يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Ares Management Shares After Recent Volatility and Industry Shifts in 2025

Ares Management Corporation ARES | 130.46 | +7.05% |

If you are holding Ares Management stock or considering whether now is the right time to jump in, you are not alone in weighing your choices. The recent price action has been a rollercoaster, and investors everywhere are trying to size up where opportunity meets risk. Over the past week, shares rebounded 3.0%, but that comes in the context of a tougher month with a 7.4% slide and a negative year-to-date performance of 15.6%. Still, zooming out shows Ares Management has delivered a stellar 117.2% return over the last three years and an eye-catching 317.0% return over five years. That kind of long-term outperformance tends to grab attention, but short-term volatility can make even the most seasoned investor hesitate.

Recent news has added new layers to the story, as market optimism around alternative asset managers has fluctuated. With industry peers adjusting strategies and navigating changes in capital flows, there is a sense that Ares’s position in the market is both resilient and dynamic. However, rapid growth in assets under management and shifting investor preferences are making analysts watch closely for changes in valuation, especially given recent market swings.

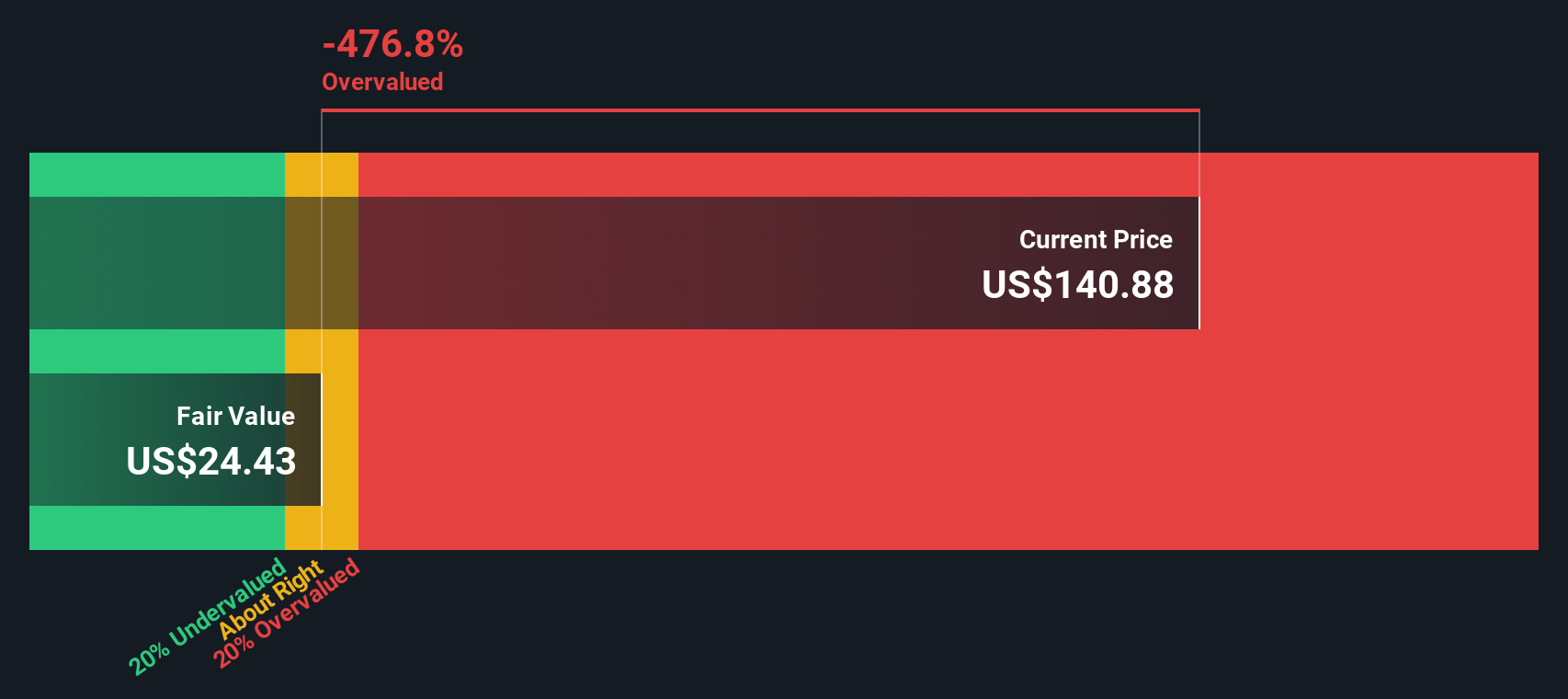

Now, how does Ares stack up when it comes to value? By the numbers, the company's valuation score currently stands at just 0 out of 6 according to standard under-valuation checks. This means it does not appear undervalued by any of the usual metrics. But valuation is never just about ticking boxes. Next, we will dive into how these common valuation methods work, what they are really telling us about Ares, and most importantly, why there might be an even better way to judge value by the end of the article.

