يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing PBF Energy (PBF) Valuation After Recent Share Price Momentum And Analyst Target Update

PBF Energy, Inc. Class A PBF | 34.38 | +1.42% |

PBF Energy (PBF) has recently drawn investor attention after a period in which the stock showed mixed short term returns, with gains over the past month contrasting with pressure over the past 3 months.

The recent 1 month share price return of 26.35% and 7 day gain of 7.31% suggest building momentum for PBF Energy, although the 3 month share price return of a 3.14% decline contrasts with a 1 year total shareholder return of 16.62% and a very large 5 year total shareholder return, all from a starting point of US$33.04 per share today.

If the recent move in refiners has caught your eye, it could be a good moment to widen the lens and check out aerospace and defense stocks as another area of the market to research.

With PBF Energy trading around US$33.04, recent gains, a mixed 3 year track record and an analyst price target a little below today’s level, you have to ask: is there undervalued potential here, or is the market already pricing in what comes next?

Most Popular Narrative: 8% Overvalued

The most followed narrative sees fair value at $30.58 per share, a little below the current $33.04, and builds a case around refining margins and Martinez progress.

PBF Energy’s analyst price target was increased by $0.50 to $30.58. Analysts cited refining margin resilience, successful Martinez restart progress, and improving profitability as key reasons for the upgrade.

Want to see what is really baked into that fair value? The narrative leans heavily on revenue growth, margin repair and a future earnings multiple that is anything but modest. Curious which specific profit and cash flow assumptions are doing the heavy lifting here, and how they connect to those refining assets and restart milestones?

Result: Fair Value of $30.58 (OVERVALUED)

However, persistent operational and regulatory issues at key refineries, especially Martinez, along with uncertain progress in renewable fuels, could quickly challenge the upbeat valuation story.

Another View: Multiples Tell a Different Story

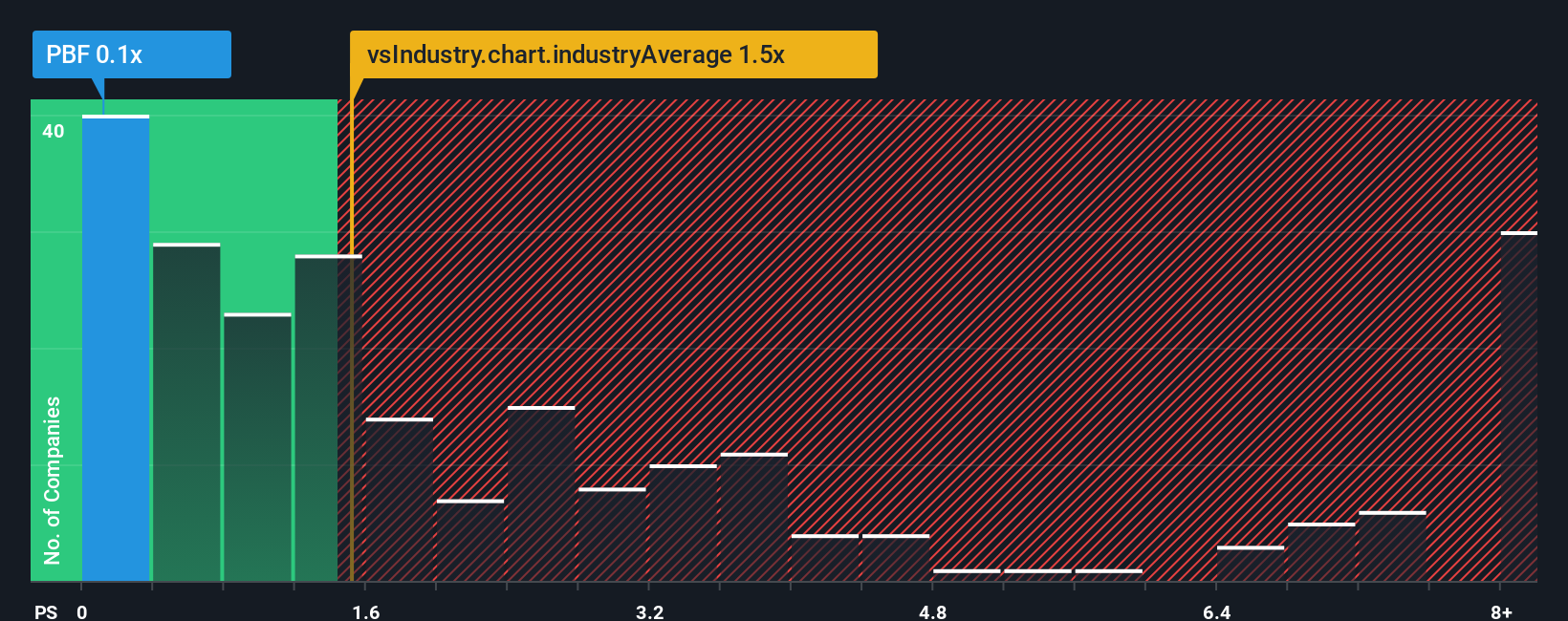

Our SWS model that leans on the P/S ratio presents a different perspective on the $30.58 fair value. PBF trades on a P/S of 0.1x, compared with 1.5x for the US Oil and Gas industry and a fair ratio of 0.4x. That gap suggests the valuation risk may not be entirely on the upside, so which signal do you place more weight on?

Build Your Own PBF Energy Narrative

If you read this and think the assumptions miss something, or you prefer to test the numbers yourself, you can build a complete view in minutes with Do it your way.

A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If PBF Energy is on your radar, do not stop there. Broaden your watchlist with a few focused screens that surface very different kinds of opportunities.

- Spot companies that combine income and potential growth by scanning these 13 dividend stocks with yields > 3% that might suit a portfolio built around regular payouts.

- Hunt for growth stories in cutting edge technology with these 24 AI penny stocks that put artificial intelligence at the center of their business models.

- Zero in on valuations that may look appealing by filtering for these 876 undervalued stocks based on cash flows and see which names stand out on discounted cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.