يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing International Flavors & Fragrances (IFF) Valuation After Recent Share Price Momentum

International Flavors & Fragrances Inc. IFF | 81.39 | -0.28% |

Why International Flavors & Fragrances (IFF) is on investors’ radar today

International Flavors & Fragrances (IFF) has caught investor attention after a period of mixed performance, with recent share price gains over the past month and past 3 months contrasting with weaker multi year total returns.

The recent swing in sentiment around International Flavors & Fragrances is clear, with a 1 month share price return of 18.27% and a 90 day share price return of 25.99%. However, the 1 year total shareholder return is slightly negative and the 5 year total shareholder return remains well below break even. This indicates that momentum has picked up in the short term, while long term holders have not yet been fully rewarded.

If this rebound has you thinking about what else could be setting up for a move, it might be a good time to broaden your search with 23 top founder-led companies.

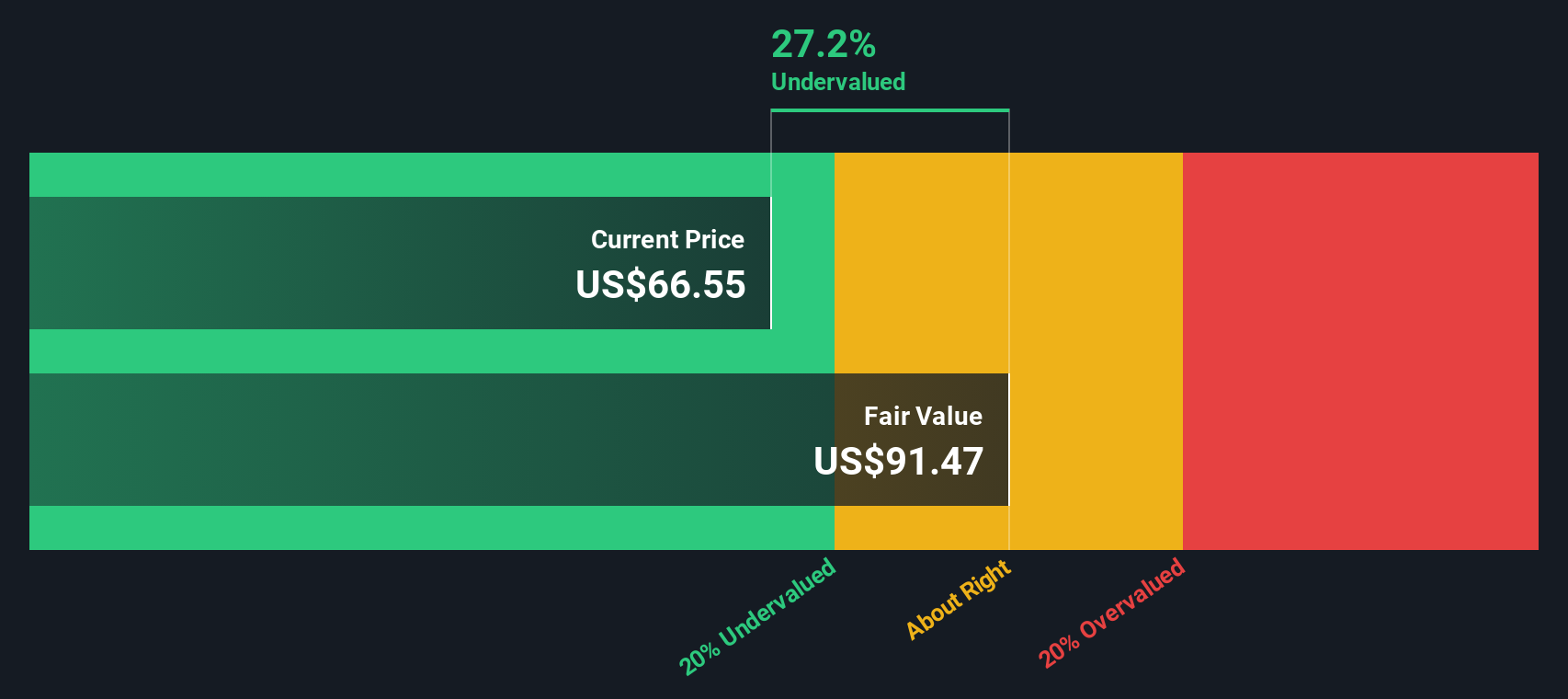

With the share price up strongly in recent months, a small discount to analyst targets, and an intrinsic value estimate slightly above the current price, the key question is whether IFF is still mispriced or if the market is already banking on better days ahead.

Most Popular Narrative: 1% Overvalued

With International Flavors & Fragrances last closing at $83 and the most followed narrative pointing to a fair value of about $82.37, the current setup hinges on how future profitability and cash flows play out under an 8.11% discount rate.

Ongoing investments in R&D and capacity (especially in Health & Biosciences, Taste, and Specialty Fragrance Ingredients) are strengthening the company's innovation pipeline, management expects these initiatives to accelerate revenue and profit growth beginning in 2026 and reaching full impact by 2027.

Curious what kind of earnings step up this story is built around, and how rich a future profit multiple it assumes to hold that fair value line, the full narrative lays out those projections in detail and lets you weigh how comfortable you are with the path it sketches. Result: Fair Value of $82.37 (OVERVALUED)

However, there are still clear risks, including ongoing softness in key markets and pressure in Fragrance Ingredients from low cost competitors, that could derail this earnings path.

Another Angle On Valuation

While the narrative pins fair value around $82.37, our DCF model comes in a touch lower at $80.44, with the current $83 price sitting above both marks. With two methods pointing to a similar range, the question is whether you think the cash flow story is conservative or generous.

Build Your Own International Flavors & Fragrances Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own assumptions against the data, you can build a complete view in just a few minutes with Do it your way.

A great starting point for your International Flavors & Fragrances research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If IFF has sharpened your focus, do not stop here. Casting a wider net with targeted stock ideas can give you more options and perspective.

- Spot potential value plays early by scanning our list of 53 high quality undervalued stocks that currently screen well on quality and pricing metrics.

- Lock in more dependable cash flow candidates by checking out 13 dividend fortresses, focused on companies offering yields from sturdier payout profiles.

- Sleep a bit easier by reviewing 85 resilient stocks with low risk scores, highlighting businesses that currently score well on lower overall risk characteristics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.