يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Aveanna Healthcare (AVAH) Valuation After Four Consecutive Earnings Beats and Analyst Upgrades

AVEANNA HEALTHCARE HOLDINGS INC. AVAH | 8.84 | -0.56% |

If you have been watching Aveanna Healthcare Holdings (AVAH) lately, you are probably wondering if now is the moment to take action. The stock has been catching investors’ eyes after climbing 16.9% in the past month and setting a fresh 52-week high. The trigger? Aveanna has consistently beaten earnings expectations over four consecutive quarters, most recently turning in an $0.18 per share profit versus a $0.04 consensus. That kind of outperformance is hard to ignore, and it is fueling some buzz among investors weighing their next move.

This steady flow of positive earnings surprises is part of a bigger trend. Aveanna shares have risen an impressive 87% year-to-date, and 55% over the past year alone, indicating growing momentum. Some short-lived investor attention came from the company’s participation in recent healthcare conferences. However, it is clear the main driver is fundamental performance, not flashy announcements. Strong annual revenue and net income growth have also been supporting this run, leaving market watchers to wonder how much further this can go.

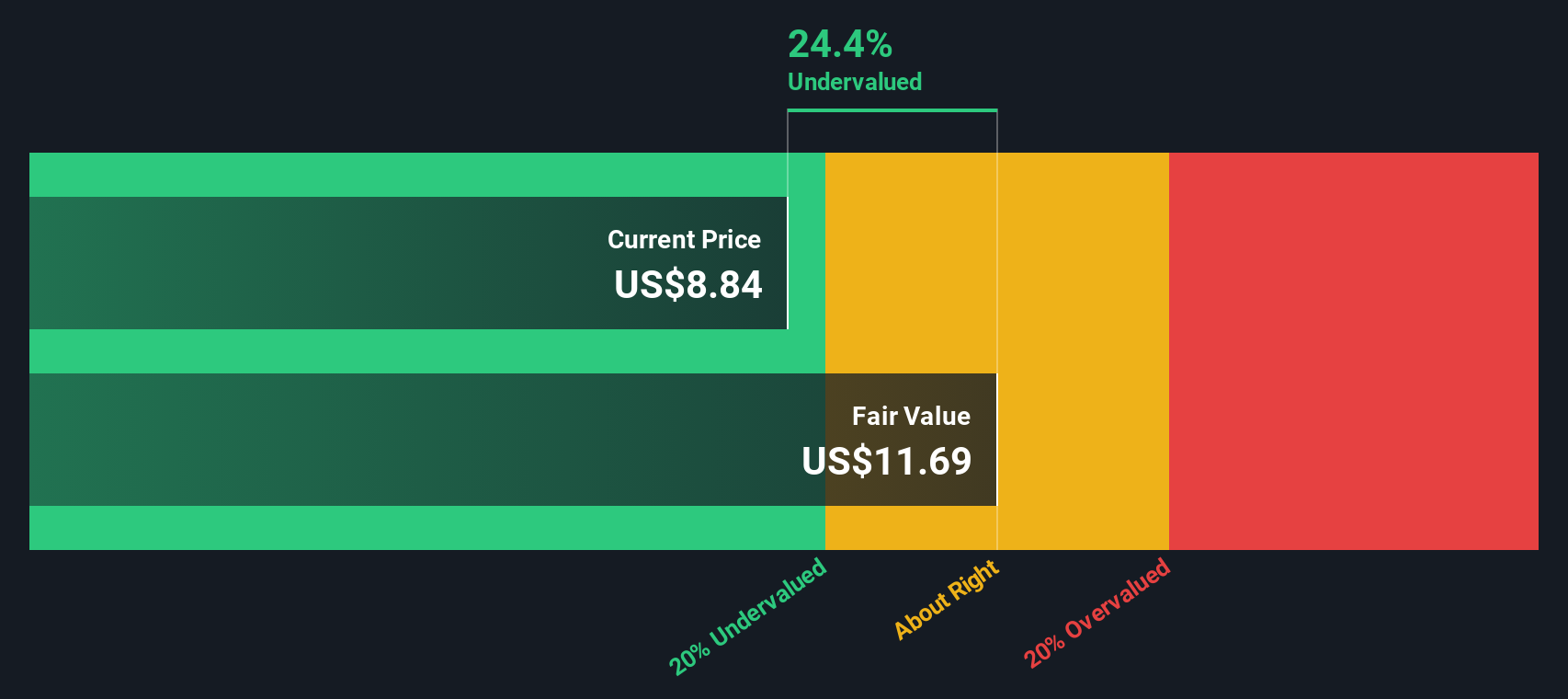

With the stock at new highs and investor optimism building, is Aveanna Healthcare Holdings undervalued, or has the market already priced in more growth ahead?

Most Popular Narrative: 4.8% Overvalued

The prevailing narrative suggests Aveanna Healthcare Holdings is currently trading slightly above its fair value, with analysts pointing to a small premium in the share price compared to consensus targets.

Ongoing investment in operational efficiencies (such as modernizing digital workflows, centralized billing, and preferred payer alignment) is expected to drive further margin expansion and increase free cash flow. This can strengthen liquidity and enable growth driven by mergers and acquisitions.

Just how sustainable is this stock’s climb? One pillar of this popular narrative is a series of ambitious internal improvements and what they could mean for profit margins. Tempted to see which earnings forecasts and future multiples underpin this call? Hold tight, because the numbers behind this bold valuation might surprise you.

Result: Fair Value of $8.06 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent wage inflation and heavy dependence on government reimbursement could undermine profitability if Aveanna struggles to meet rising demand or faces rate pressures.

Find out about the key risks to this Aveanna Healthcare Holdings narrative.Another View: Discounted Cash Flow

Taking a different approach, our DCF model suggests Aveanna shares may not be trading at a discount after all. This method, which relies on future cash flow projections, offers a starkly different perspective. Could new information shift this balance?

Build Your Own Aveanna Healthcare Holdings Narrative

If you would rather dig into the data on your own or want to come to your own conclusion, you are free to craft your perspective in minutes. Do it your way.

A great starting point for your Aveanna Healthcare Holdings research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Do not let excitement end here. Use the Simply Wall Street Screener to chase down bold investment ideas and tap into markets brimming with fresh possibilities.

- Catch early growth with companies that boast robust financial strength. Your next big find could be among penny stocks with strong financials.

- Benefit from future tech trends by jumping into promising medical innovation alongside healthcare AI stocks.

- Maximize potential returns and seek hidden value gems by screening for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.