يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Healthcare Services Group (HCSG) Valuation After Analyst Upgrades and Rising Investor Optimism

Healthcare Services Group, Inc. HCSG | 19.37 19.37 | -0.21% 0.00% Pre |

Healthcare Services Group (HCSG) caught investors’ attention after analysts raised their outlook on the stock, citing stronger revenue growth and efficient cost controls. Expectations for rising outsourced healthcare demand contribute to the current optimistic mood.

The upbeat momentum around Healthcare Services Group has pushed shares to a 52-week high, reflecting renewed investor enthusiasm for its growth story and underlying fundamentals. Over the last year, the stock delivered a modest 0.7% total shareholder return. This suggests that while the recent surge is notable, longer-term gains have been steady but not dramatic. Recent events point to building optimism, especially as investors respond to accelerating revenue growth and cost discipline. However, heightened risks from major client exposures remain on the radar.

Curious about other healthcare stocks making waves? Now is the perfect time to discover fresh opportunities with our See the full list for free.

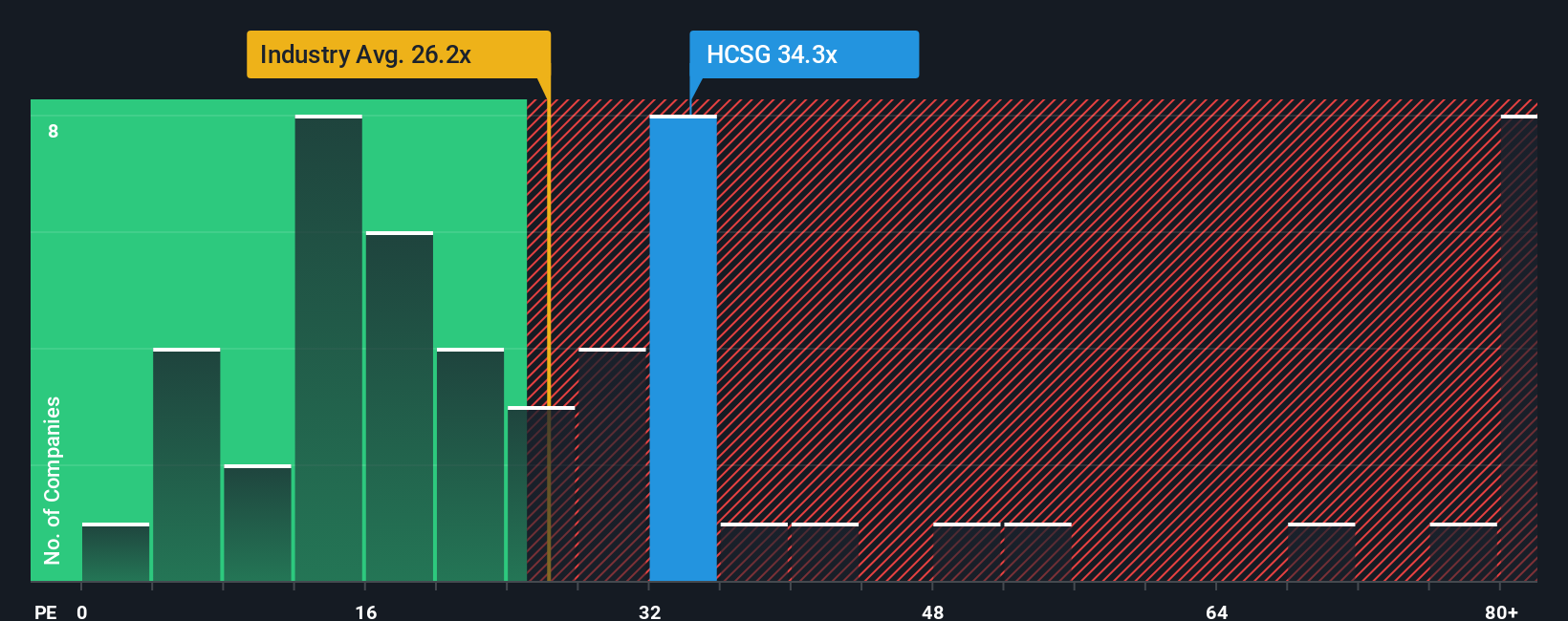

With HCSG shares hitting new highs and analysts projecting more upside, the key question is whether the stock remains attractively valued or if future growth is already fully reflected in the current price.

Most Popular Narrative: 8.1% Undervalued

With Healthcare Services Group last closing at $16.54 and the most followed narrative assigning a fair value of $18, the pricing gap signals calculated upside. Here is one of the main drivers behind this viewpoint:

Strong operational execution, including 90%+ client retention, increased cross-selling of dining services into environmental accounts, and a focus on bundled solutions, should drive recurring revenues and improve earnings consistency over time.

Want to know the assumptions fueling this fair value? This narrative leans on bold jumps in revenue, margin expansion, and a profit multiple with echoes of industry giants. Curious what numbers underpin the story? Dive in to uncover the high-stakes projections that support the analysts' target.

Result: Fair Value of $18 (UNDERVALUED)

However, persistent client concentration and ongoing labor market pressures could quickly challenge the bullish narrative. These factors could potentially undermine revenue momentum and margin progress.

Another View: Market Ratios Raise Caution

Taking a look at market-based ratios, Healthcare Services Group is currently valued at 110.8 times earnings. That is much higher than the industry average of 28.1 times and also above the fair ratio of 51.4 times. This wide gap suggests that investors may be taking on more valuation risk than they realize. Is the optimism already built into the price, or is a future rerating on the way?

Build Your Own Healthcare Services Group Narrative

Feel that your perspective is different or want to dig deeper into the numbers yourself? You can shape your own story about Healthcare Services Group in just a few minutes with our Do it your way

A great starting point for your Healthcare Services Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your opportunities beyond Healthcare Services Group and seize your next winning investment. Don’t let the market move on without you. Take a fresh look at these high-potential stock groups today.

- Unlock the potential of digital transformation by analyzing these 24 AI penny stocks poised for growth in artificial intelligence and automation.

- Strengthen your income strategy by reviewing these 19 dividend stocks with yields > 3% offering attractive yields above 3% for consistent returns.

- Get ahead of the curve in innovation by checking out these 26 quantum computing stocks at the forefront of breakthrough computing technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.