يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Arrow Electronics (ARW): Evaluating Valuation After a Recent 12.4% Three-Month Share Price Pullback

Arrow Electronics, Inc. ARW | 113.04 113.04 | -0.31% 0.00% Pre |

Arrow Electronics (ARW) has quietly drifted lower over the past 3 months, even as revenues and profits are still growing. That disconnect is exactly what makes the stock interesting right now.

The 12.4% slide in Arrow’s 3 month share price return contrasts with its modestly negative 1 year total shareholder return. This hints that sentiment has cooled recently, even while the long term trajectory remains positive and earnings keep grinding higher.

If Arrow’s pullback has you thinking about where else value might be building, this is a good moment to explore fast growing stocks with high insider ownership.

With earnings still inching higher but the share price lagging and even slipping below analyst targets, the key question now is whether Arrow is quietly undervalued or if the market is already pricing in modest future growth.

Most Popular Narrative: 2.5% Overvalued

Arrow’s last close of $110.95 sits slightly above the most followed fair value estimate of $108.25, suggesting a modestly rich valuation built on steady, not explosive, growth.

Analysts expect earnings to reach $734.1 million (and earnings per share of $18.01) by about September 2028, up from $467.2 million today. The analysts are largely in agreement about this estimate.

Want to see what justifies that earnings leap? The narrative leans on moderate revenue growth, fatter margins, and a lower future earnings multiple. Curious how those pieces fit together?

Result: Fair Value of $108.25 (OVERVALUED)

However, that outlook could wobble if OEMs increasingly bypass distributors, or if geopolitical tensions and tariffs squeeze Arrow’s margins harder than expected.

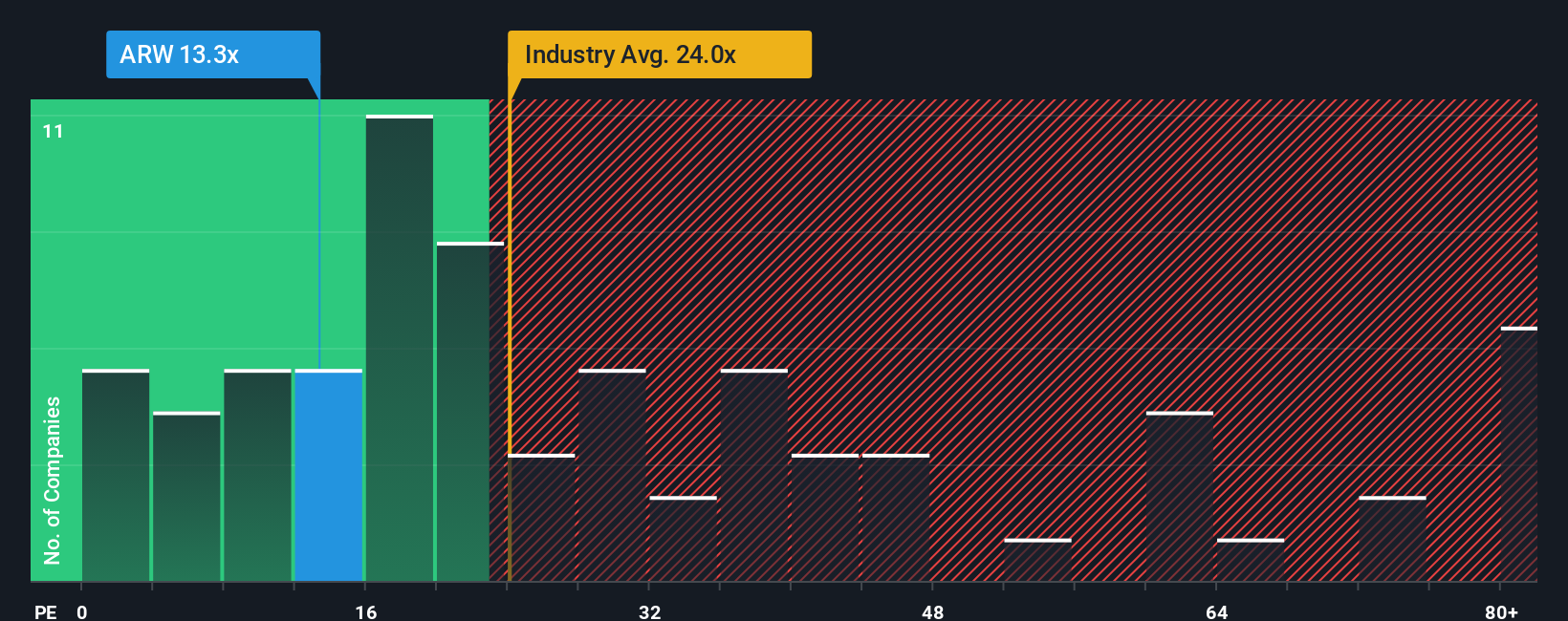

Another View: Multiples Tell a Different Story

While the narrative points to a slightly overvalued fair value of $108.25, Arrow’s current price to earnings ratio of about 12x looks inexpensive next to peers at 17.7x, the US Electronic industry at 23.5x, and a fair ratio near 19.6x. This suggests potential upside if sentiment normalizes, or it may indicate that the discount is signaling something else.

Build Your Own Arrow Electronics Narrative

If you are not fully convinced by this perspective or would rather review the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Arrow Electronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

If Arrow is only one piece of your portfolio puzzle, now is the moment to lock in fresh ideas before the next wave of opportunities moves without you.

- Capitalize on potential mispricing by targeting these 909 undervalued stocks based on cash flows that pair strong fundamentals with attractive entry points.

- Ride powerful structural tailwinds by focusing on these 30 healthcare AI stocks transforming diagnostics, treatment planning, and hospital efficiency.

- Position yourself early in the next potential boom by assessing these 81 cryptocurrency and blockchain stocks shaping payments, data security, and decentralized infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.