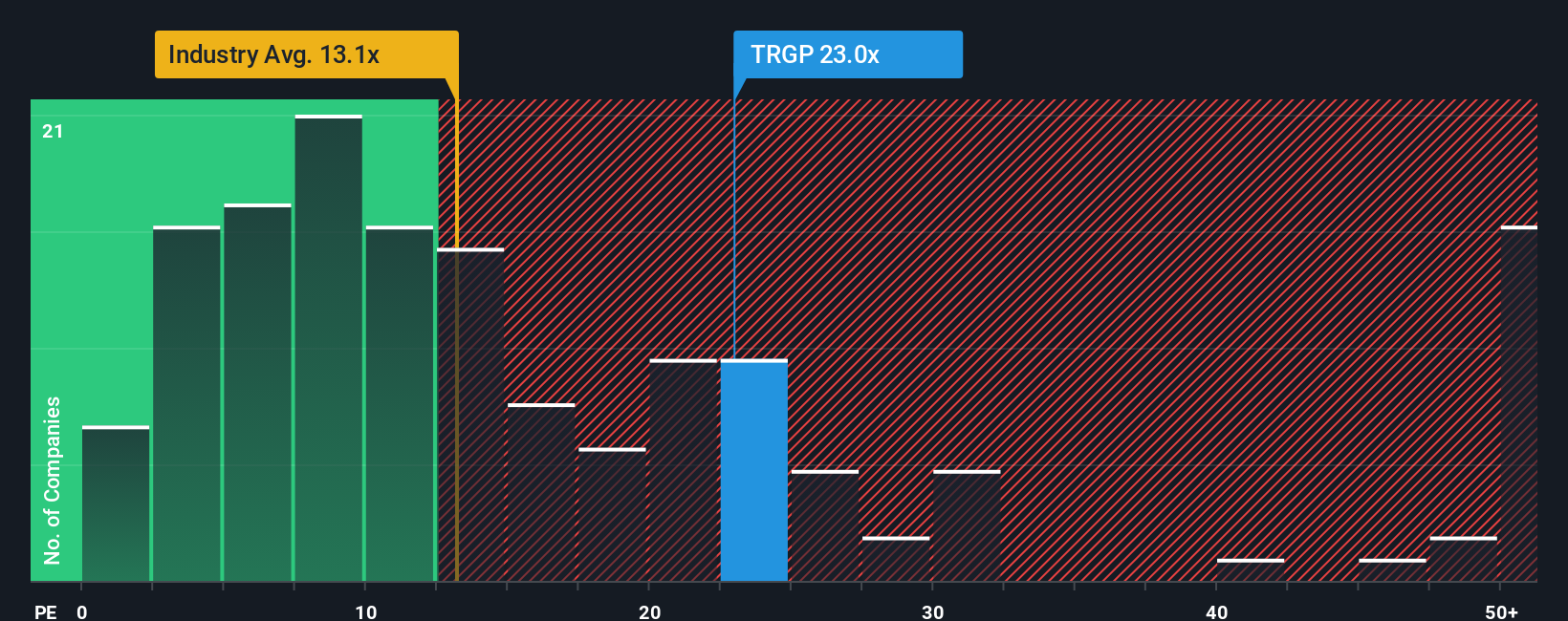

Another Way To Look At Targa’s Valuation

The cash flow work suggests Targa is about 25.5% below our estimate of fair value, which leans toward an undervalued story. However, on earnings the picture is tighter, with a P/E of 27.1x versus a fair ratio of 22.9x and an industry average of 13.5x. That gap points to valuation risk if growth or cash flows do not match expectations. Which signal do you think should carry more weight?

Build Your Own Targa Resources Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a fresh, data driven view in just a few minutes with Do it your way.

A great starting point for your Targa Resources research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready To Find More Investment Ideas?

If Targa has caught your eye, do not stop here; use the Simply Wall St Screener to quickly spot other opportunities that fit your style and goals.

- Zero in on potential mispricings by scanning these 871 undervalued stocks based on cash flows that may offer more attractive entry points based on cash flows.

- Capture growth themes early by checking out these 26 AI penny stocks shaping the future of automation and data driven business models.

- Strengthen your income ideas by reviewing these 13 dividend stocks with yields > 3% that focus on companies offering higher yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.