يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Pentair (PNR) Valuation After TD Cowen Downgrade And Mixed Analyst Views

Pentair plc PNR | 104.08 | +0.81% |

TD Cowen’s downgrade of Pentair (PNR) from Hold to Sell, together with a more cautious outlook than some recent positive opinions, has sharpened debate around the stock’s risk profile and return potential.

Those mixed analyst views are landing after a softer patch in the share price, with the stock at US$102.67 and a 90 day share price return of an 8.17% decline, even though the 3 year total shareholder return of 122.04% remains very strong. Momentum has cooled recently, which helps explain why fresh research opinions, like TD Cowen’s downgrade, are getting more attention from investors weighing short term swings against a strong multi year track record.

If this downgrade has you rethinking where growth and confidence might be building, it could be a good time to scan for fast growing stocks with high insider ownership and see what else stands out.

So with TD Cowen turning cautious just as Pentair trades at US$102.67, sits 18% below the average analyst price target and carries a very strong 3 year total return, are you looking at a genuine opportunity or a market that is already pricing in future growth?

Most Popular Narrative: 15.8% Undervalued

Compared with Pentair’s last close at US$102.67, the most followed narrative points to a fair value of US$122, using a 9.06% discount rate and long term cash flow forecasts.

Secular shifts toward stricter regulations on water quality and sustainability, alongside rising investments in ESG and resource-efficient water infrastructure, are increasing global demand for Pentair's advanced purification and filtration technologies, supporting future top-line and margin growth.

Curious what kind of revenue profile and margin expansion need to line up to back that higher fair value? The narrative leans on steady top line gains, stronger profitability and a premium P/E several years out. The full breakdown sets out how those ingredients come together to close the gap to US$122.

Result: Fair Value of $122 (UNDERVALUED)

However, that upside case still depends on residential and pool demand holding up, as well as on price increases not running into pushback that could pressure margins.

Another Way To Look At Pentair’s Valuation

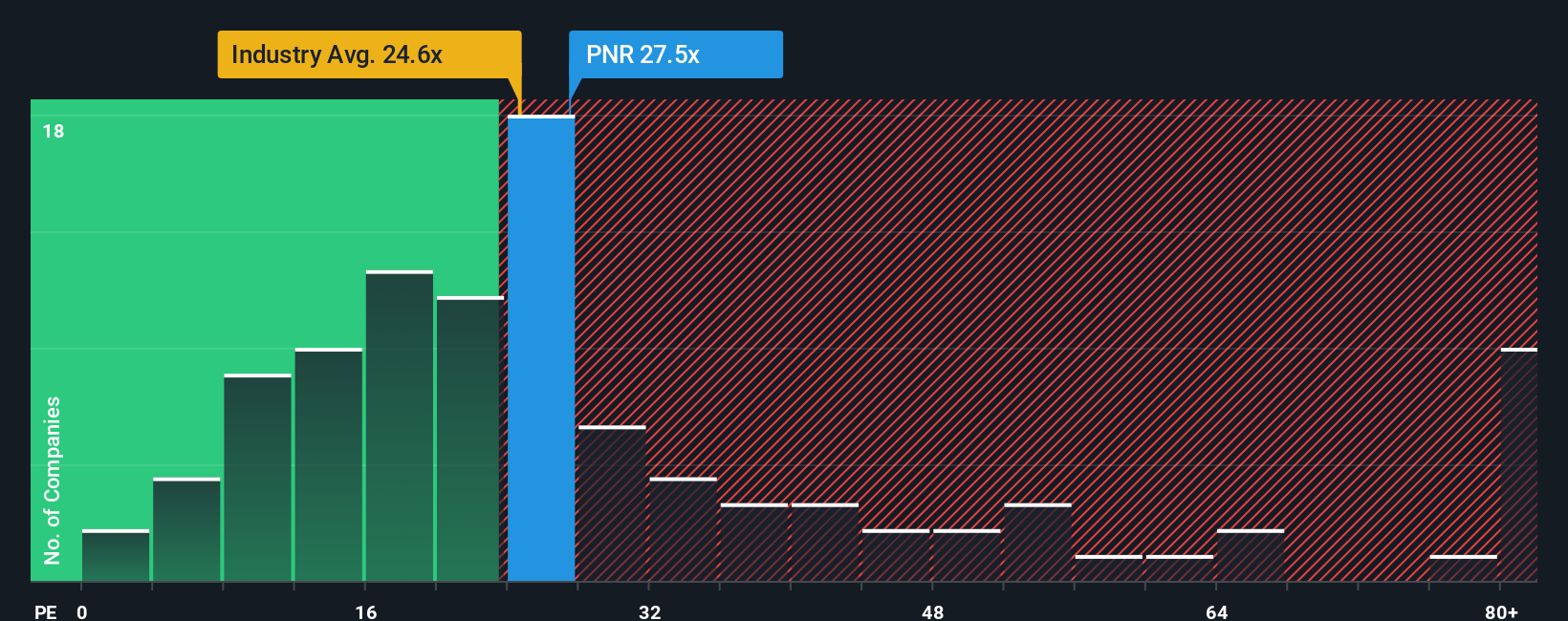

That 15.8% “undervalued” narrative sits beside a different signal. On a P/E of 25.7x, Pentair screens more expensive than both peers at 23.4x and the wider US Machinery group at 25.1x, while its fair ratio is 26.2x. Is this a margin-of-safety gap, or simply fully priced quality?

Build Your Own Pentair Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can build a custom Pentair view in just a few minutes with Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pentair.

Looking for more investment ideas?

If Pentair has caught your attention, do not stop there. Widening your search can help you spot ideas that fit your style before others do.

- Target potential bargains by scanning these 882 undervalued stocks based on cash flows that align with your view on price versus fundamentals.

- Ride powerful tech trends by checking out these 25 AI penny stocks tied to advances in artificial intelligence.

- Tap into income focused opportunities by screening these 13 dividend stocks with yields > 3% that may suit a yield oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.