يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing McGrath RentCorp (MGRC) Valuation After Recent Share Price Weakness

McGrath RentCorp MGRC | 112.77 | -0.97% |

What McGrath RentCorp’s latest trading snapshot tells you

McGrath RentCorp (MGRC) has been moving without a clear headline catalyst. This can be a useful moment to step back and look at how the stock’s recent returns line up with its fundamentals.

At a share price of $108.83, McGrath RentCorp’s recent 1 day and 7 day share price declines sit against a 90 day share price return of a 10.94% decline and a 1 year total shareholder return of an 8.86% decline. This suggests that shorter term momentum has faded even though longer term total shareholder return over 3 and 5 years remains positive.

If you are comparing McGrath RentCorp with other capital goods names, this can be a useful moment to scan the market using fast growing stocks with high insider ownership and see what else stands out.

With McGrath RentCorp trading at $108.83, a recent total shareholder return decline over 1 year, and a small intrinsic discount, you have to ask: is there a mispriced opportunity here, or is the market already baking in future growth?

Price to earnings of 18.4x, is it justified?

With McGrath RentCorp closing at $108.83 and trading on a P/E of 18.4x, the shares are described as good value compared with both peers and the wider US Trade Distributors industry.

The P/E ratio links what you pay today to the company’s earnings. For a rental and capital goods business like McGrath RentCorp it is a simple way to see how much of those earnings are already reflected in the price.

Here, the stock’s 18.4x P/E is below the peer average of 21x and also below the sector average of 22.7x, which implies the market is currently assigning a lower earnings multiple than similar companies. At the same time, that 18.4x is very close to the estimated fair P/E of 18.6x, suggesting the current level is in line with where the market could reasonably settle if sentiment does not shift materially.

Result: Price-to-earnings of 18.4x (ABOUT RIGHT)

However, you still have to weigh risks, such as a 9% 1 year total shareholder return decline and the possibility that rental demand or equipment spending softens.

Another view on McGrath RentCorp’s value

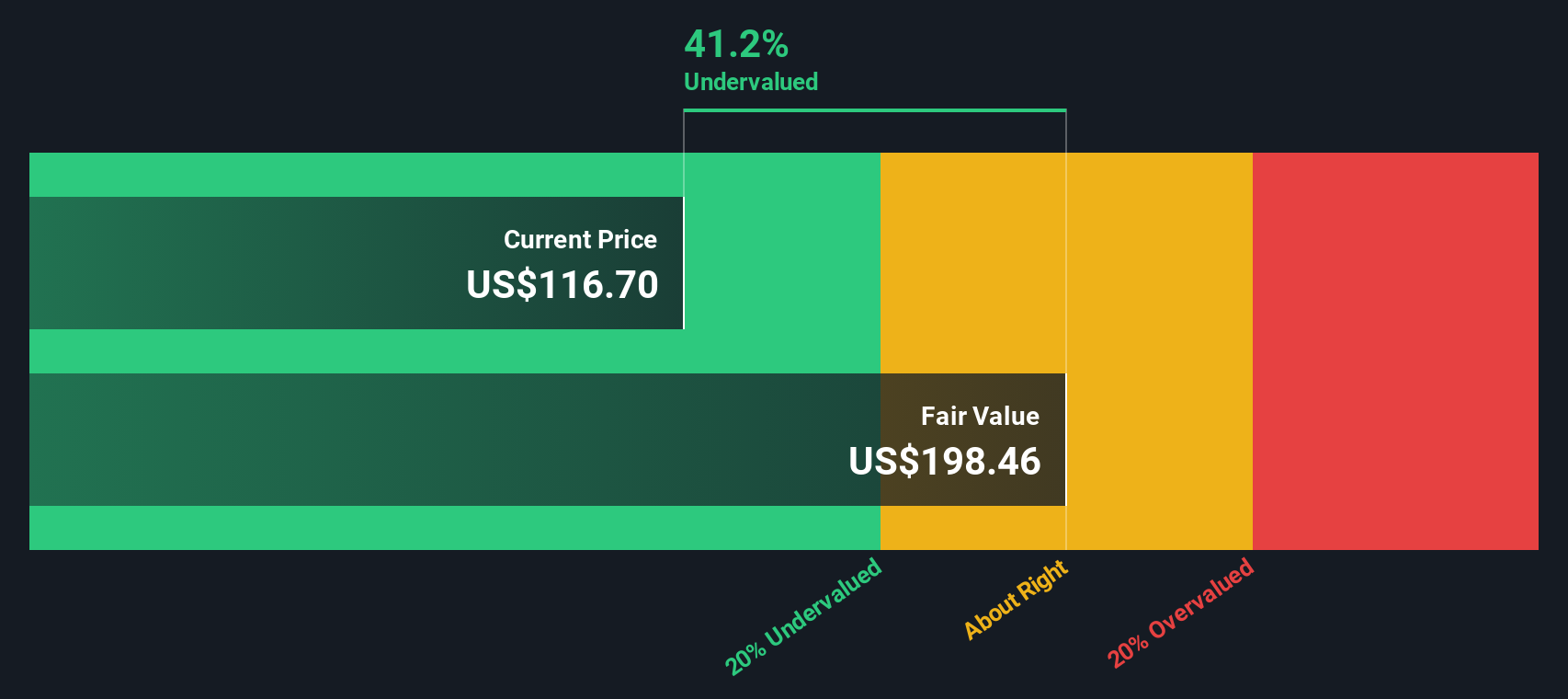

Our DCF model points to a fair value of $114.45 for McGrath RentCorp, compared with the current $108.83 share price, which implies the stock trades about 4.9% below that estimate. It is a modest gap, so the question is whether you see it as a margin of safety or just noise.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out McGrath RentCorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own McGrath RentCorp Narrative

If you look at the same data and reach a different conclusion, or simply want to test your own view, you can build a full narrative and run the numbers yourself in just a few minutes using Do it your way.

A great starting point for your McGrath RentCorp research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, take a moment to scan a few fresh ideas so you are not leaving potential opportunities on the table.

- Spot potential bargains by checking out these 874 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Hunt for future-focused themes through these 23 quantum computing stocks at the intersection of advanced computing and listed equities.

- Strengthen your income watchlist with these 13 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.