يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Artisan Partners Asset Management (APAM) Net Margin Improvement Challenges Cautious Earnings Narratives

Artisan Partners Asset Management, Inc. Class A APAM | 41.60 | -0.55% |

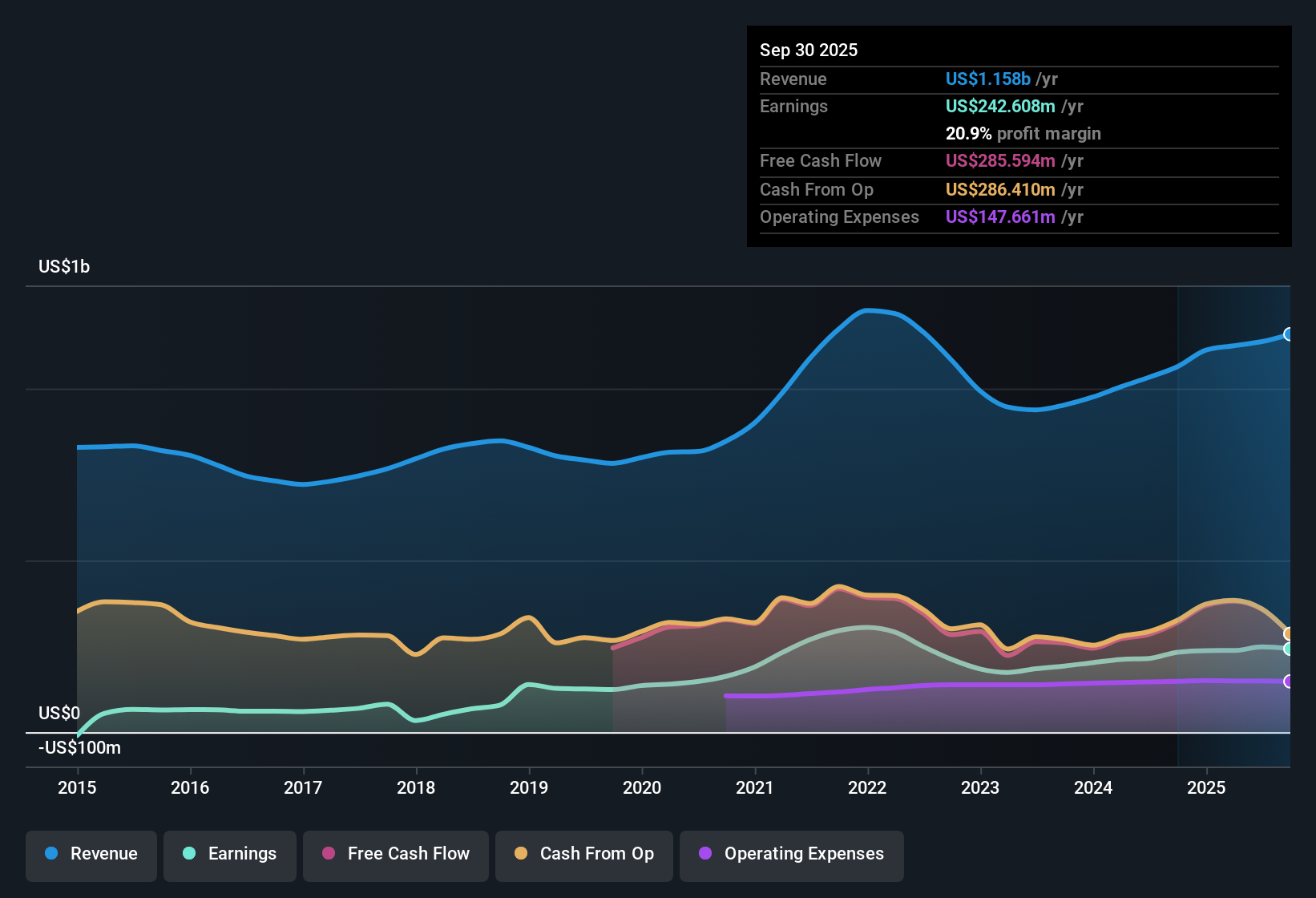

Artisan Partners Asset Management (APAM) closed FY 2025 with fourth quarter revenue of US$335.5 million and basic EPS of US$1.44, while trailing twelve month revenue came in at about US$1.2 billion with EPS of US$4.43. Over the past year, revenue has moved from US$1.11 billion to roughly US$1.2 billion and EPS has shifted from US$3.66 to US$4.43 on a trailing basis, setting a clear earnings benchmark for investors watching the trend. With net profit margin higher than a year ago and headline earnings growth over the last 12 months, the latest numbers point to firmer profitability and support a closer look at how sustainable these margins really are.

See our full analysis for Artisan Partners Asset Management.With the headline figures on the table, the next step is to see how they line up against the widely held stories about Artisan Partners, highlighting where the numbers back those narratives and where they start to push back.

24.3% Net Margin and One Off Gain

- Over the last 12 months, Artisan Partners converted about US$1.2b of revenue into US$290.3 million of net income, giving a 24.3% net profit margin compared with 21.4% a year earlier.

- What stands out for the bullish view is that stronger recent profitability sits alongside an US$88.1 million one off gain, so:

- Headline earnings grew 22.3% year over year while five year annualised earnings fell by 0.6% per year, which limits how far bulls can lean on the latest jump.

- At the same time, FY 2025 quarterly net income moved from US$55.2 million in Q1 to US$94.8 million in Q4, which supports the idea of firmer recent margins even after accounting for that one off item.

AUM Drifts While Outflows Hit US$12.7b

- Across the trailing 12 months to Q4 2025, assets under management moved from US$161.2b at the start of the period to US$179.9b at the end, while cumulative net outflows over that time were about US$12.7b.

- Bears focus on business pressure, and the flows data gives them some backing alongside some pushback:

- Quarterly figures show net outflows of US$5.6b in Q4 2025 on top of US$2.3b in Q3 and US$743 million in Q3 2024, which fits a cautious view around client money leaving.

- Yet, despite those outflows, trailing revenue still sits at roughly US$1.2b, suggesting fee income has held up even while flows have been negative.

P/E of 10.7x Versus DCF Fair Value

- At a share price of US$43.97 and trailing P/E of 10.7x, the stock trades below both the US Capital Markets industry average P/E of 22.5x and peer average of 14.7x, and below a DCF fair value estimate of about US$51.48.

- For a bullish read, valuation and growth inputs pull in the same direction but also leave some questions:

- The gap between the current price and the DCF fair value plus the lower P/E multiples support the idea that the market is assigning a discount despite 22.3% reported earnings growth and margin at 24.3%.

- On the other hand, forecasts in the data set point to earnings growth of about 8.55% per year and revenue growth of about 6.3% per year, which are described as below US market growth rates, so bulls need to weigh the apparent discount against those more moderate growth expectations.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Artisan Partners Asset Management's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Artisan Partners’ higher margins and earnings sit alongside US$12.7b of net outflows and forecasts that point to more moderate revenue and earnings growth.

If those softer growth signals concern you, use our stable growth stocks screener (2191 results) to focus on companies with steadier expansion that may offer a smoother ride through future results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.