يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Hinge Health (HNGE) Valuation After Recent Share Price Gains and New Partnerships

Hinge Health, Inc. HNGE | 48.48 | -2.45% |

HNGE’s near-term share price bump comes after a series of product rollouts and partnerships earlier this year, which had already sparked stronger interest in the stock. The momentum is building, with a year-to-date share price return of 41% suggesting that investors are growing more optimistic about Hinge Health’s longer-term growth story despite the lack of long-term total shareholder return data to date.

If you want to see which other healthcare stocks are gaining traction this year, check out the opportunities in our See the full list for free..

With such strong year-to-date gains and investor enthusiasm rising, the real question now is whether HNGE shares remain undervalued or if the market has already factored in much of the company’s promising growth potential.

Price-to-Sales Ratio of 8.6x: Is it justified?

Hinge Health’s shares trade at a price-to-sales (P/S) ratio of 8.6x, more than double the peer average of 3.7x. This suggests the stock is priced at a substantial premium compared to similar companies, making valuation a critical talking point as shares rally.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of the company’s sales. For rapidly growing healthcare businesses like Hinge Health, investors may accept a higher P/S multiple if they believe strong future growth will translate into profitability.

Currently, the market is assigning Hinge Health a valuation far above both its peer average and the broader US Healthcare industry, which has an average P/S of just 1.5x. There is insufficient data to calculate the fair ratio. Investors must decide if this premium is truly warranted given the company’s growth profile.

Result: Price-to-Sales of 8.6x (OVERVALUED)

However, slowing revenue growth and continued net losses could challenge Hinge Health’s premium valuation if investor expectations for rapid improvement are not met.

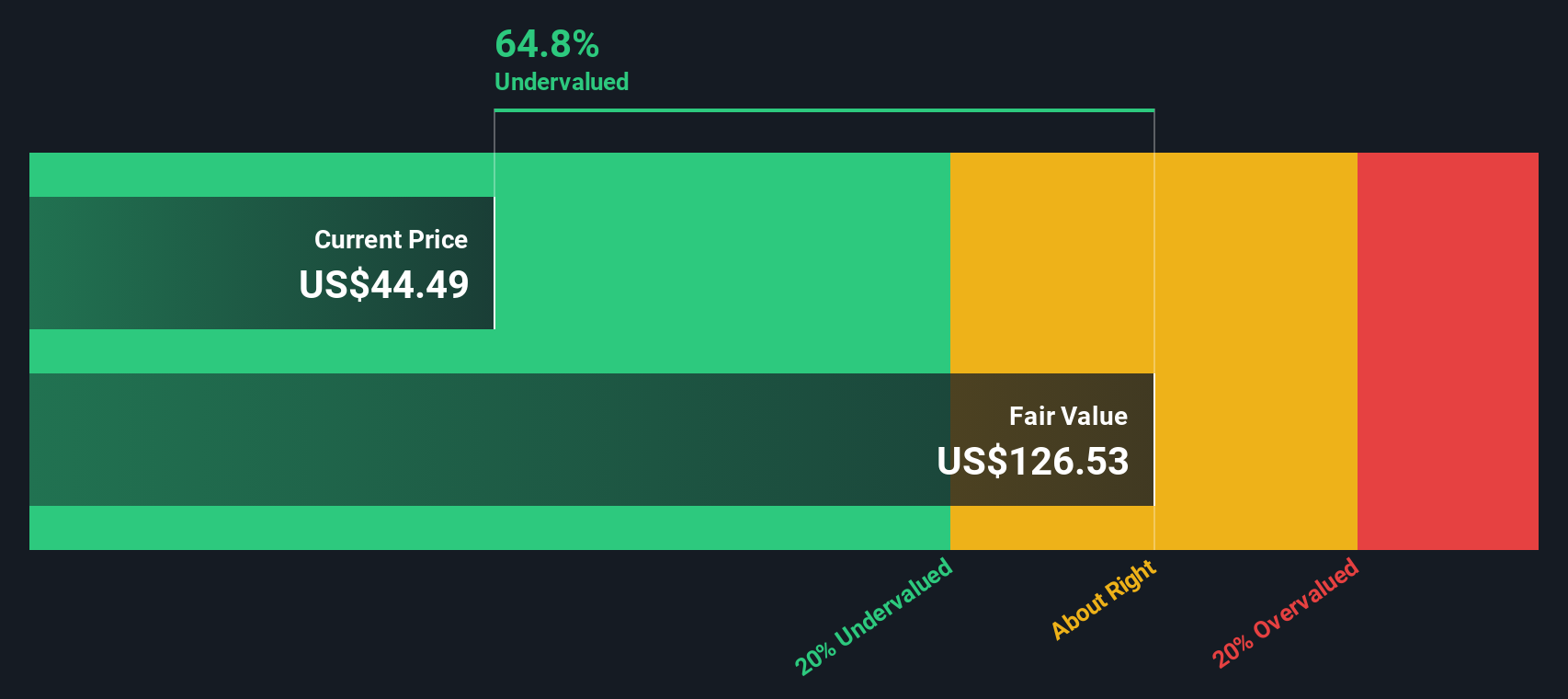

Another View: Deep Discount According to SWS DCF Model

While HNGE’s high price-to-sales ratio makes it look expensive compared to peers, our DCF model offers a completely different picture. It suggests shares are trading about 58.7% below estimated fair value, which points to significant undervaluation. Could the market be underestimating Hinge Health’s long-term cash flow potential?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hinge Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hinge Health Narrative

If you see the story differently or want to dig deeper on your own, you can quickly build your own narrative using the available data. Do it your way.

A great starting point for your Hinge Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. Use the same smart tools professional investors trust to turn fresh insights into your next portfolio win.

- Boost your income by targeting strong cash flow and reliable payouts with these 19 dividend stocks with yields > 3%.

- Supercharge your returns by tracking these 909 undervalued stocks based on cash flows that are currently flying under the radar and may offer real upside.

- Stay ahead of the curve by unearthing tomorrow's market leaders using these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.