يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Construction Partners (ROAD) Valuation After Recent Steady Share Performance

Construction Partners, Inc. Class A ROAD | 131.90 | +0.53% |

What the recent move in Construction Partners means for investors

Construction Partners (ROAD) has seen mixed share performance recently, with a 2% gain over the past day, a small decline over the past week, and a modest rise over the past month. This has kept investor attention focused on underlying fundamentals.

At a share price of US$114.42, Construction Partners has paired relatively modest recent share price moves with stronger longer run gains, with a 1 year total shareholder return of 26.81% and a very large 3 year total shareholder return of more than 3x. This suggests earlier optimism is now being reassessed rather than rapidly accelerating.

If this kind of steady construction story interests you, it can be useful to compare it with other infrastructure exposed names via aerospace and defense stocks.

With annual revenue at roughly US$2.8b, net income above US$100m, and analyst targets sitting around 10% higher than the current price, you have to ask: is ROAD still undervalued, or has the market already priced in future growth?

Most Popular Narrative: 11% Undervalued

With Construction Partners last closing at US$114.42 compared to a narrative fair value of US$128, the current share price sits below that central estimate. This estimate is built using a 9.17% discount rate and detailed long term earnings assumptions.

The analysts have a consensus price target of $120.167 for Construction Partners based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $286.4 million, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 8.7%.

Curious what sits behind that higher fair value, even as the assumed future P/E steps down sharply from today and margins shift to a very different level? The full narrative lays out a detailed earnings, revenue and valuation profile that goes well beyond simple headline growth.

Result: Fair Value of $128 (UNDERVALUED)

However, this hinges on public infrastructure funding and activity in key Sunbelt markets holding up, since budget shifts or softer regional demand could quickly challenge that optimistic outlook.

Another View: Expensive On Earnings

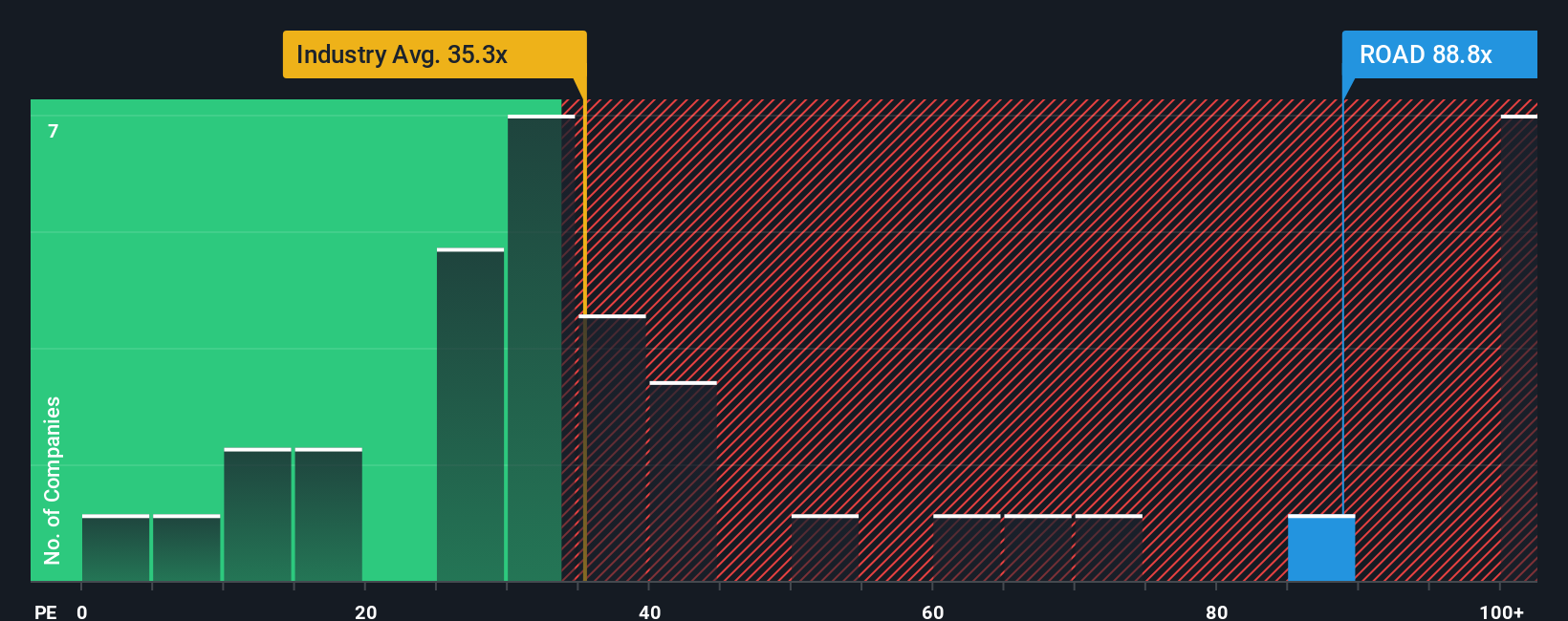

That 11% undervalued fair value of US$128 contrasts with what the earnings multiples indicate. At around 63.5x P/E, Construction Partners trades well above the US Construction industry at 34.9x, its peer average of 33.2x, and a fair ratio of 30x. This suggests clear valuation risk if sentiment cools.

Build Your Own Construction Partners Narrative

If you look at these numbers and come to a different conclusion, or simply prefer to test your own assumptions, you can quickly build a personalised view and Do it your way.

A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond Construction Partners?

If ROAD has you thinking more broadly about your portfolio, do not stop here. Cast a wider net now or you risk missing opportunities others are already reviewing.

- Target income-focused ideas by scanning these 12 dividend stocks with yields > 3% that may suit a portfolio built around regular cash returns.

- Spot potential growth trends early with these 24 AI penny stocks that aim to capitalise on advances in artificial intelligence.

- Hunt for value oriented opportunities using these 863 undervalued stocks based on cash flows that might trade below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.