يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Artisan Partners (APAM) Valuation Check After Strong Results And Enhanced Dividend Payout

Artisan Partners Asset Management, Inc. Class A APAM | 41.60 | -0.55% |

Artisan Partners Asset Management (APAM) has drawn fresh attention after reporting fourth quarter and full year 2025 results, as well as declaring a combined US$1.58 per share dividend that includes a special payout.

Against this backdrop, Artisan Partners Asset Management’s share price closed at US$44.27, with a 1-day share price return of a 2.51% decline, a 6.91% year to date share price return, and a 3-year total shareholder return of 50.49%. This suggests momentum has built more over the longer term than in recent weeks as investors weigh stronger earnings, the enlarged dividend and recent leadership changes.

If the latest dividend news has you thinking about income and growth elsewhere, it could be a good time to scan our screener of 22 top founder-led companies for fresh ideas beyond asset managers.

With APAM trading at US$44.27, sitting above the latest analyst price target but at a discount to its estimated intrinsic value, should you view the current level as an undervalued entry point or as a sign that markets are already pricing in future growth?

Most Popular Narrative: 2.4% Overvalued

Artisan Partners Asset Management’s widely followed narrative points to a fair value of $43.25, slightly below the recent $44.27 close. This frames a modest valuation premium.

The analysts have a consensus price target of $46.125 for Artisan Partners Asset Management based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $51.0, and the most bearish reporting a price target of just $41.5.

Curious what sits behind that tight gap between current price and fair value? Revenue assumptions, margin tweaks and a lower future earnings multiple all matter here. The full narrative connects those moving parts.

Result: Fair Value of $43.25 (OVERVALUED)

However, this view could shift if expanded investment teams weigh on margins or if new strategies in intermediated wealth channels fail to attract the expected asset flows.

Another View: Multiples Point To A Discount

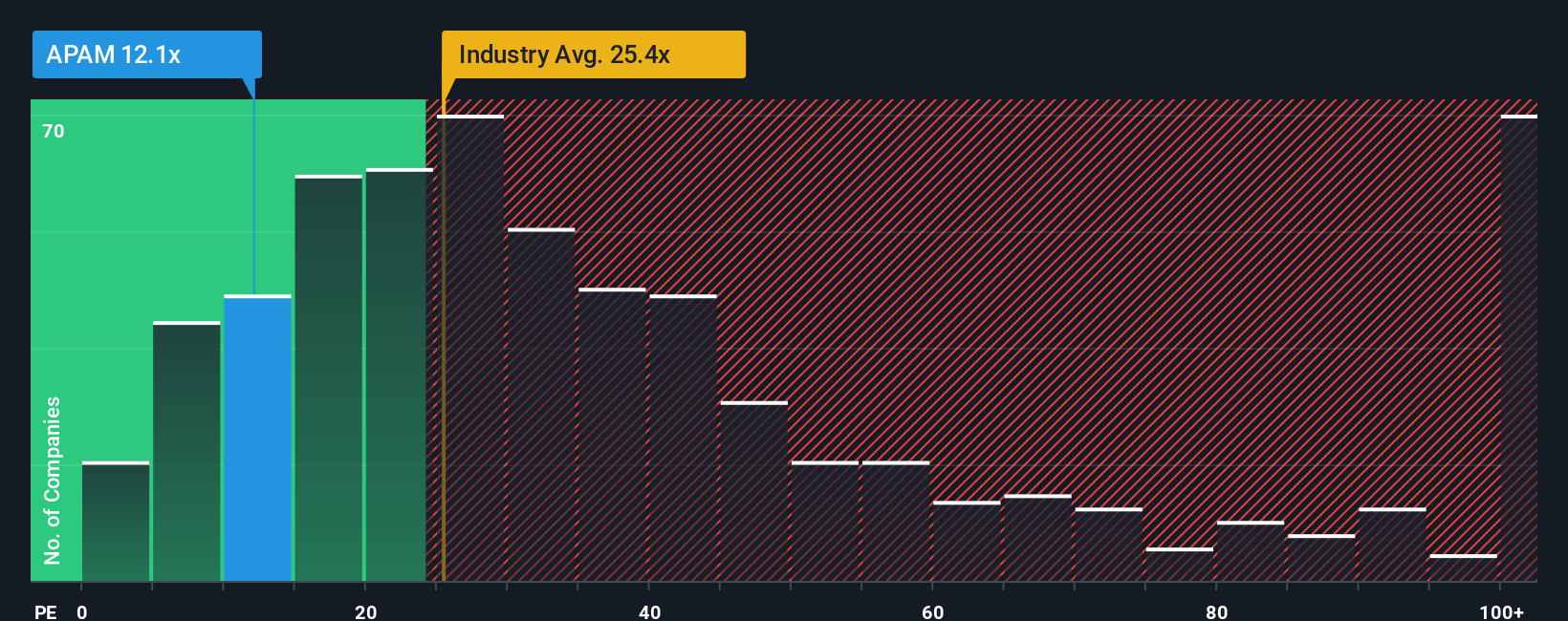

While the narrative model indicates APAM is 2.4% overvalued, the current P/E of 10.7x versus a fair ratio of 13.9x and a peer average of 15x presents a different picture. That gap suggests the market may be pricing in extra risk, or it may be overlooking some strengths.

Build Your Own Artisan Partners Asset Management Narrative

If you look at the numbers and reach a different conclusion, or simply prefer your own research trail, you can build a custom narrative in just a few minutes and Do it your way.

A great starting point for your Artisan Partners Asset Management research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If APAM has sharpened your focus, do not stop here. The next step is widening your opportunity set with curated stock ideas that match how you like to invest.

- Target quality at a discount by scanning our list of 52 high quality undervalued stocks, which combines strong fundamentals with prices that may sit below their estimated worth.

- Strengthen your income approach by reviewing 13 dividend fortresses, a collection of companies offering higher yields that could appeal if regular cash returns matter to you.

- Prioritize resilience by checking 84 resilient stocks with low risk scores, where companies with lower risk scores may help you keep your portfolio steadier through swings in sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.