يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing German American Bancorp (GABC) Valuation After Margin Gains And New Leadership Appointment

German American Bancorp, Inc. GABC | 43.67 | +1.16% |

German American Bancorp (GABC) is back on investor radars after German American Bank named Matt Merkel as Southwest senior regional president, alongside recent commentary on net interest margin and tangible book value trends.

At a share price of $39.73, German American Bancorp has seen a 2.5% 90 day share price return and a 6.8% 1 year total shareholder return, which may indicate gradually improving momentum as investors respond to stronger net interest margin trends and leadership changes.

If you are comparing GABC with other financial names, it can also help to look beyond banks and scan for breadth across sectors using fast growing stocks with high insider ownership.

With GABC trading at $39.73 and indications of both an intrinsic discount and a gap to analyst targets, the key question is simple: is the stock still underappreciated, or is the market already pricing in its future growth?

Price-to-Earnings of 14.9x: Is it justified?

At a last close of $39.73, German American Bancorp trades on a P/E of 14.9x, which screens as expensive relative to both peers and the wider US banks group.

The P/E multiple compares the share price with earnings per share, so for a bank like GABC it reflects what investors are currently willing to pay for each dollar of earnings. When that multiple sits above sector norms, the market is effectively attaching a premium to those earnings.

Here, the premium is clear. GABC's 14.9x P/E is higher than the peer average of 12.1x and also above the US banks industry average of 11.8x, suggesting the market is pricing its earnings more richly than many competitors. Against an estimated fair P/E of 12.8x, the current level also stands above a ratio that the market could potentially move toward if expectations cool.

Result: Price-to-Earnings of 14.9x (OVERVALUED)

However, that richer P/E could reset quickly if net income growth stalls or if analysts reassess their $45.67 price target and implied upside.

Another View: Our DCF Model Points the Other Way

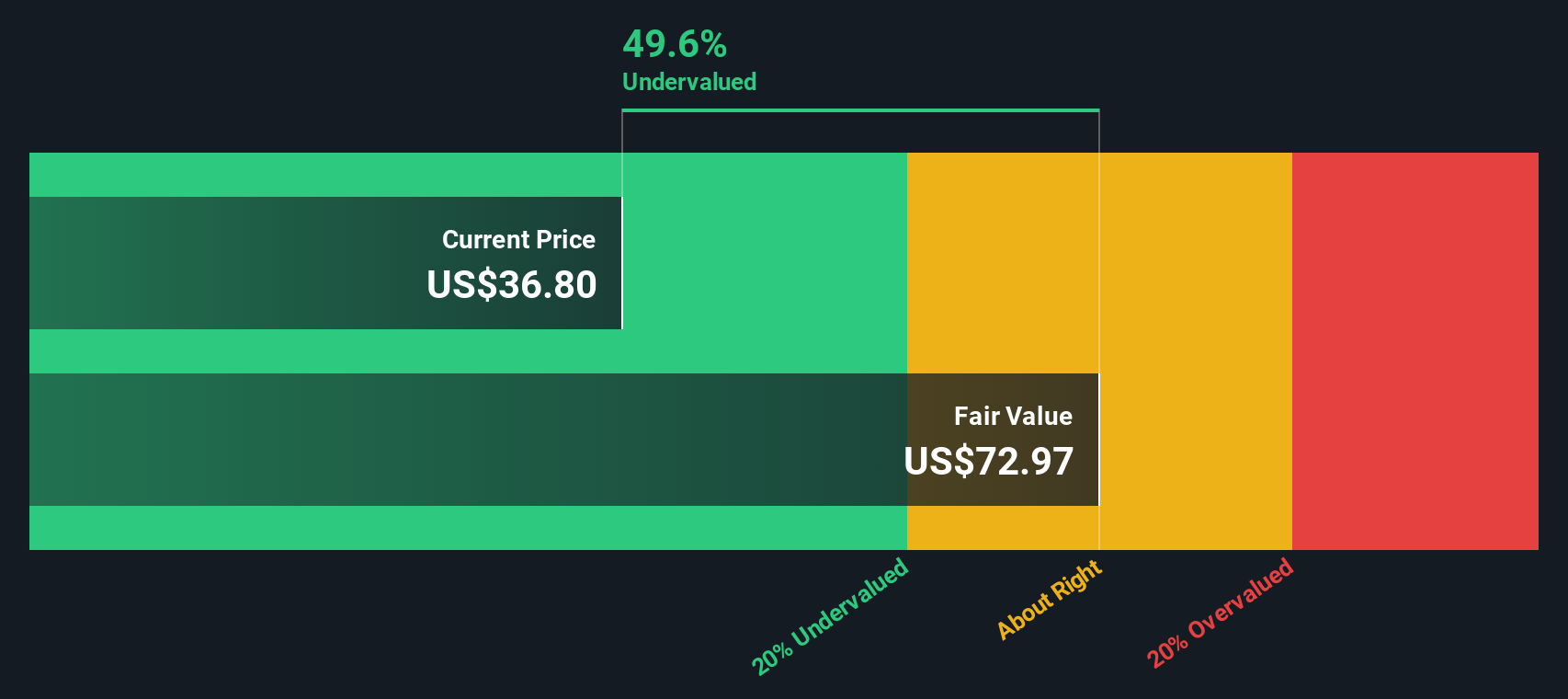

The P/E makes GABC look expensive, but our DCF model paints a very different picture. With shares at $39.73 versus an estimated fair value of $75.34, it flags GABC as materially undervalued. For you, that is a wide gap to weigh against the richer earnings multiple.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out German American Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own German American Bancorp Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to build on your own research, you can shape a custom view in just a few minutes with Do it your way.

A great starting point for your German American Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If GABC has sparked your interest, do not stop here. The next smart move is lining up a few more candidates that could fit your watchlist.

- Target higher income potential by reviewing these 11 dividend stocks with yields > 3% that might suit an income focused approach.

- Spot value opportunities early by scanning these 877 undervalued stocks based on cash flows that currently trade below estimated cash flow based measures.

- Add growth angles to your watchlist by checking these 29 healthcare AI stocks that sit at the intersection of technology and medical applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.