يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Piece Of The Puzzle Missing From Oil-Dri Corporation of America's (NYSE:ODC) 27% Share Price Climb

Oil-Dri Corporation of America ODC | 63.69 | +1.33% |

Oil-Dri Corporation of America (NYSE:ODC) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

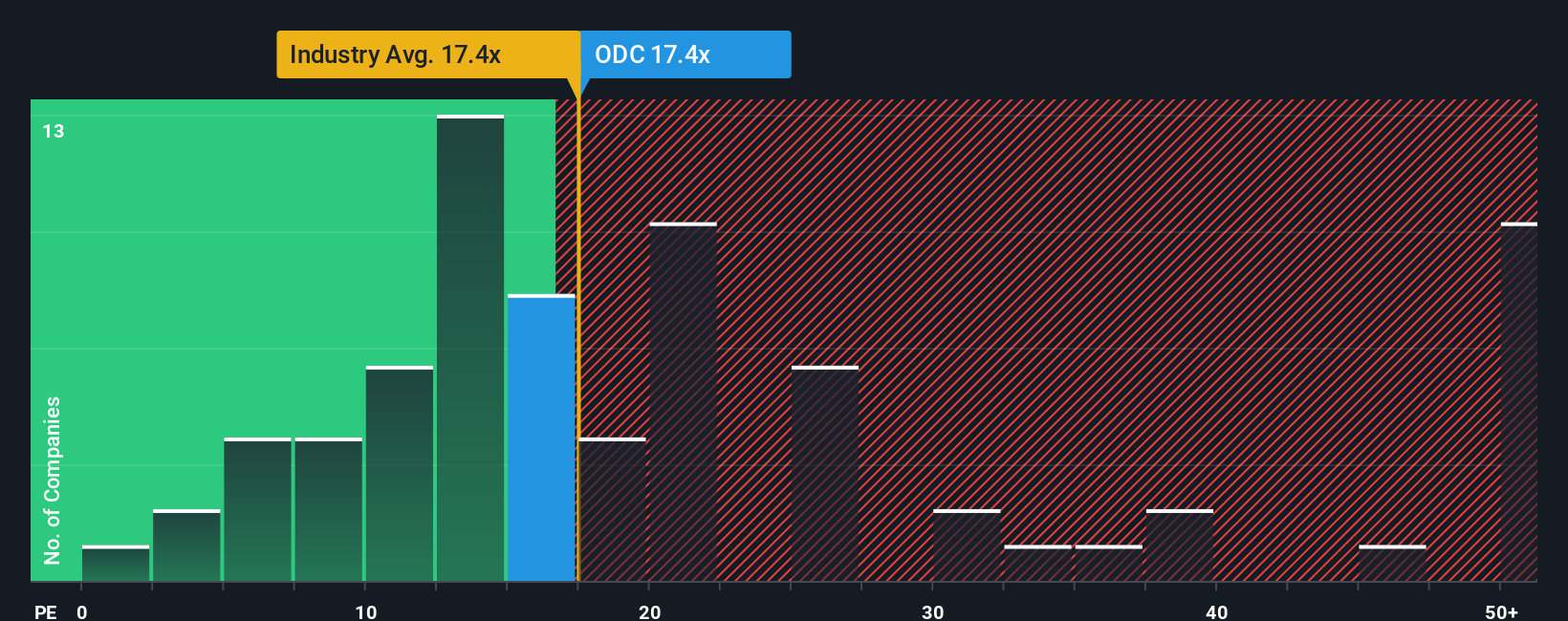

Even after such a large jump in price, it's still not a stretch to say that Oil-Dri Corporation of America's price-to-earnings (or "P/E") ratio of 17.7x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 19x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Earnings have risen firmly for Oil-Dri Corporation of America recently, which is pleasing to see. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Is There Some Growth For Oil-Dri Corporation of America?

The only time you'd be comfortable seeing a P/E like Oil-Dri Corporation of America's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 17%. The latest three year period has also seen an excellent 360% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 16% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Oil-Dri Corporation of America's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Oil-Dri Corporation of America's P/E?

Its shares have lifted substantially and now Oil-Dri Corporation of America's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Oil-Dri Corporation of America revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Oil-Dri Corporation of America with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Oil-Dri Corporation of America.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.