يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Century Communities (CCS) Valuation After Dividend Hike And New Luxury Townhome Launch

Century Communities, Inc. CCS | 71.85 | +0.27% |

Century Communities (CCS) is back on investors’ radar after a 10% quarterly dividend increase to $0.32 per share and news of its first luxury townhome community in St. Johns County, Florida.

Those moves come as Century Communities’ share price sits at US$72.30, with a 90 day share price return of 23.38% and a 1 year total shareholder return of 2.63%, suggesting recent momentum has picked up after a more modest longer term outcome.

If this kind of housing focused story has your attention, it can also be worth scanning the market for other quality names through our 23 top founder-led companies as a fresh source of ideas.

With CCS trading around US$72.30, close to one analyst price target of US$72.00 but with other forecasts pointing higher, should you view the current level as a valuation gap, or has the market already reflected expectations for future growth in the price?

Most Popular Narrative: 1% Undervalued

Century Communities' widely followed narrative pegs fair value around $72.67, almost exactly in line with the recent $72.30 close. This keeps attention on the assumptions behind that figure.

Strong operational efficiency, a growing community footprint, and a flexible land strategy position Century Communities for long-term growth despite ongoing affordability challenges in the housing market.CatalystsAbout Century CommunitiesEngages in the design, development, construction, marketing, and sale of single-family attached and detached homes.What are the underlying business or industry changes driving this perspective?

Want to see what is doing the heavy lifting in that fair value math? The narrative leans on shifting revenue expectations, margin compression, and a richer future earnings multiple. Curious which of those really moves the needle on $72.67 versus today’s price?

Result: Fair Value of $72.67 (ABOUT RIGHT)

However, there are still clear swing factors, such as softer entry level demand in key regions and pressure on margins from incentives and input costs, that could upset this fair value story.

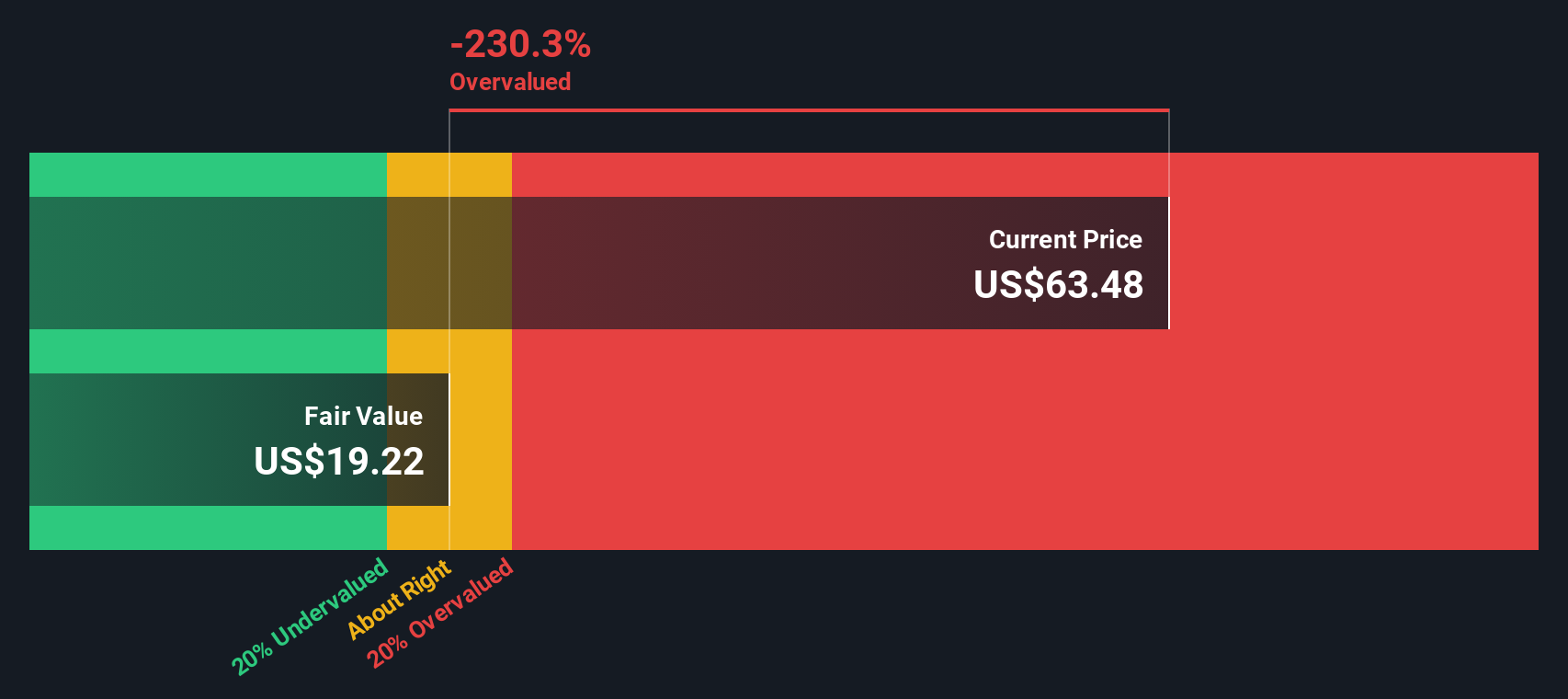

Another View: Cash Flows Paint A Harsher Picture

While the narrative fair value sits close to the current US$72.30 share price, our DCF model is far more cautious and points to a future cash flow value of about US$15.77. That gap suggests a lot has to go right for today’s price to hold up, so which story do you trust more?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Century Communities for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Century Communities Narrative

If you are not convinced by these viewpoints or prefer to lean on your own research, you can pull together a fresh, data backed story in just a few minutes, Do it your way.

A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to hunt for more investment ideas?

If CCS has sparked your interest, do not stop here. Broaden your watchlist with fresh ideas that line up with the kind of portfolio you want to build.

- Target quality at a discount by checking out our 55 high quality undervalued stocks that screens for companies combining solid fundamentals with prices that may not fully reflect them.

- Strengthen your income stream by reviewing our 16 dividend fortresses highlighting companies with higher yielding payouts that may appeal to dividend focused investors.

- Put resilience first by scanning our 85 resilient stocks with low risk scores featuring stocks that score better on risk metrics so you can build with greater confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.