يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing IDT (IDT) Valuation As NRS Same-Store Sales And Pricing Show New Strength

IDT Corporation Class B IDT | 49.62 | +0.18% |

Fresh data from IDT (IDT) subsidiary NRSInsights showed December 2025 same-store sales up 4.5% year over year, with average prices for the top 500 items rising 2.3% across its retail point of sale network.

That pickup in NRS same-store sales and pricing lands against a mixed share price backdrop, with a recent 90 day share price return of 8.9% and a 1 year total shareholder return of 12.1%. The 5 year total shareholder return of about 2.7x suggests longer term holders have already seen substantial value creation, while recent momentum looks more muted.

If this kind of retail and payments story has your attention, it can be worth widening the lens and checking out fast growing stocks with high insider ownership for other fast growing names with committed insiders.

With shares up 12.1% over the past year but still trading at a sizeable discount to the US$80 analyst price target and an implied intrinsic value gap, you have to ask: is IDT quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative: 35.8% Undervalued

With IDT last closing at US$51.38 against a narrative fair value of US$80, the current price sits well below that implied estimate.

The company's intention to continue repurchasing shares and increasing dividends, backed by strong cash generation, suggests improved earnings per share (EPS) growth potential. With ongoing subscription revenue growth and strategic investments in AI and digital channels, net2phone's future performance is expected to boost revenue and improve adjusted EBITDA margins.

It is worth asking what kind of earnings path and margin profile could justify that higher fair value. The narrative leans on steady profits, richer margins, and a future P/E multiple that stands above the wider telecom group.

Result: Fair Value of $80 (UNDERVALUED)

However, you still need to weigh risks such as the significant working capital needs at BOSS Money, as well as potential integration or spending issues if future growth depends on acquisitions.

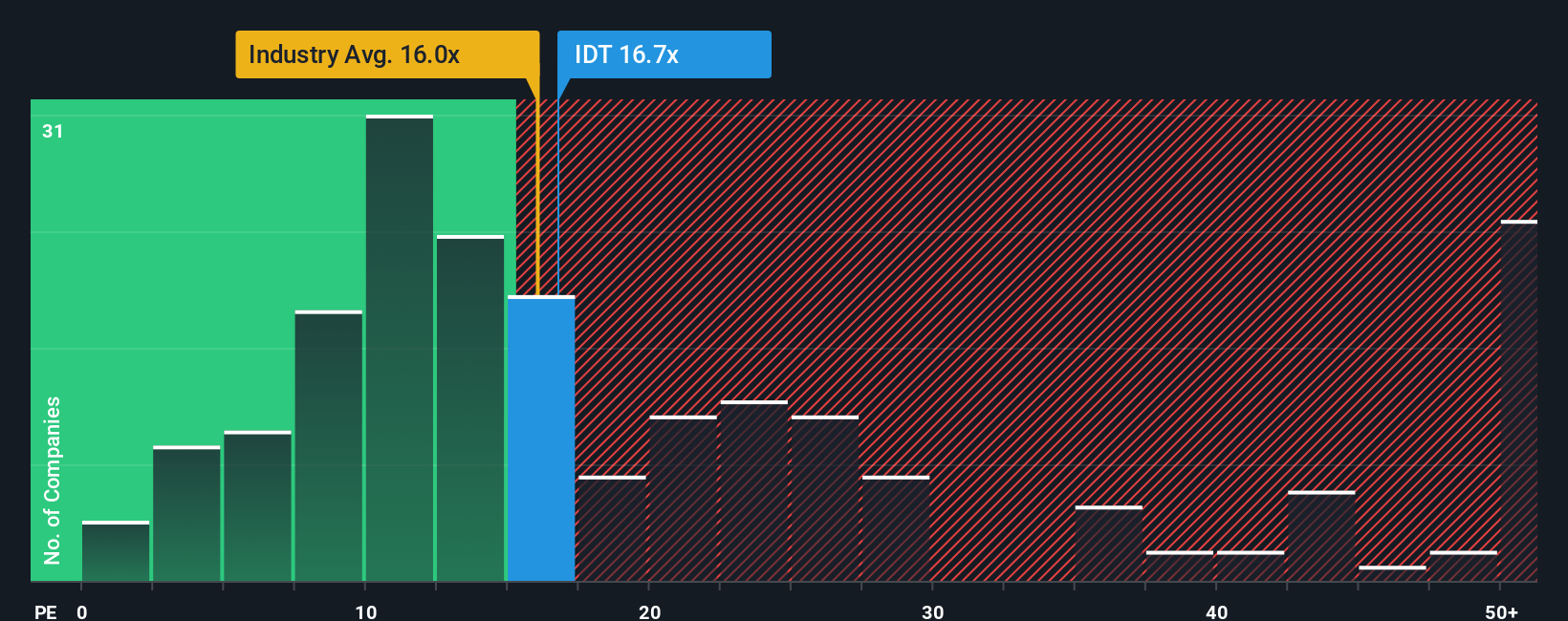

Another View: Market Ratios Tell A Different Story

Our fair value narrative points to meaningful upside, yet the current P/E of 15.9x sends a mixed signal. It sits above the fair ratio of 13.3x and well above peers at 8.8x, which hints at less margin of safety if expectations around growth or margins are tested.

Build Your Own IDT Narrative

If you see the numbers differently, or simply prefer to stress test the assumptions yourself, you can build a personalised view of IDT in minutes by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding IDT.

Looking for more investment ideas?

If IDT has sparked your interest, do not stop here. Broaden your opportunity set by scanning other corners of the market where different stories are taking shape.

- Target income-focused opportunities by reviewing these 12 dividend stocks with yields > 3% that may suit investors who want yields alongside potential capital growth.

- Spot growth trends early by checking out these 26 AI penny stocks that are tied to real business models rather than hype alone.

- Hunt for mispriced names using these 878 undervalued stocks based on cash flows that might line up better with the return profile you want over the long run.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.