يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Applied Industrial Technologies (AIT) Valuation Check After Mixed Quarter And Guidance Raise

Applied Industrial Technologies, Inc. AIT | 279.84 | +0.47% |

Applied Industrial Technologies (AIT) drew fresh attention after its latest quarter combined higher sales and EPS with a guidance raise, yet left analysts cautious due to softer organic growth, margin pressure, and choppy demand.

That mixed earnings reaction has come alongside a share price of US$287.03, with a 7 day share price return of 10.6% and a 90 day share price return of 10.9%. The 3 year total shareholder return is above 100%, which hints that shorter term momentum has eased back from a stronger multi year run.

If this kind of earnings driven move has you looking beyond a single industrial name, it could be a good moment to broaden your search. You may want to check out our screener of 22 power grid technology and infrastructure stocks as another way to find companies tied to real economy infrastructure trends.

With AIT now at US$287.03 and sitting only around 6% below one major analyst target, the key question is whether recent guidance, acquisitions, and dividend growth still leave upside on the table or if the market is already pricing in future growth.

Most Popular Narrative: 5.4% Undervalued

With Applied Industrial Technologies last closing at $287.03 versus a most followed fair value near $303, the current price sits slightly behind that narrative.

The accelerating build-out of data center, semiconductor, and advanced manufacturing infrastructure is increasing demand for industrial automation, robotics, and flow control solutions, positioning Applied Industrial Technologies to capture higher-margin sales and expand its addressable market, supporting long-term revenue and margin growth.

Curious what is backing that higher fair value? The narrative leans on steady revenue gains, firmer margins, and a richer earnings multiple than the sector. Want to see how those pieces fit together and what they imply for future earnings power and valuation? The full narrative lays out the assumptions in detail.

Result: Fair Value of $303.33 (UNDERVALUED)

However, the story can change quickly if weak organic growth in key industrial markets persists, or if acquisitions fail to deliver the margin uplift analysts expect.

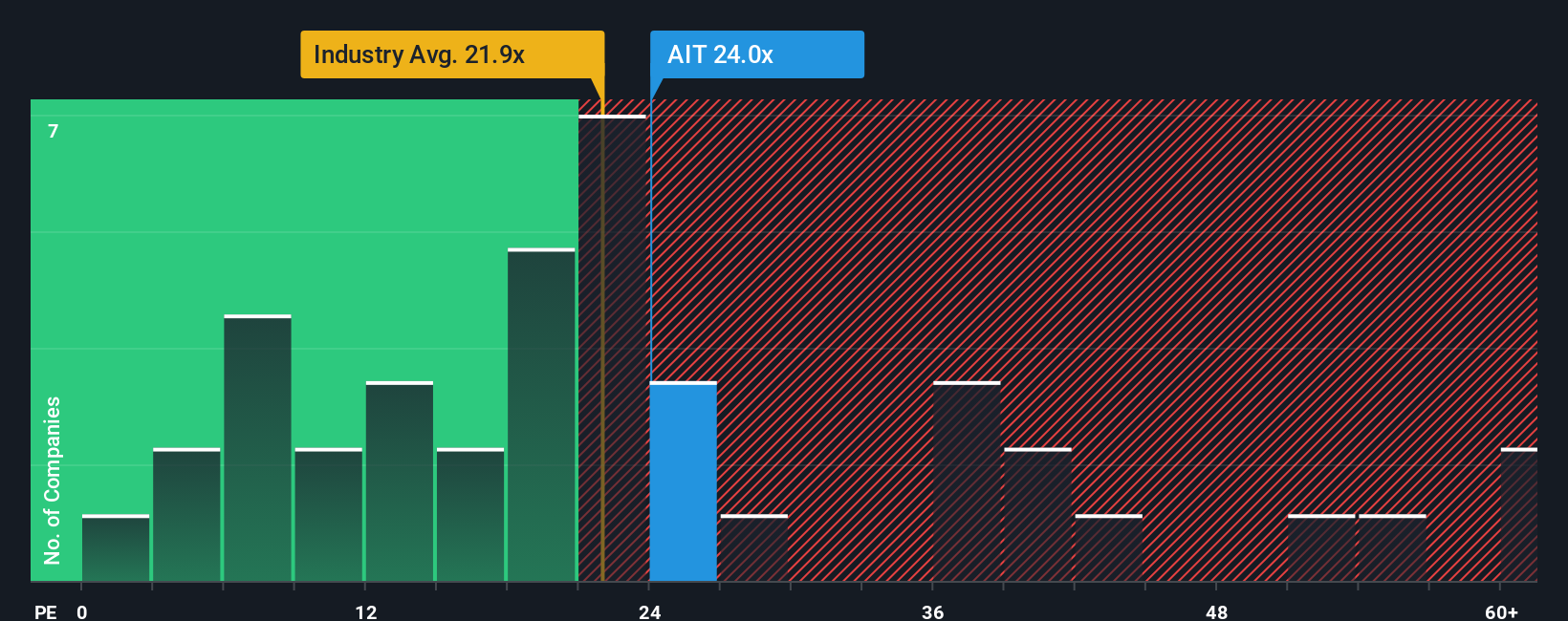

Another Take: Expensive on Earnings

While the consensus fair value of about $303 suggests some upside, AIT’s current P/E of 26.5x sits above both the US Trade Distributors industry at 23.9x and a fair ratio of 24.1x. In plain terms, you are paying a richer price for each dollar of earnings. This raises the question: is the margin of safety really that generous?

Build Your Own Applied Industrial Technologies Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own assumptions, you can build a tailored view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Applied Industrial Technologies.

Looking for more investment ideas?

If you are weighing up your next move after looking at Applied Industrial Technologies, do not stop here. Broaden your watchlist with a few focused stock ideas.

- Target stability first by scanning companies in our 81 resilient stocks with low risk scores and see which names keep risk scores in check while still offering meaningful exposure.

- Hunt for quality at a fair price with our 55 high quality undervalued stocks, where the focus is on companies that pair solid fundamentals with room for valuation upside.

- Stack potential income streams by reviewing the 15 dividend fortresses, highlighting companies with dividend yields above 5% that aim to combine resilience with regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.