يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Noble (NE) Valuation After US$1.3b Global Contract Backlog Expansion

Noble Corporation PLC Class A NE | 45.52 | +0.40% |

Noble (NE) has put fresh contract activity in the spotlight after announcing about US$1.3b in new backlog tied to nine rigs, spanning Norway, Nigeria, Guyana, the U.S. Gulf, South America, and Trinidad.

That new US$1.3b backlog lands at a time when Noble’s share price has gained 22.8% year to date, including a 22.8% 30 day share price return and a 19.6% 1 year total shareholder return. This indicates that recent momentum has been building rather than fading.

If you are looking for more ideas in energy related names, this could be a good moment to see what else is moving among aerospace and defense stocks.

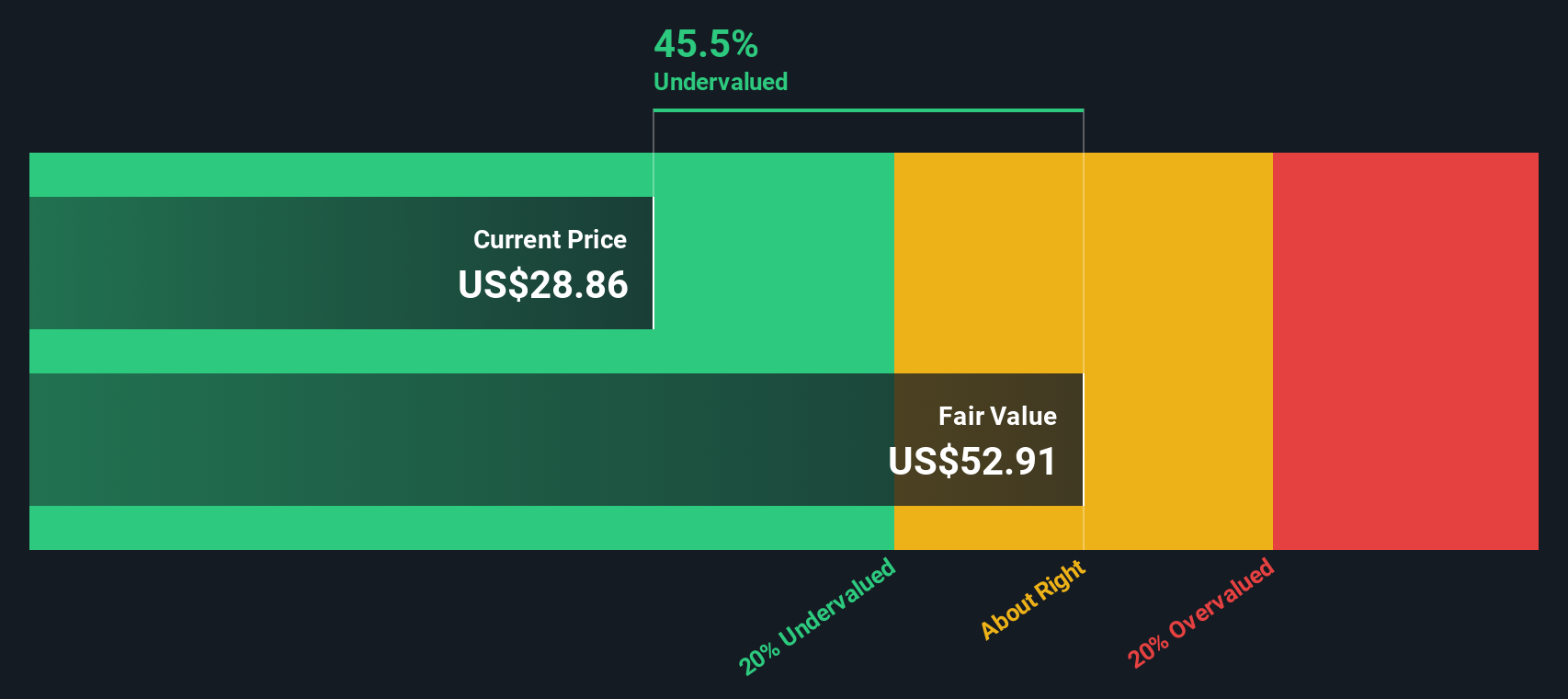

With the shares up sharply and trading near an analyst price target of US$34.50, yet still flagged with an intrinsic discount of about 54%, it raises a key question for you: Is Noble undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 6% Overvalued

Compared to Noble’s last close at $35.62, the most followed narrative points to a fair value of $33.60, suggesting the shares are a little ahead of that view.

Large offshore project pipelines in South America (notably Brazil), West Africa, and other regions are set to drive a rebound in ultra-deepwater drilling activity by late 2026 to 2027 due to global energy demand growth, supporting higher rig utilization and dayrates, which is likely to boost Noble's future revenue and EBITDA.

Curious what earnings profile and margin path sit behind this fair value call? The narrative leans on measured growth, firmer profitability, and a future valuation multiple that needs careful unpacking.

Result: Fair Value of $33.60 (OVERVALUED)

However, you still need to weigh risks such as softer offshore demand that leaves rigs idle and tougher competition that could pressure dayrates and margins.

Another View: Cash Flows Tell a Different Story

The narrative based on earnings multiples points to Noble trading a little ahead of fair value. However, our DCF model paints a very different picture. On that view, the shares at $35.62 sit about 54% below an estimated future cash flow value of $76.61, which suggests a large valuation gap. Is this a genuine opportunity, or is the cash flow outlook simply too optimistic?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Noble for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Noble Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Noble research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You have seen how one company’s story can unfold, so do not stop there when the wider market is full of other potential opportunities to research.

- Broaden your opportunity set by checking out these 3528 penny stocks with strong financials that might sit under the radar but still meet your quality filters.

- Explore growth themes by scanning these 24 AI penny stocks that are linked to AI and could suit a higher risk portion of your portfolio.

- Focus on value by reviewing these 875 undervalued stocks based on cash flows that trade below estimated cash flow based assessments and may warrant further research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.