يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Photronics (PLAB) Valuation After Recent Share Price Momentum And Conflicting Fair Value Signals

Photronics, Inc. PLAB | 38.00 | +2.01% |

Why Photronics is on investors’ radar

Photronics (PLAB) has drawn fresh attention after its recent share price moves, with the stock showing mixed short term returns but a strong performance profile over the past 3 months and 1 year.

With the share price at US$34.39, recent trading has been choppy in the very short term. However, a 90 day share price return of 58.41% alongside a 1 year total shareholder return of 50.24% suggests momentum has been building over a longer window as investors reassess the company’s growth prospects and risks.

If strong recent gains in one semiconductor name have you curious about what else might be moving, this could be a good moment to scan 33 AI infrastructure stocks for other potential ideas.

After such strong recent returns, the key question now is whether Photronics at US$34.39 still trades at a discount, or if the market is already pricing in its future growth potential and leaving little room for a buying opportunity.

Most Popular Narrative: 18.1% Undervalued

With Photronics last closing at US$34.39 and the most followed narrative placing fair value at US$42.00, there is a gap investors are paying attention to, built on detailed forecasts for revenue, margins and future valuation multiples.

Ongoing and planned technological upgrades in Asia (extension to 6nm and 8nm nodes) enable Photronics to participate in next-generation chip production for edge AI, automotive, and communications, creating new high-value growth streams and potential revenue share gains as industry complexity increases.

Curious what earnings power that kind of participation implies? This narrative leans on measured revenue growth, firmer profit margins and a future P/E that sits below many peers. The full set of assumptions may surprise you.

Result: Fair Value of $42 (UNDERVALUED)

However, there are still real swing factors here, including heavy capital spending that could pressure cash flow, as well as geopolitical or customer shifts that could unsettle future revenue and margins.

Another angle on valuation

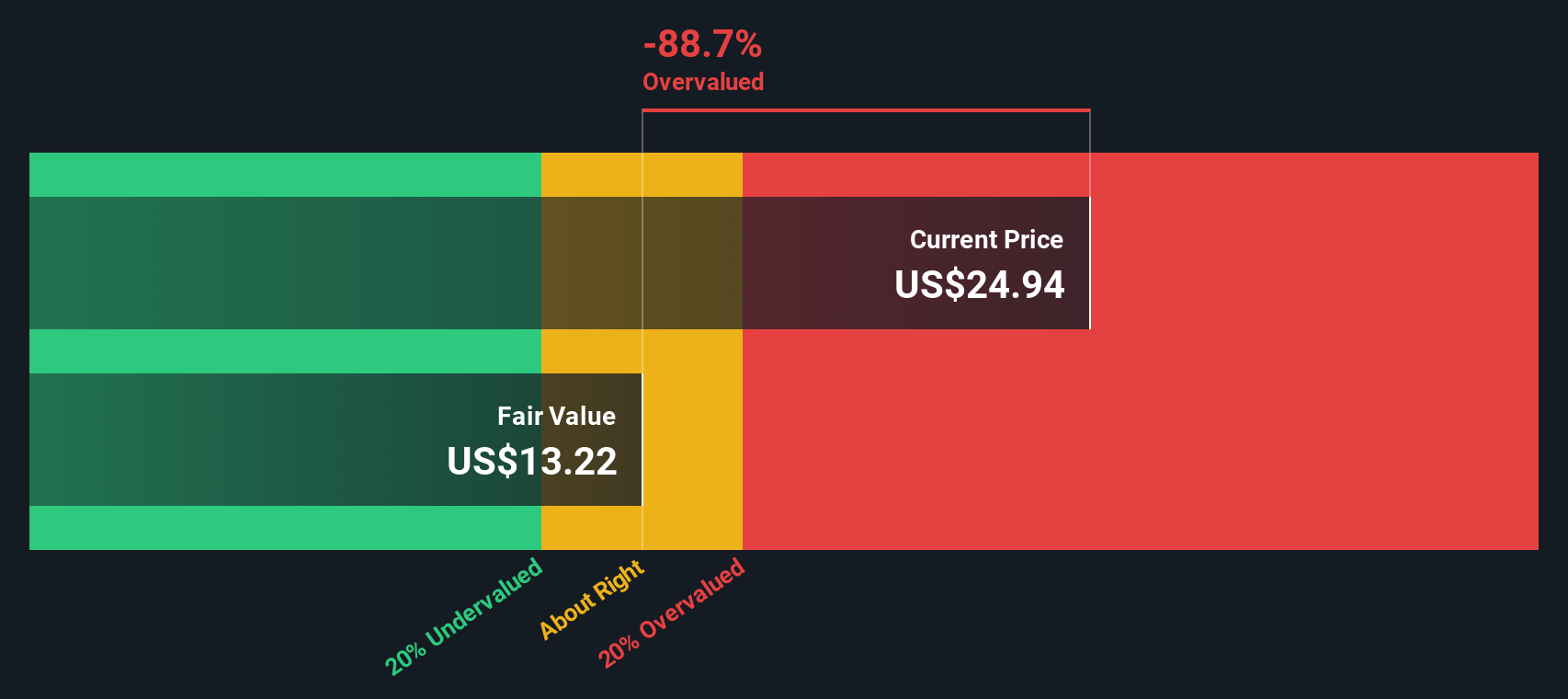

Our DCF model presents a very different picture compared with the US$42 narrative fair value. On this basis, Photronics at US$34.39 sits above an estimated future cash flow value of about US$19.76, which suggests a potentially overvalued outcome and raises questions about how reliable cash flow forecasts are in this case.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Photronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Photronics Narrative

If parts of this story do not quite fit your view, or you would rather test the assumptions yourself, you can build a custom Photronics thesis in just a few minutes, starting with Do it your way.

A great starting point for your Photronics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Photronics has sharpened your interest, do not stop here. Cast a wider net with focused stock lists built from the Simply Wall St screener.

- Target potential bargains by scanning 55 high quality undervalued stocks that combine quality fundamentals with prices that may still sit below their estimated worth.

- Prioritise resilience with 81 resilient stocks with low risk scores so you are not missing companies that score well on financial strength and business stability.

- Spot earlier stage opportunities using our 25 elite penny stocks with strong financials that meet fundamental criteria instead of relying purely on hype or headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.