يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

APi Group (APG) Valuation Check After Earnings Momentum And Shift Toward Recurring Fire And Life Safety Services

APi Group Corporation APG | 44.64 | +0.52% |

APi Group (APG) has drawn fresh attention after reaching a new 52 week high, coinciding with a run of positive earnings surprises and upward estimate revisions. This performance has been supported by its focus on mission critical fire and life safety services.

Even after touching a new 52 week high, APi Group’s recent 1 day and 7 day share price pullback contrasts with its 30 day share price return of 6.7% and very strong multi year total shareholder returns. Together, these factors indicate that positive momentum has been building over a longer horizon despite short term swings.

If APi Group’s run has caught your eye, it could be a good moment to broaden your search to fast growing stocks with high insider ownership and see what else is gaining traction.

APi Group now trades close to a fresh high, with a recent 1 year total return of 65.5% and only a modest 13.5% intrinsic discount. So is this still a mispriced compounder, or are markets already pricing in future growth?

Most Popular Narrative: 7.4% Undervalued

APi Group’s most followed narrative pegs fair value at about $44.90, a touch above the recent $41.57 close, putting the current pullback in context.

Consistent expansion in recurring contracts, now targeted to reach 60%+ of revenue by 2028, supports higher adjusted EBITDA margins and predictable cash generation, further improving earnings quality and financial resilience. Continued progress on digital transformation, AI driven productivity tools, and process standardization is expected to deliver ongoing operating leverage and SG&A efficiency, enhancing incremental margins and overall profitability.

Curious what kind of revenue mix shift, margin lift, and future earnings multiple are baked into that fair value? The narrative leans on ambitious profitability gains and a premium earnings profile, and the underlying math might challenge your own expectations.

Result: Fair Value of $44.90 (UNDERVALUED)

However, that story can change quickly if material and labor costs stay elevated, or if acquisition integration proves harder than expected and eats into the margin ambition.

Another View: Multiples Paint a Tougher Picture

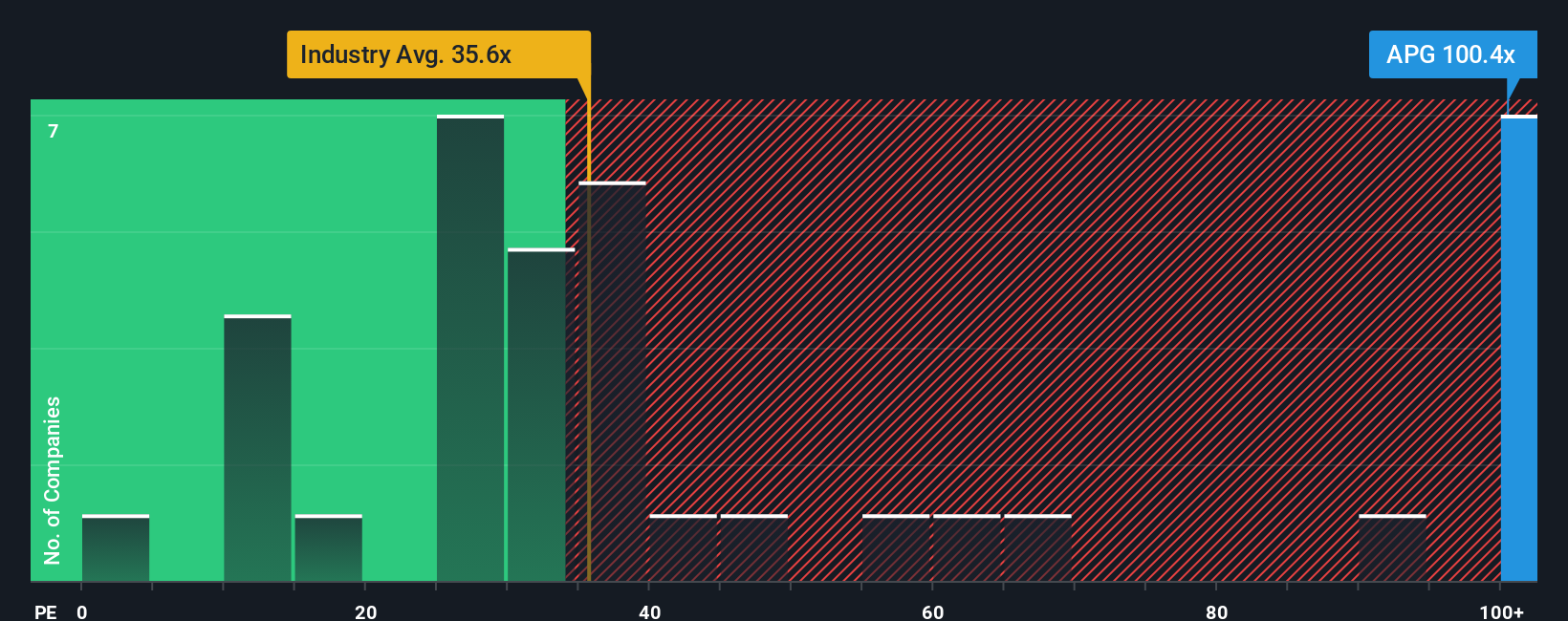

While the narrative and fair value work point to APi Group trading at a discount, the simple P/E check tells a different story. At about 114.9x earnings versus a fair ratio of 58x, the current price looks stretched, especially when the US Construction industry sits near 34.8x and peers around 36.9x.

That gap suggests the market is already paying a high price for future earnings. This raises the question: how confident are you that the story plays out as modeled?

Build Your Own APi Group Narrative

If you see the numbers differently, or prefer to test the assumptions yourself, you can create your own full APi Group view in minutes: Do it your way.

A great starting point for your APi Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If APi Group is on your radar, do not stop there. The Simply Wall St Screener can quickly surface other names that fit the kind of opportunities you are hunting.

- Spot potential value ideas early by scanning these 887 undervalued stocks based on cash flows that currently trade below their estimated worth based on cash flows and fundamentals.

- Tap into powerful tech themes by checking out these 24 AI penny stocks that are harnessing artificial intelligence to reshape their business models.

- Lock in potential portfolio income by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% and may suit an income focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.