Ares Management scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ares Management Excess Returns Analysis

The Excess Returns valuation model examines how much profit a company generates over and above the cost of its equity capital, focusing on sustainable value creation instead of just short-term earnings. This method places weight on the actual returns Ares Management achieves with its shareholders’ money compared to what investors demand for taking on risk.

For Ares Management, the numbers are as follows:

- Book Value: $13.23 per share

- Stable EPS: $1.94 per share (Source: Median Return on Equity from the past 5 years.)

- Cost of Equity: $0.93 per share

- Excess Return: $1.01 per share

- Average Return on Equity: 20.47%

- Stable Book Value: $9.47 per share (Source: Median Book Value from the past 5 years.)

The model estimates an intrinsic value far below the current share price, indicating the stock is trading at a 513.0% premium to its calculated worth using this method. In other words, Ares appears significantly overvalued when judged by its ability to generate excess returns for investors.

Result: OVERVALUED

Our Excess Returns analysis suggests Ares Management may be overvalued by 513.0%. Find undervalued stocks or create your own screener to find better value opportunities.

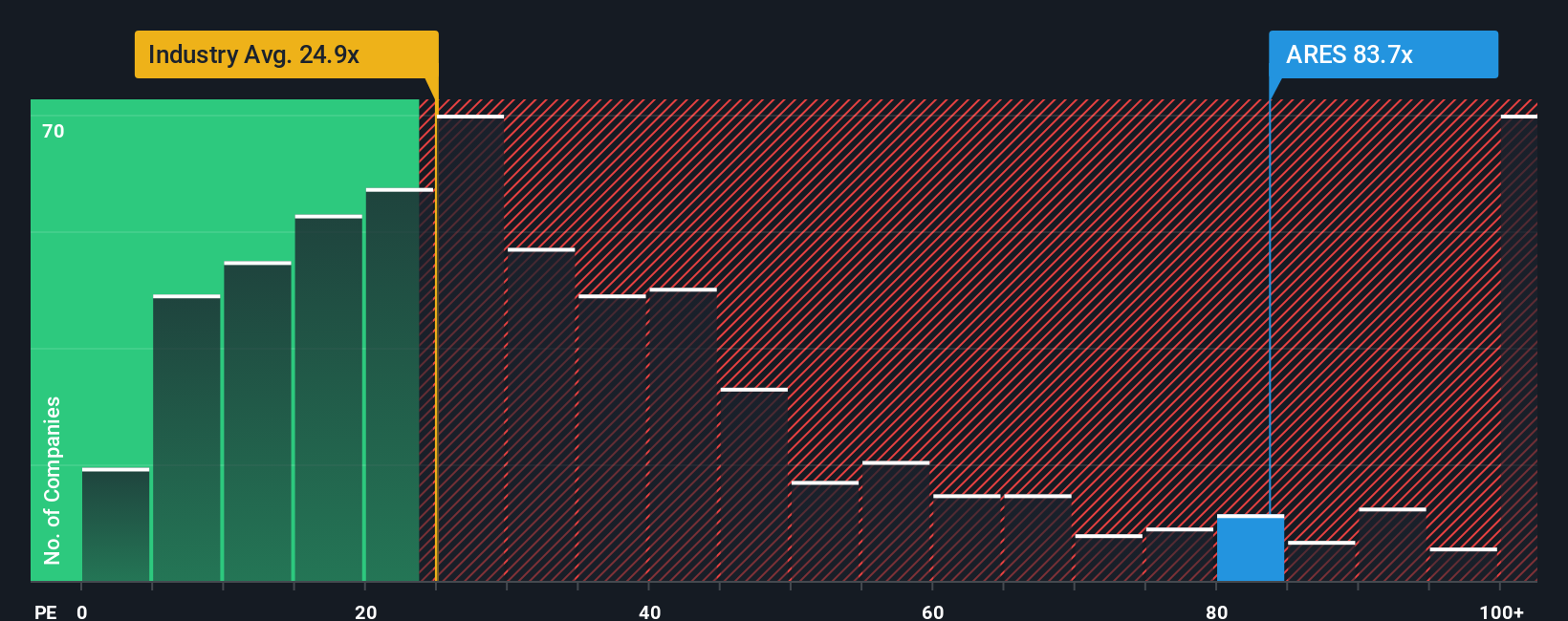

Approach 2: Ares Management Price vs Earnings

The price-to-earnings (PE) ratio is a time-tested valuation tool for profitable companies because it directly ties a company’s market value to its bottom-line earnings. A higher PE generally signals that investors expect higher growth ahead, while a lower PE can indicate market skepticism, risk, or lower growth prospects. However, what counts as a “normal” or “fair” PE ratio should always be viewed in the context of growth outlook and industry risk. Fast-growing firms or those in less volatile sectors commonly command higher multiples.

