يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Custom Truck One Source’s Valuation After The Hiab Partnership Expands Its U.S. Reach

Custom Truck One Source Inc CTOS | 7.54 | +1.89% |

What the Hiab partnership could mean for Custom Truck One Source

The new dealer agreement between Hiab and Custom Truck One Source (CTOS) expands sales and service coverage for HIAB cranes and MOFFETT forklifts across Western and Northeastern states, providing investors with an additional data point on the company’s growth ambitions.

Recent news around the Hiab agreement sits alongside strong share price momentum, with a 22.3% 90 day share price return and 37.2% one year total shareholder return, which contrasts with weaker three and five year total shareholder returns.

If this partnership has you thinking about where equipment and infrastructure demand could go next, it might be worth scanning 24 power grid technology and infrastructure stocks as another way to spot potential beneficiaries of long term network upgrades.

With the shares near a recent high, trading at $7.08 and only about 9% below one set of analyst expectations at $7.75, the key question is whether Custom Truck One Source still offers upside or if the market is already pricing in future growth.

Most Popular Narrative: 8.9% Overvalued

The most followed valuation narrative puts Custom Truck One Source’s fair value at $6.50, which sits below the recent $7.08 close and frames the latest move as slightly ahead of that model.

The company's aggressive fleet expansion strategy, evidenced by record Q2 OEC and ongoing high CapEx commitments, increases exposure to financial risk if end-market rental demand slows or if technological disruption accelerates. This could drive down utilization rates, depress asset values, and heighten leverage, ultimately putting future earnings and balance sheet stability under pressure.

Curious how this view still lands on a premium price tag? The narrative leans on steady revenue gains, margin repair, and a punchy future earnings multiple to make the math work.

Result: Fair Value of $6.50 (OVERVALUED)

However, sustained demand in utility markets and record utilization levels could support healthier cash generation and resilience than this cautious fair value implies.

Another angle on value

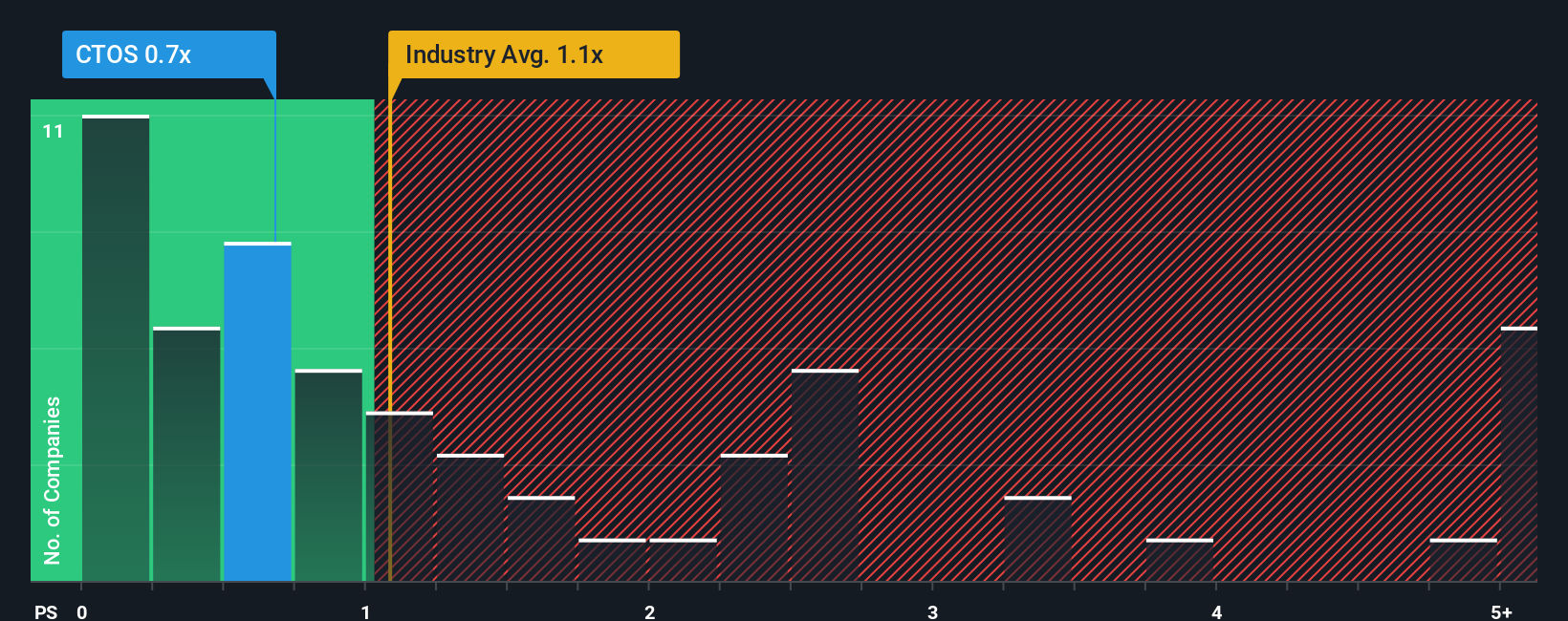

The narrative you just read leans on future earnings and a rich P/E to argue Custom Truck One Source looks 8.9% overvalued around $7.08. Yet on sales, the picture is different, with a P/S of 0.8x versus peers at 1.2x, the wider industry at 1.4x, and a fair ratio of 1.1x. That kind of discount can signal a margin of safety or a warning that the market is still cautious. Which explanation do you think fits better with your view of the business?

Build Your Own Custom Truck One Source Narrative

If you see the story differently or just prefer to work from the raw numbers yourself, you can build a fresh view in a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Custom Truck One Source.

Looking for more investment ideas?

If Custom Truck One Source has sharpened your thinking, do not stop here, use the Simply Wall St screener to turn that curiosity into a concrete watchlist.

- Target solid businesses at reasonable prices by scanning our 55 high quality undervalued stocks and see which names currently sit on a discount.

- Prioritise financial strength by checking the solid balance sheet and fundamentals stocks screener (45 results) so you are not caught off guard by weak balance sheets.

- Hunt for less crowded opportunities using the screener containing 23 high quality undiscovered gems before everyone else starts paying attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.