يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Arlo Technologies (ARLO) Valuation Check After Samsung SmartThings Partnership And Recent Share Price Weakness

ARLO TECHNOLOGIES, INC. ARLO | 11.61 | -0.09% |

Arlo Technologies (ARLO) is drawing fresh attention after announcing a partnership with Samsung SmartThings that brings Arlo’s Smart Security Platform and AI-powered object detection into the SmartThings app for U.S. users.

Despite the SmartThings partnership and recent headlines around insider share sales, Arlo’s short term momentum has cooled, with a 30 day share price return showing a 14.62% decline and a year to date share price return showing a 12.62% decline. However, the 3 year total shareholder return of around 16x the original investment highlights how powerful the longer term move has been.

If this SmartThings tie up has you thinking more broadly about connected-tech opportunities, it could be worth checking out 34 AI infrastructure stocks as a way to spot other AI powered infrastructure names catching investor attention.

With the stock down in the short term yet still showing a strong multi year return and trading below some valuation estimates, should you see Arlo as mispriced value today, or are markets already pricing in the next leg of growth?

Most Popular Narrative: 50.2% Undervalued

At a last close of $11.56 against a widely followed fair value estimate of $23.20, the current price sits well below that narrative view of Arlo.

Continual migration of subscribers to higher priced AI driven service tiers (Arlo Secure 6) and the corresponding increase in ARPU (now over $15, up 26% y/y) reinforces the long term shift to recurring, high margin (85% non GAAP service margin) subscription revenue, supporting expanding net margins and earnings visibility.

Curious what kind of revenue mix and margin profile could justify that gap to fair value? The narrative focuses on recurring services, rising profitability and firm long term earnings targets. Want to see exactly how those assumptions compare over the next few years?

Result: Fair Value of $23.20 (UNDERVALUED)

However, that upside story could be knocked off course if hardware pricing pressure weighs on margins or if subscriptions do not grow as quickly as expected.

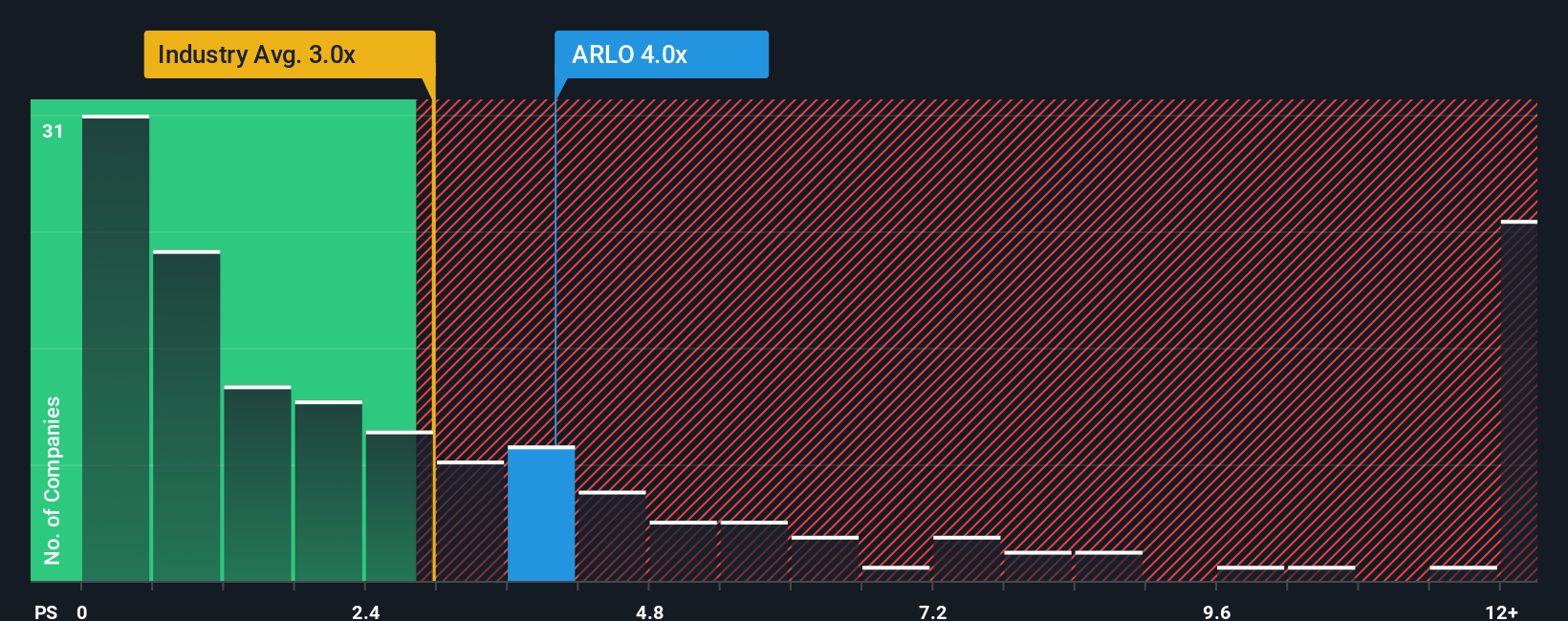

Another View: What The Sales Multiple Is Telling You

While the narrative points to a fair value of $23.20, Arlo currently trades on a P/S of 2.4x. That sits below the US Electronic industry average of 2.9x and well under a peer average of 6.3x, yet above its fair ratio of 1.9x. So is the discount a cushion or a warning sign?

Build Your Own Arlo Technologies Narrative

If you see the story differently or just want to test your own view against the numbers, you can build a custom thesis in minutes: Do it your way.

A great starting point for your Arlo Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you only stop at Arlo, you could miss other opportunities that fit your style. Take a few minutes to scan what else is out there.

- Target reliable income by checking out 13 dividend fortresses that aim to combine meaningful yields with resilience.

- Hunt for potential bargains using 51 high quality undervalued stocks that pair quality fundamentals with pricing that may look appealing.

- Focus on capital preservation first and review 85 resilient stocks with low risk scores designed to prioritize stability and calmer portfolio swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.