Ares Management is currently trading at a PE ratio of 89.6x. That number towers above both the industry average of 27.0x for the broader capital markets sector and the peer group average of just 13.9x. Such a premium can be justified if investors are pricing in exceptional growth, market dominance, or other distinct advantages, but it is noticeably elevated compared to standard benchmarks.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Ares stands at 26.8x, factoring in not just industry context but also the company’s growth rate, profitability, market capitalization, and risk profile. This makes it a more nuanced benchmark than a simple industry or peer comparison, as it aligns expectations with the company’s real-world fundamentals rather than just rough averages.

With Ares trading at 89.6x while its Fair Ratio is 26.8x, the stock looks significantly overvalued using this method. The current premium suggests investors are pricing in very aggressive future earnings growth, which may not be sustainable in the long run.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ares Management Narrative

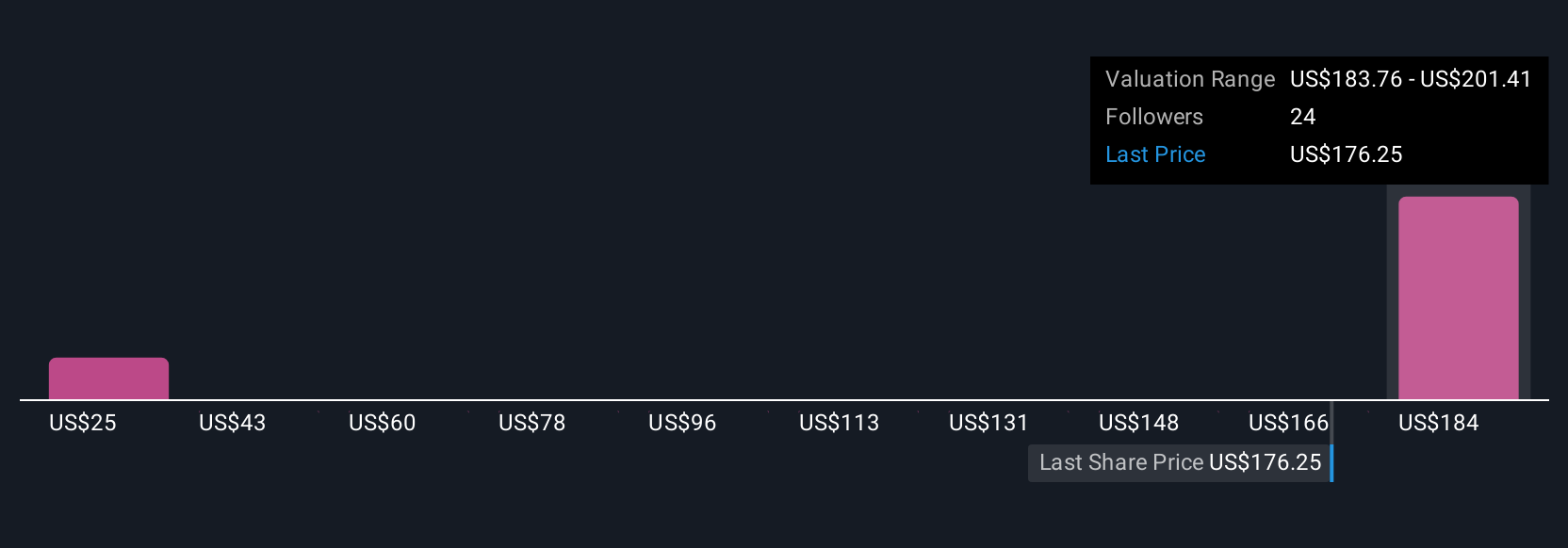

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story and perspective on a company like Ares Management, turning your own expectations for its future revenues, profits, and margins into a financial forecast and ultimately a fair value. Narratives are more than just a set of numbers, because they connect what you believe is happening in the business to why you think the stock is a buy, sell, or hold, all in an accessible, easy-to-use tool on Simply Wall St’s Community page, where millions of investors weigh in.

By comparing your Narrative’s fair value to the current market price, you get a clear, dynamic signal on when opportunity or risk may be emerging. Narratives are constantly updated as new data, company news, or earnings are released, keeping your decision making current and precise. For example, an optimistic investor might create a Narrative reflecting global expansion and recurring fee growth and assign a fair value of $215 for Ares Management, while a more cautious perspective seeing heightened competition and margin pressure might land closer to $160. Narratives empower you to set your own expectations, track how they evolve, and stay focused on the story that matters to your investment decision.

Do you think there's more to the story for Ares Management? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.