يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Bladex (NYSE:BLX) Valuation Following Strong Demand for Landmark $200 Million AT1 Capital Issuance

Banco Latinoamericano de Comercio Exterior, S.A. Class E BLX | 49.88 | +1.92% |

Most Popular Narrative: 3.6% Undervalued

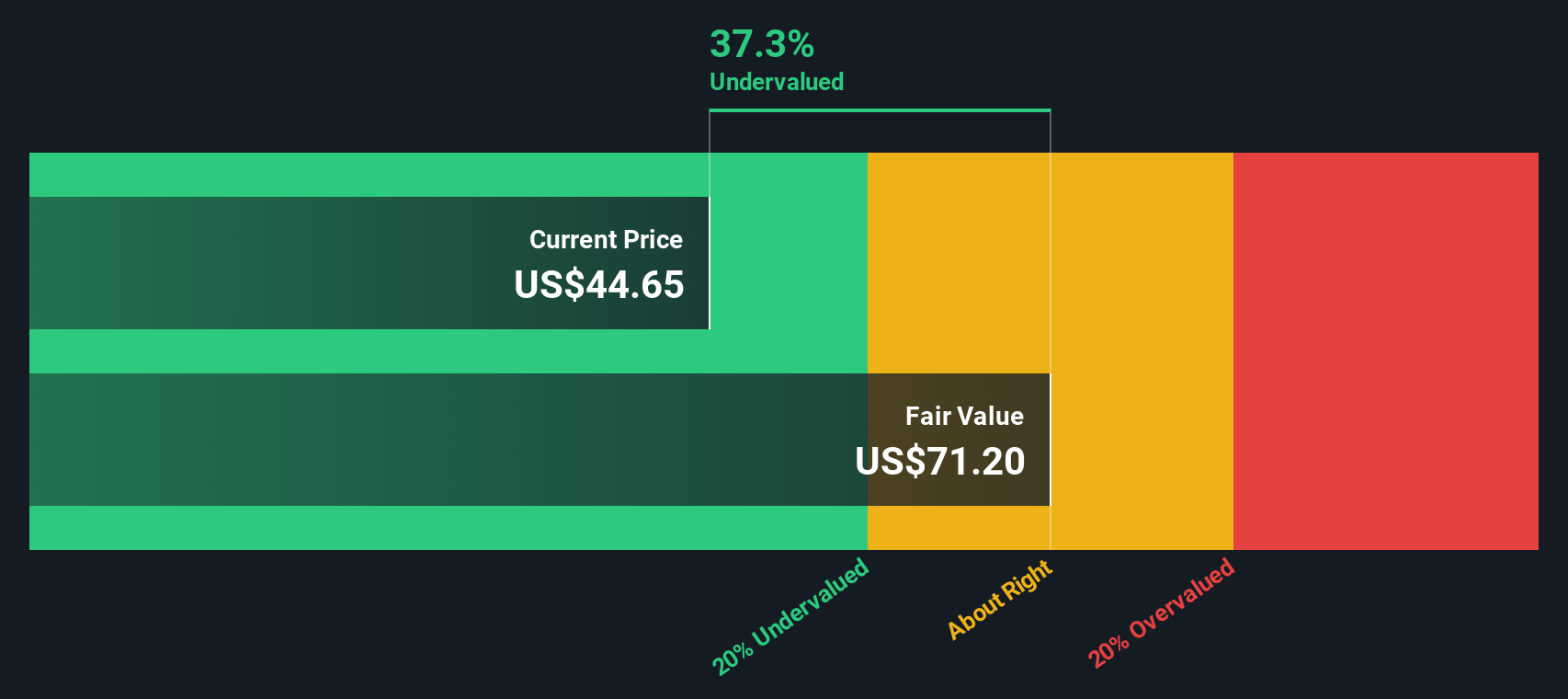

According to the most widely followed narrative, Banco Latinoamericano de Comercio Exterior S. A appears to be trading just below its calculated fair value, suggesting a modest undervaluation in the stock at current levels. The valuation is grounded in a comprehensive projection of the company’s future earnings potential, profit margins, and long-term growth prospects, all discounted at a rate of 10.7%.

The rollout of a new digital trade finance platform positions Bladex to significantly increase transaction volumes, improve client retention, and expand service offerings to underbanked SMEs. This development could drive fee income, boost revenue growth, and enhance operational efficiency over the coming 18 months.

Curious what’s behind that fair value? The main element of this narrative is built on bold growth forecasts and financial discipline. These numbers could transform how investors see this bank’s future. Wondering which key projections justify the price target and drive the narrative? The answers might surprise you.

Result: Fair Value of $49.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slowdown in regional trade or a lack of repeat large transactions could challenge the expectations that are built into the current fair value.

Find out about the key risks to this Banco Latinoamericano de Comercio Exterior S. A narrative.Another View: SWS DCF Model

Looking at things through the lens of our DCF model, the stock’s value appears to offer even greater upside than the traditional analyst view. However, is the market missing something, or are these forecasts too optimistic?

Build Your Own Banco Latinoamericano de Comercio Exterior S. A Narrative

If you have a different perspective or want to dig into the figures yourself, you can craft your own insights from the data in just minutes. Do it your way

A great starting point for your Banco Latinoamericano de Comercio Exterior S. A research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stop at a single opportunity when the market is full of exciting paths? Get ahead of the curve by tapping these unique investment screens. Missing out means missing tomorrow’s leaders.

- Tap into the future of healthcare by spotting breakthroughs in medical AI, advanced diagnostics, and patient care through our healthcare AI stocks.

- Maximize potential for strong returns by identifying companies trading well below their intrinsic value with our undervalued stocks based on cash flows.

- Accelerate your portfolio's growth by uncovering high-upside opportunities in the rapidly-evolving field of artificial intelligence using our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.