يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

نظرة على سعر سهم Spok Holdings Inc. مقارنةً بالأرباح

Spok Holdings, Inc. SPOK | 13.56 | -0.22% |

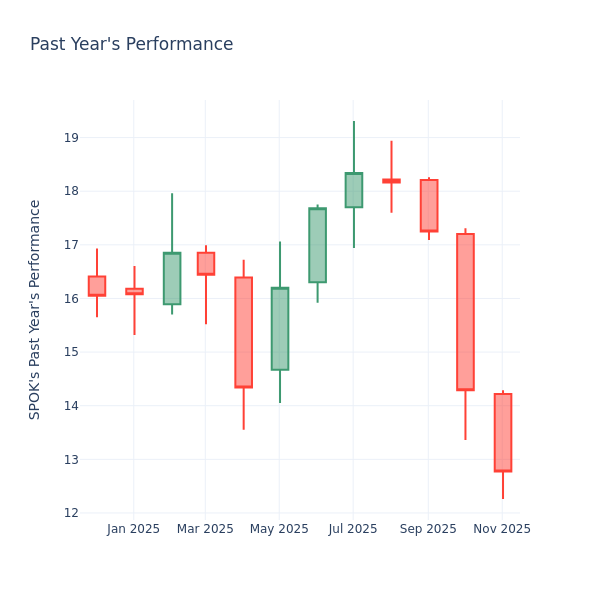

في جلسة التداول الحالية، بلغ سعر سهم شركة سبوك هولدينغز (ناسداك: SPOK ) 12.75 دولارًا أمريكيًا، بعد ارتفاع طفيف بنسبة 0.24% . مع ذلك، انخفض السهم بنسبة 22.15% خلال الشهر الماضي، وبنسبة 21.96% خلال العام الماضي. قد يرغب المساهمون في معرفة ما إذا كان السهم مقومًا بأقل من قيمته الحقيقية، حتى وإن كان أداء الشركة جيدًا في جلسة التداول الحالية.

تحليل نسبة السعر إلى الأرباح لشركة سبوك هولدينغز مقارنةً بنظيراتها في القطاع

يستخدم المساهمون على المدى الطويل نسبة السعر إلى الأرباح لتقييم أداء الشركة في السوق مقارنةً ببيانات السوق الإجمالية، والأرباح التاريخية، والقطاع ككل. قد تشير نسبة السعر إلى الأرباح المنخفضة إلى أن المساهمين لا يتوقعون تحسن أداء السهم في المستقبل، أو قد تعني أن الشركة مقومة بأقل من قيمتها الحقيقية.

تتمتع شركة Spok Holdings بنسبة سعر إلى ربحية أفضل تبلغ 15.9 مقارنةً بمتوسط نسبة السعر إلى الربحية لقطاع خدمات الاتصالات اللاسلكية البالغ 15.24 . قد يُفترض نظرياً أن أداء Spok Holdings Inc. قد يتفوق مستقبلاً على أداء شركات القطاع، إلا أنه من المرجح أن يكون سعر سهمها مبالغاً فيه.

في الختام، يُعدّ مُضاعف الربحية (P/E) مقياسًا مفيدًا لتحليل أداء الشركة في السوق، ولكنه لا يخلو من بعض القيود. فبينما قد يُشير انخفاض مُضاعف الربحية إلى أن الشركة مُقوّمة بأقل من قيمتها الحقيقية، قد يُوحي أيضًا بأن المساهمين لا يتوقعون نموًا مُستقبليًا. إضافةً إلى ذلك، لا ينبغي استخدام مُضاعف الربحية بمعزل عن غيره، إذ يُمكن لعوامل أخرى، مثل اتجاهات القطاع والدورات الاقتصادية، أن تُؤثر على سعر سهم الشركة. لذا، ينبغي على المُستثمرين استخدام مُضاعف الربحية جنبًا إلى جنب مع مؤشرات مالية أخرى وتحليلات نوعية لاتخاذ قرارات استثمارية مدروسة.