يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing EMCOR Group (EME) Valuation After Raised Guidance And Strengthening Contracting Fundamentals

EMCOR Group, Inc. EME | 812.79 | +1.15% |

Recent commentary from Stifel on EMCOR Group (EME) focuses on strengthening fundamentals in its mechanical and electrical contracting businesses, with activity levels and demand trends helping shape investor expectations for the stock.

The recent 21.20% 1 month share price return to US$800.82, alongside a 29.19% 3 month share price return and very large 5 year total shareholder return, suggests momentum has been building as investors react to raised guidance and acquisition activity.

If EMCOR’s run has you thinking about other infrastructure related themes, you might like our power grid and infrastructure screen highlighting 25 power grid technology and infrastructure stocks as potential candidates for further research.

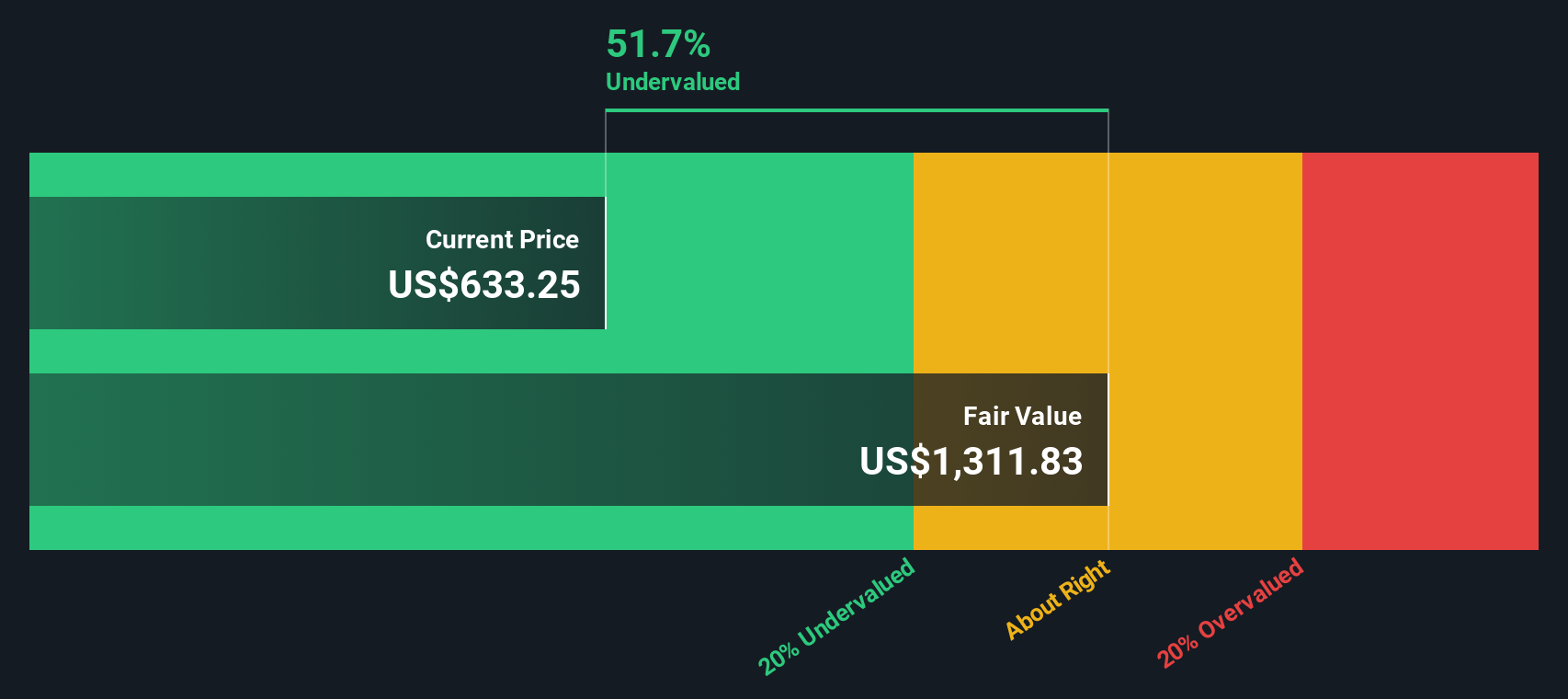

With EMCOR trading at US$800.82, above the latest analyst price target but with an indicated intrinsic discount and a very large multi year total return, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 70.8% Overvalued

According to the widely followed narrative on EMCOR Group, the fair value estimate of $468.79 sits well below the recent $800.82 share price. This creates a clear valuation gap that investors are debating.

With strong exposure to data center expansion, electrification, infrastructure spending, and industrial reshoring, the company has demonstrated consistent revenue growth and improving profitability.

Read the complete narrative. Read the complete narrative.

Curious what earnings power and profit margins would need to look like to bridge a gap of this size? The narrative leans on robust revenue expansion, firmer margins, and a future earnings multiple more commonly associated with higher growth names. If you want to see exactly how those assumptions stack up into a $468.79 fair value, the full narrative lays out every step.

Result: Fair Value of $468.79 (OVERVALUED)

However, that story could crack if government infrastructure spending slows, or if tight labor markets and rising wage costs start to squeeze EMCOR’s project margins.

Another Angle On Value

That $468.79 fair value from the user narrative contrasts sharply with our view that EMCOR is trading at good value, both versus peers and versus our estimate of its future cash flow value of $924.20. When one model flags 70.8% overvaluation and another points to a discount, which story do you lean toward?

Build Your Own EMCOR Group Narrative

If you are not fully on board with these narratives or prefer to lean on your own work, you can test the assumptions, reshape the story, and build a personalised view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding EMCOR Group.

Looking for more investment ideas?

If EMCOR has sharpened your thinking, do not stop here. Broaden your watchlist with a few focused ideas that could reshape how you allocate capital.

- Target value first by scanning our list of 53 high quality undervalued stocks, so you are not just reacting to headlines but comparing prices to fundamentals.

- Prioritise resilience with 85 resilient stocks with low risk scores, especially if you want companies where risk checks already point to sturdier business profiles.

- Spot under the radar opportunities using our screener containing 23 high quality undiscovered gems, before these names sit squarely on everyone else’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.