يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

APi Group (APG): Valuation Insights as Options Volatility Signals Big Investor Expectations

API GROUP CORPORATION APG | 39.66 | -1.83% |

APi Group has caught the market’s eye after its options contracts saw a surge in implied volatility, signaling expectations of a big price swing. This uptick comes amid cautious analyst sentiment and growing institutional interest.

APi Group’s share price has cooled off recently, but context is everything. The 1-year total shareholder return sits at an impressive 54%, and gains over the past three and five years far outpace the broader market. Modest short-term pullbacks have been overshadowed by a strong run, with recent institutional interest and events like mini-tender offers adding new dimensions to investor sentiment and valuation debates.

If you’re watching for the next breakout, this could be the right time to discover fast growing stocks with high insider ownership.

With APi Group trading at a discount to analyst price targets and high volatility signaling potential shifts, investors may wonder whether there is untapped value left or if the market is already factoring in all of the company’s growth prospects.

Most Popular Narrative: 17% Undervalued

With a fair value estimate of $41 and the last close at $34.05, the narrative sets a notably higher benchmark for APi Group’s potential. This prompts a closer look at the numbers and strategy driving this target.

Consistent expansion in recurring contracts, now targeted to reach 60%+ of revenue by 2028, supports higher adjusted EBITDA margins and predictable cash generation. These trends further improve earnings quality and financial resilience.

Curious how a steady stream of recurring contracts could justify such a lofty target? The valuation hinges on ambitious margin growth and a transformation in cash generation. These projections challenge what most expect from the sector. Discover the detailed narrative powering the forecast.

Result: Fair Value of $41 (UNDERVALUED)

However, persistent input cost pressures or challenges integrating acquisitions could still threaten the margin improvements and optimistic growth targets outlined in the bull case.

Another View: Market Multiples Raise an Eyebrow

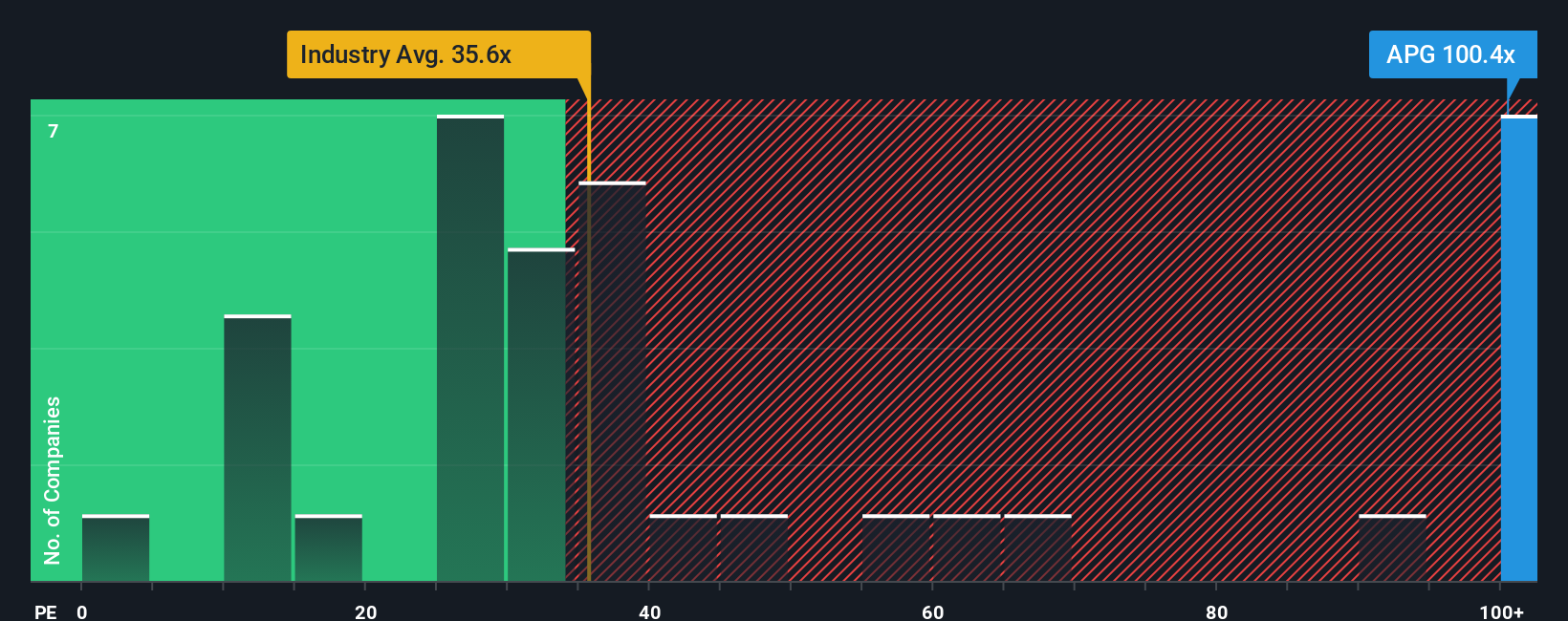

While our model suggests APi Group is undervalued based on future cash flows, market comparisons tell a different story. The company’s current price-to-earnings ratio stands at 100.4x, nearly triple the US Construction industry average of 36.7x and well above the fair ratio of 54.2x. This hefty premium means the market is demanding a lot of future growth, which brings more risk if expectations are not met. So which valuation lens tells the real story here?

Build Your Own APi Group Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can craft your own personalized analysis in just a few minutes, Do it your way.

A great starting point for your APi Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always look beyond a single stock. Don’t miss your chance to tap into the next wave of opportunities and strengthen your strategy with new, future-ready picks.

- To target reliable income streams and stay ahead of inflation, check out these 19 dividend stocks with yields > 3% with proven yields above 3%.

- You can uncover impressive value deals by researching these 899 undervalued stocks based on cash flows backed by strong cash flow, before the rest of the market catches on.

- Position yourself at the forefront of artificial intelligence by finding leaders in the field using these 24 AI penny stocks with innovative growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.