يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing BioMarin Pharmaceutical (BMRN) Valuation After Mixed Short And Long Term Share Price Performance

BioMarin Pharmaceutical Inc. BMRN | 64.08 | +1.04% |

Why BioMarin Pharmaceutical (BMRN) is on investors’ radar

BioMarin Pharmaceutical (BMRN) has drawn attention after a recent stretch of mixed returns, with the share price higher over the past week, month and past 3 months, yet lower over the past year.

At the current share price of $59.87, BioMarin Pharmaceutical’s recent 7 day and 3 month share price returns of 2.99% and 9.39% contrast with a 1 year total shareholder return decline of 7.68%. This suggests that near term momentum is improving while longer term holders are still under water.

If BioMarin’s recent rebound has you thinking about where else growth stories might emerge in healthcare, it could be a good time to scan 25 healthcare AI stocks as a starting list of ideas.

With BioMarin trading at US$59.87 and indicators like analyst targets and intrinsic estimates suggesting a sizeable gap, the key question is whether this rare disease specialist is genuinely undervalued today or whether the market already reflects its future growth.

Most Popular Narrative: 34% Undervalued

With BioMarin Pharmaceutical last closing at $59.87 against a narrative fair value of about $90.74, the current setup frames a sizeable valuation gap that turns on how future growth and margins play out.

Strong year over year revenue growth driven by increasing global demand, new patient starts, and international expansion of key therapies like VOXZOGO and VIMIZIM aligns with demographic shifts and improved rare disease diagnosis, supporting continued top line revenue growth. Accelerated pipeline advancement, including late stage programs (BMN 333 for achondroplasia, BMN 401 for ENPP1 deficiency, and label expansions for PALYNZIQ), positions BioMarin to capitalize on growing patient pools through earlier and more accurate genetic identification, which should expand future addressable markets and boost revenue.

Curious what kind of revenue run rate, profit margins and future earnings multiple are baked into that gap to fair value? The narrative leans on detailed projections for top line growth, profitability and a richer earnings multiple than the broader biotech group. Want to see which specific assumptions need to line up for that valuation to hold?

Result: Fair Value of $90.74 (UNDERVALUED)

However, there is still clear risk that heavier R&D and SG&A spending, or tougher pricing and reimbursement for rare disease drugs, could cap margins and challenge that upbeat narrative.

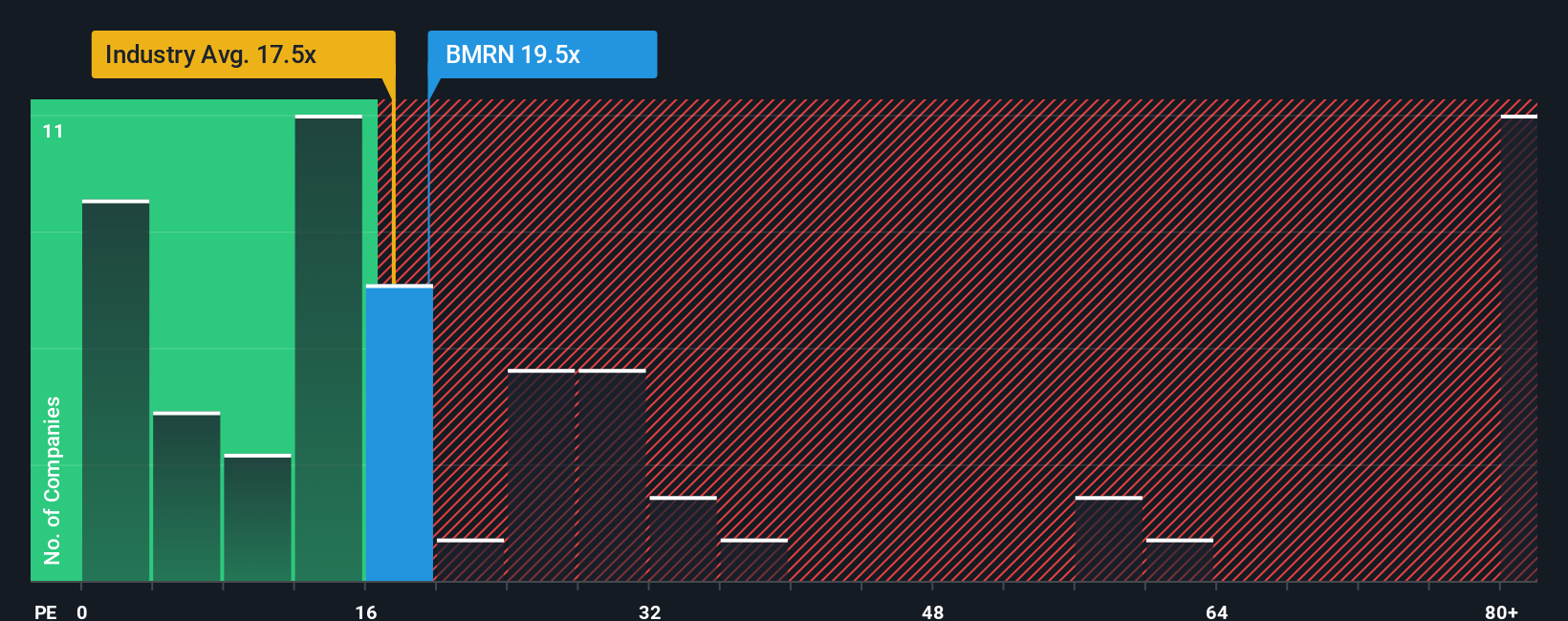

Another View: What Earnings Multiples Are Saying

Our fair value narrative leans on detailed cash flow and growth assumptions, but the current P/E of 22.1x tells a slightly different story. It roughly matches the US Biotechs average of 22.1x and sits just below a fair ratio of 23.2x, so the market is not clearly screaming bargain or bubble here.

That tight range suggests valuation risk and opportunity may hinge more on how earnings progress than on a simple re rating. If profits track forecasts, the gap to the fair ratio could close in your favor, but if they stumble, the current multiple leaves limited room for error. How comfortable are you with that trade off?

Build Your Own BioMarin Pharmaceutical Narrative

If you see the numbers differently or prefer to run your own checks, you can build a fresh BioMarin story in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BioMarin Pharmaceutical.

Looking for more investment ideas?

If BioMarin has you thinking more broadly about your portfolio, do not stop here. This is the moment to widen your watchlist before the next move.

- Spot potential bargains early by checking companies that look mispriced on quality and valuation using our 53 high quality undervalued stocks as a focused starting point.

- Strengthen your income stream by reviewing companies with robust payouts through our 13 dividend fortresses that highlights higher yielding options.

- Sleep easier by scanning companies with healthier finances via the solid balance sheet and fundamentals stocks screener (44 results) so you are not caught out by weak balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.