يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Merit Medical Systems (MMSI) Valuation After Bullish Analyst Reactions To Earnings Beats

Merit Medical Systems, Inc. MMSI | 82.21 | +0.45% |

Recent commentary around Merit Medical Systems (MMSI) centers on analysts reacting to its pattern of beating earnings estimates and the view that its free cash flow and balance sheet support further reinvestment.

Despite the optimistic earnings commentary, the share price has eased recently, with a 30 day share price return decline of 8.75% and a 1 year total shareholder return decline of 25.79%, suggesting momentum has faded after earlier gains.

If you are reassessing healthcare exposure after Merit Medical Systems's recent moves, it could be a good moment to scan other opportunities across healthcare stocks.

With analysts pointing to earnings beats, a solid balance sheet and a roughly 29% gap to their price target, is Merit Medical looking mispriced after its pullback, or is the market already factoring in future growth?

Most Popular Narrative: 22.3% Undervalued

With Merit Medical Systems last closing at $80.50 against a narrative fair value of about $103.55, the widely followed view is that the current pullback leaves a material gap to what future cash flows could support.

Ongoing investments in operational efficiency, manufacturing automation, and product portfolio expansion through innovation and strategic M&A are driving improved gross and operating margins (evidenced by record 21% non-GAAP operating margin), supporting higher cash flow and net earnings.

Want to see why this narrative leans so bullish on margins without expecting hyper growth in sales or earnings multiples? The entire case rests on a tight set of revenue, earnings and discount rate assumptions that have to line up almost perfectly. Curious which numbers matter most and how they add up to that fair value gap? The full narrative spells it out in plain terms.

Result: Fair Value of $103.55 (UNDERVALUED)

However, this hinges on WRAPSODY CIE securing timely reimbursement and China revenue stabilising, as further setbacks there could quickly chip away at the bullish margin story.

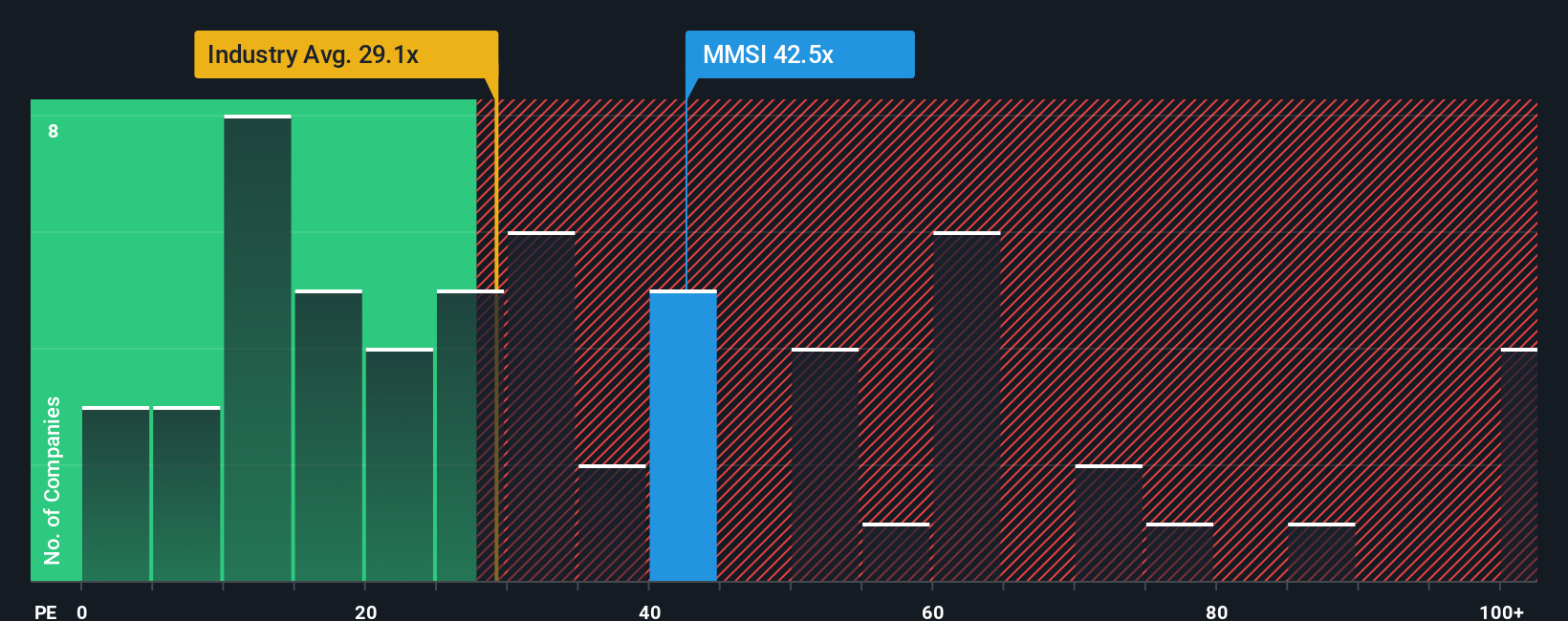

Another View: High P/E Puts Pressure On The Story

While the narrative fair value points to Merit Medical Systems being 22.3% undervalued, the current P/E of 40.3x tells a tougher story. It sits well above the US Medical Equipment group at 31.7x and a fair ratio of 24.4x, which raises the risk that any earnings wobble hits the share price first, not later.

Build Your Own Merit Medical Systems Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to stress test the assumptions yourself, you can build your own view in just a few minutes, starting with Do it your way.

A great starting point for your Merit Medical Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one company, you risk missing out on other opportunities that might fit your goals even better, so widen your search with a few focused screens.

- Spot potential value candidates by checking out these 877 undervalued stocks based on cash flows that currently trade below what their cash flows suggest.

- Tap into fast moving themes by scanning these 24 AI penny stocks that are tied to artificial intelligence trends.

- Strengthen your search for cash focused income opportunities with these 14 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.