يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Angi Inc.'s (NASDAQ:ANGI) Shares Not Telling The Full Story

Angi Inc Class A ANGI | 12.49 12.49 | -1.42% 0.00% Post |

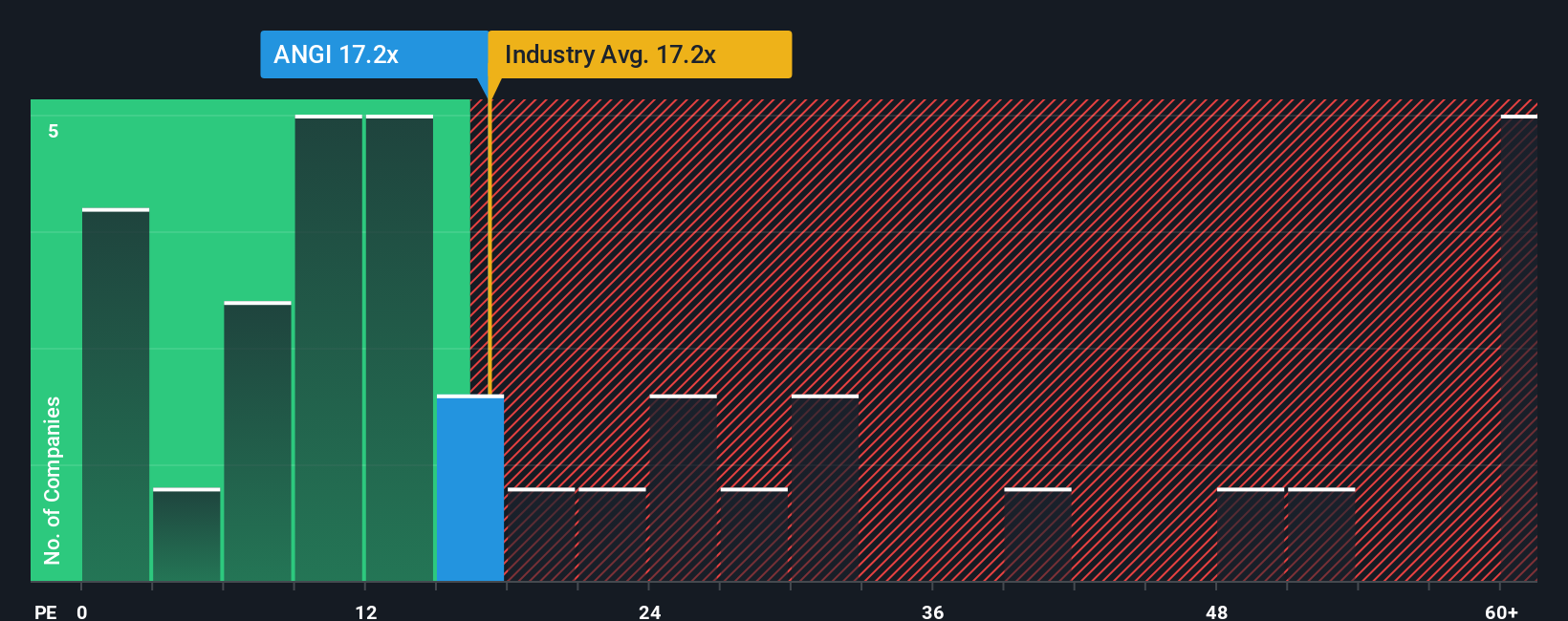

Angi Inc.'s (NASDAQ:ANGI) price-to-earnings (or "P/E") ratio of 17.2x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 20x and even P/E's above 35x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Angi's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Is There Any Growth For Angi?

The only time you'd be truly comfortable seeing a P/E as low as Angi's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 6.6% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader market.

With this information, we find it odd that Angi is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Angi currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Angi with six simple checks on some of these key factors.

You might be able to find a better investment than Angi.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.