يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Douglas Emmett’s Valuation After Strong Q4 Results And Coastal Redevelopment Progress

Douglas Emmett, Inc DEI | 10.46 | +2.85% |

Douglas Emmett (DEI) is back in focus after its latest earnings update highlighted strong fourth quarter results, with positive office leasing absorption, full multifamily occupancy, and progress on several high-profile redevelopment projects in coastal markets.

The recent earnings update comes after a challenging run for investors, with the 1 year total shareholder return at a loss of 37.28% and the 5 year total shareholder return down 56.73%. Shorter term performance has also been soft, including a 30 day share price return of a 9.08% decline and a 90 day share price return of a 12.62% decline. The latest move to a US$10.11 share price and modest 1 day share price return of 2.33% therefore appears more like a tentative reassessment of risk than a clear change in momentum.

If the mixed signals around office and multifamily real estate have you looking wider, now could be a good moment to check out 23 top founder-led companies as another way to spot potential opportunities beyond this stock.

With Douglas Emmett trading at US$10.11 after a tough few years and at an implied discount to some valuation estimates, is the market overlooking a potential recovery story here, or correctly pricing in limited future growth?

Most Popular Narrative: 23.1% Undervalued

With Douglas Emmett last closing at $10.11 and the most followed narrative pointing to a fair value of $13.15, the gap between price and modeled worth is clear and sets the context for what is driving that view.

The analyst price target for Douglas Emmett has been trimmed as analysts factor in slower new office leasing activity and recent target cuts from firms that now view the shares as value oriented but facing more tempered expectations.

Maintaining ratings such as Overweight or Outperform while lowering targets signals that, in these analysts’ view, recent valuation resets may already embed more cautious expectations into the share price.

Curious why a value focused story still assumes modest growth, thicker margins and a very different earnings multiple than today. The full narrative lays out the revenue glide path, margin reset and discount rate that all have to line up for $13.15 to make sense long term.

Result: Fair Value of $13.15 (UNDERVALUED)

However, slower office leasing and higher interest expenses could still pressure occupancy, cash flow visibility, and the earnings path implied in that US$13.15 fair value.

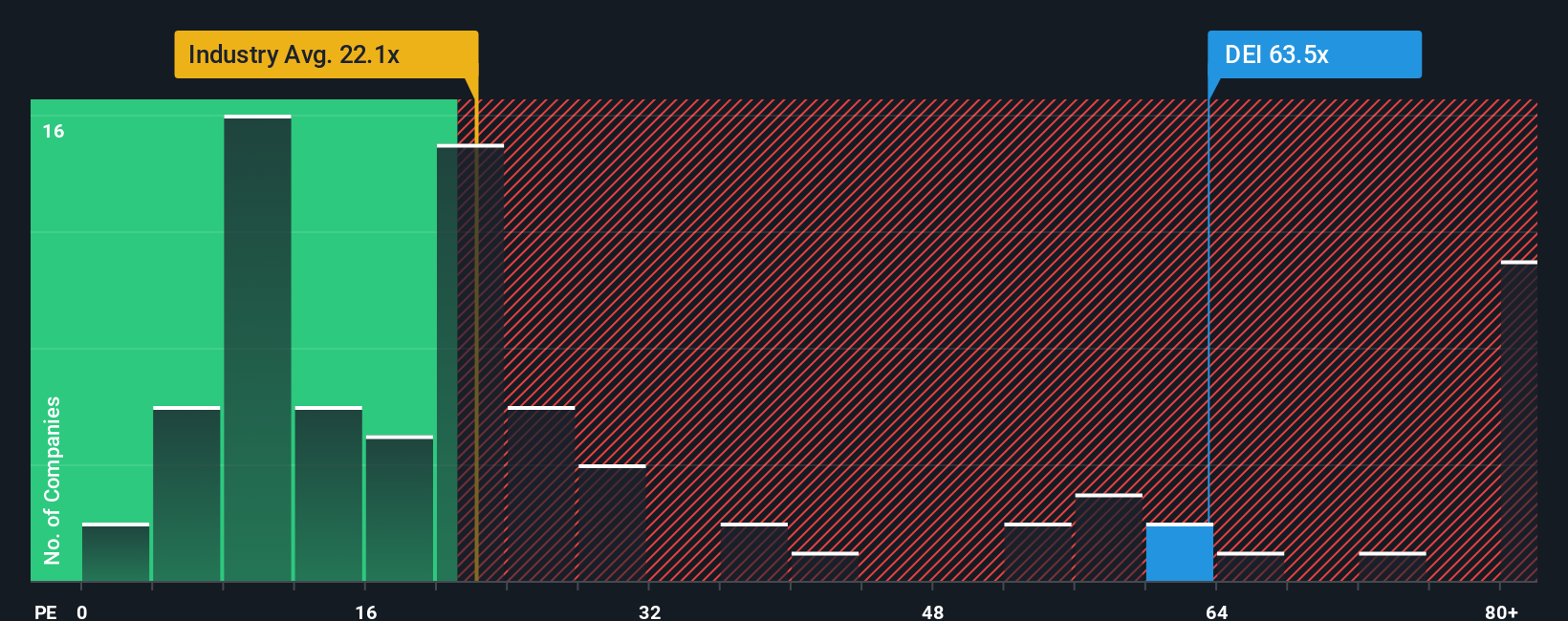

Another View: What The P/E Ratio Is Saying

While the fair value model points to Douglas Emmett being 40.1% undervalued at $10.11 versus an estimated future cash flow value of $16.89, the P/E ratio tells a very different story. At about 104x, it is far higher than the Global Office REITs average of 21x, the peer average of 35.9x, and the fair ratio of 12.8x. That kind of gap suggests you could be paying a premium multiple for a company with declining earnings, which raises the question of how comfortable you are with that trade off.

Build Your Own Douglas Emmett Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to rely on your own work, you can build a complete view in just a few minutes with Do it your way.

A great starting point for your Douglas Emmett research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Douglas Emmett has sharpened your thinking, do not stop here. Use the Simply Wall St screener to uncover other opportunities that might better fit your style and goals.

- Target income first and see which companies show up as 13 dividend fortresses that could help you build a more reliable cash flow stream.

- Zero in on quality and check the solid balance sheet and fundamentals stocks screener (44 results) for companies that pair financial strength with consistent fundamentals.

- Get ahead of the crowd by scanning our screener containing 24 high quality undiscovered gems that highlight companies with strong underlying metrics but limited current attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.