يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Noble (NE) After US$1.3b In New Offshore Drilling Contracts And Expanding Backlog

Noble Corporation PLC Class A NE | 45.52 | +0.40% |

Noble (NE) is back in focus after announcing about US$1.3b in new offshore drilling contracts across nine rigs, including a three year Aker BP deal offshore Norway that expands its harsh environment presence.

This contract win comes on top of an already strong run, with a 30 day share price return of 28.69% and a year to date share price return of 35.17%. The 1 year total shareholder return of 32.54% contrasts with a more modest 3 year total shareholder return of 4.20%, suggesting that recent momentum has picked up meaningfully.

If activity in offshore drilling has your attention, it could be a good moment to widen your watchlist with our screener of 24 power grid technology and infrastructure stocks that may benefit from long term energy infrastructure trends.

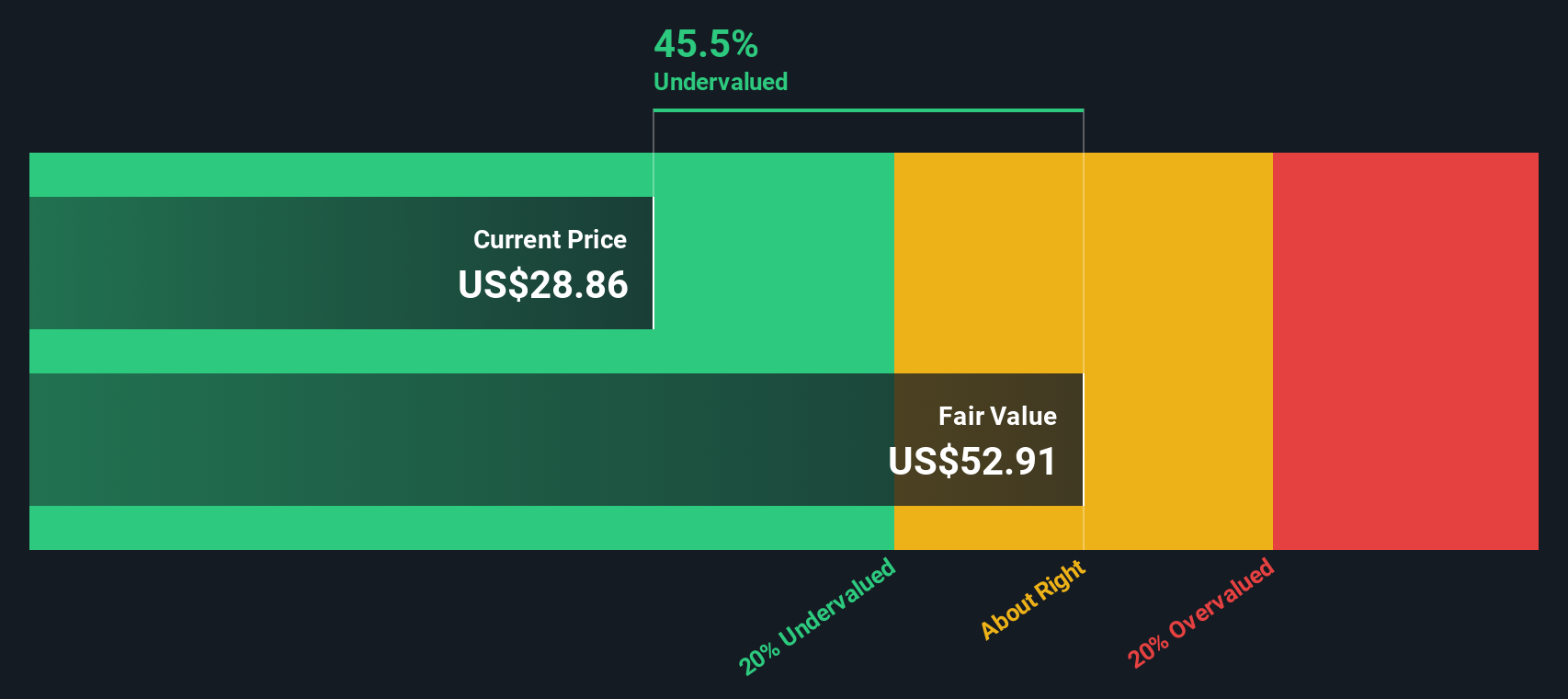

With US$1.3b of new contracts, a reported intrinsic discount of 51.45% and a share price sitting above the average analyst target, the key question is whether Noble is still on sale or if the market already reflects its future growth prospects.

Most Popular Narrative: 16.7% Overvalued

Against the most followed narrative fair value of $33.60, Noble's last close at $39.20 sits higher, which puts extra focus on what is built into those assumptions.

Large offshore project pipelines in South America (notably Brazil), West Africa, and other regions are set to drive a rebound in ultra-deepwater drilling activity by late 2026 to 2027 due to global energy demand growth, supporting higher rig utilization and dayrates, which is likely to boost Noble's future revenue and EBITDA.

Curious what kind of revenue path and margin profile are baked into that view, and what profit multiple it assumes several years out? The full narrative lays out a detailed earnings ramp, a tighter share count, and a higher future valuation anchor, all tied together by one discount rate and a single fair value line in the sand.

Result: Fair Value of $33.60 (OVERVALUED)

However, softer offshore demand with idle rigs into 2026 and aggressive bidding that pressures dayrates could quickly challenge the earnings and valuation path behind that $33.60 fair value.

Another Take on Noble’s Valuation

The most popular narrative flags Noble as 16.7% overvalued at $39.20 versus a $33.60 fair value, but the SWS DCF model paints a very different picture, with a fair value of $80.75 and a reported 51.5% discount. When two methods disagree this much, which one do you treat as your anchor?

Build Your Own Noble Narrative

If parts of this story do not sit right with you, or you simply prefer to test the assumptions yourself, you can build a custom Noble thesis in just a few minutes, starting with Do it your way.

A great starting point for your Noble research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Noble has sharpened your curiosity, do not stop here. Use the screener to line up more names that match your style and risk tolerance.

- Spot potential value candidates quickly by scanning our list of 52 high quality undervalued stocks that combine quality fundamentals with attractive pricing signals.

- Prioritize stability by reviewing a 84 resilient stocks with low risk scores that scores well on resilience and downside protection based on our risk checks.

- Seek fresh opportunities by checking a screener containing 24 high quality undiscovered gems that have strong fundamentals but sit under most investors' radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.