يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Navient (NAVI) Valuation After Leadership Reshuffle And New CFO Appointment

Navient Corp NAVI | 9.37 | -1.37% |

Navient (NAVI) is back in focus after a leadership shake up that puts long time executive Steve Hauber in the Chief Financial Officer seat, consolidating oversight of finance, legal, risk and compliance.

That reshuffle comes as Navient’s share price sits at US$12.51, with a 30 day share price return of 5.23% decline and a 1 year total shareholder return of 5.70% decline. This suggests recent momentum has softened even as investors weigh the upcoming 2025 results webcast and the broader leadership refresh.

If you are reassessing financial names after Navient’s leadership moves, it could be a useful moment to see what else is out there through fast growing stocks with high insider ownership.

With Navient trading at US$12.51, a value score of 1, a recent share price decline and the stock sitting only slightly below analyst targets, you have to ask: is there hidden value here, or are markets already pricing in whatever comes next?

Most Popular Narrative: 4.2% Undervalued

On the most followed view, Navient’s fair value of about US$13.06 sits slightly above the last close at US$12.51, which frames a modest valuation gap for investors to assess.

Meaningful operating expense reductions tied to divestitures and ongoing simplification initiatives are on track, with the company reiterating an ambitious $400 million expense reduction target; continued progress here is expected to directly contribute to higher net margins and greater earnings leverage as volume scales.

Want to understand why expense cuts, margin expansion, and a very different earnings profile sit at the heart of this fair value? The narrative leans on rapid profit growth, a sharply lower future P/E and material share count changes, all layered over a specific discount rate. Curious how those moving parts fit together into US$13.06 per share? The full story connects each assumption to the valuation step by step.

Result: Fair Value of $13.06 (UNDERVALUED)

However, the fair value story can shift quickly if credit losses run higher than expected or if ongoing regulatory changes reshape student loan economics more sharply than modeled.

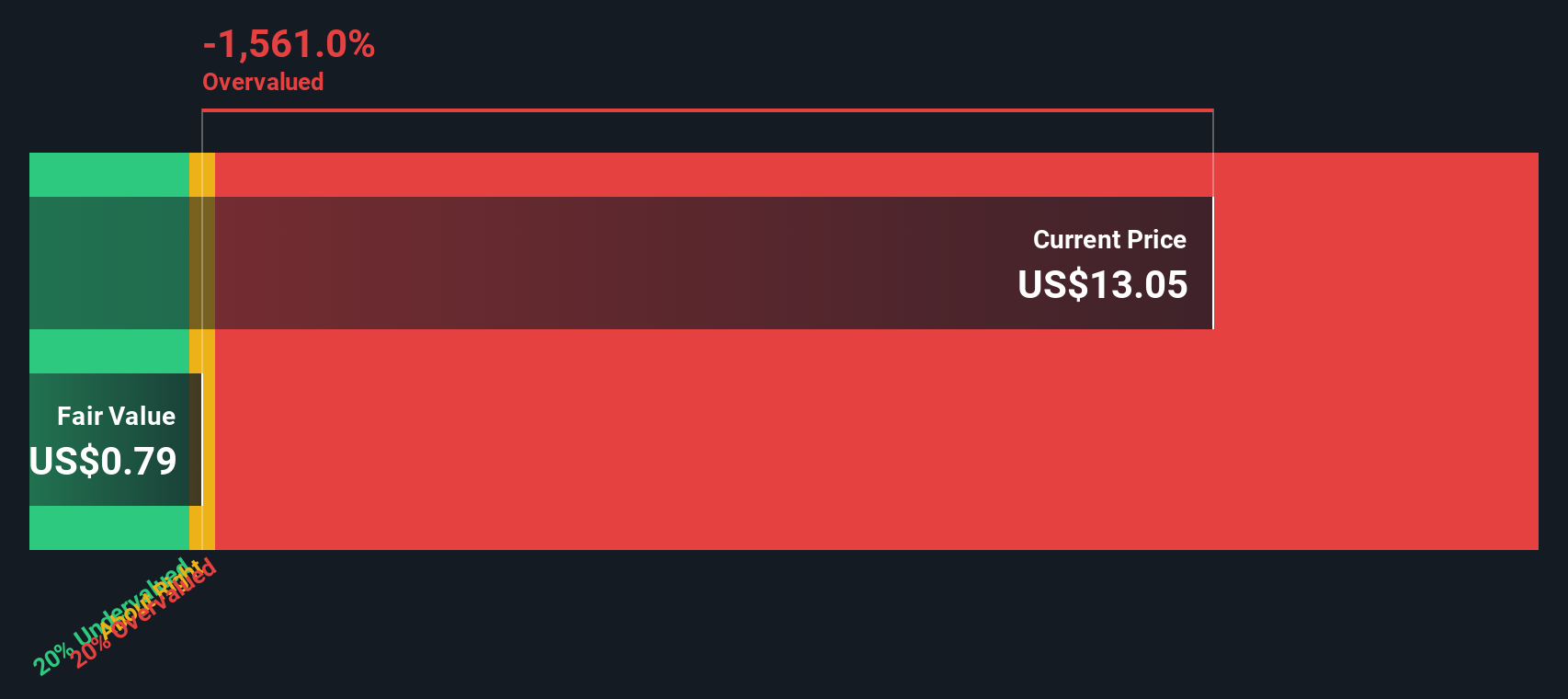

Another View: DCF Paints A Sharper Picture

While the consensus narrative points to Navient trading about 4.2% below a fair value of roughly US$13.06, our DCF model tells a very different story. On that approach, Navient screens as overvalued, with a DCF fair value of about US$4.99 against the current US$12.51 share price. That gap raises a simple question for you: are analyst growth and margin assumptions too generous, or is the DCF framework being too strict for a business with this kind of earnings profile?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Navient for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 871 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Navient Narrative

If this view does not quite line up with your own thinking, or you prefer to test the numbers yourself, you can build a custom thesis in just a few minutes with Do it your way.

A great starting point for your Navient research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Navient has sharpened your focus, do not stop here. The screener can quickly surface other angles you might wish you had looked at sooner.

- Spot potential underpriced names early by checking out these 871 undervalued stocks based on cash flows that line up with your approach to risk and return.

- Ride powerful tech trends by scanning these 24 AI penny stocks shaping how data, automation and machine learning show up in listed companies.

- Add a different growth angle by reviewing these 3528 penny stocks with strong financials that still meet clear financial quality checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.