يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing RPC (RES) Valuation After Q4 Earnings Miss And Net Loss Report

RPC, Inc. RES | 6.10 | -0.16% |

Q4 earnings miss and revenue softness weigh on RPC (RES)

RPC (RES) stock moved after the company reported fourth quarter 2025 results, posting a net loss and sequential revenue decline as industry softness, seasonal factors and accounting changes pressured margins.

For the fourth quarter, RPC reported sales of US$425.78 million compared with US$335.36 million in the same period a year earlier, while net loss was US$3.06 million versus net income of US$12.76 million.

Basic and diluted loss per share from continuing operations came in at US$0.02, compared with basic and diluted earnings per share of US$0.06 a year earlier.

Over the full year to December 31, 2025, sales were US$1.63b compared with US$1.42b a year before, and net income was US$32.08 million compared with US$91.44 million in the prior year.

Full year basic and diluted earnings per share from continuing operations were US$0.15, versus US$0.43 a year earlier, which sets the backdrop for how investors are reassessing RPC’s risk and return profile after the latest report.

RPC’s latest earnings miss and Q4 net loss came alongside a 1 day share price return of 6.46% to US$5.77. Recent momentum has been soft, with a 7 day share price return of 13.23% and a 30 day share price return of 2.37%, while the 1 year total shareholder return of 2.48% and 3 year total shareholder return of 35.48% set a mixed backdrop as investors weigh buybacks, dividends and management’s acquisition plans against more cautious sentiment around margins and activity levels.

If energy services volatility has you rethinking your watchlist, this could be a good moment to widen the net with our screener of 21 elite gold producer stocks.

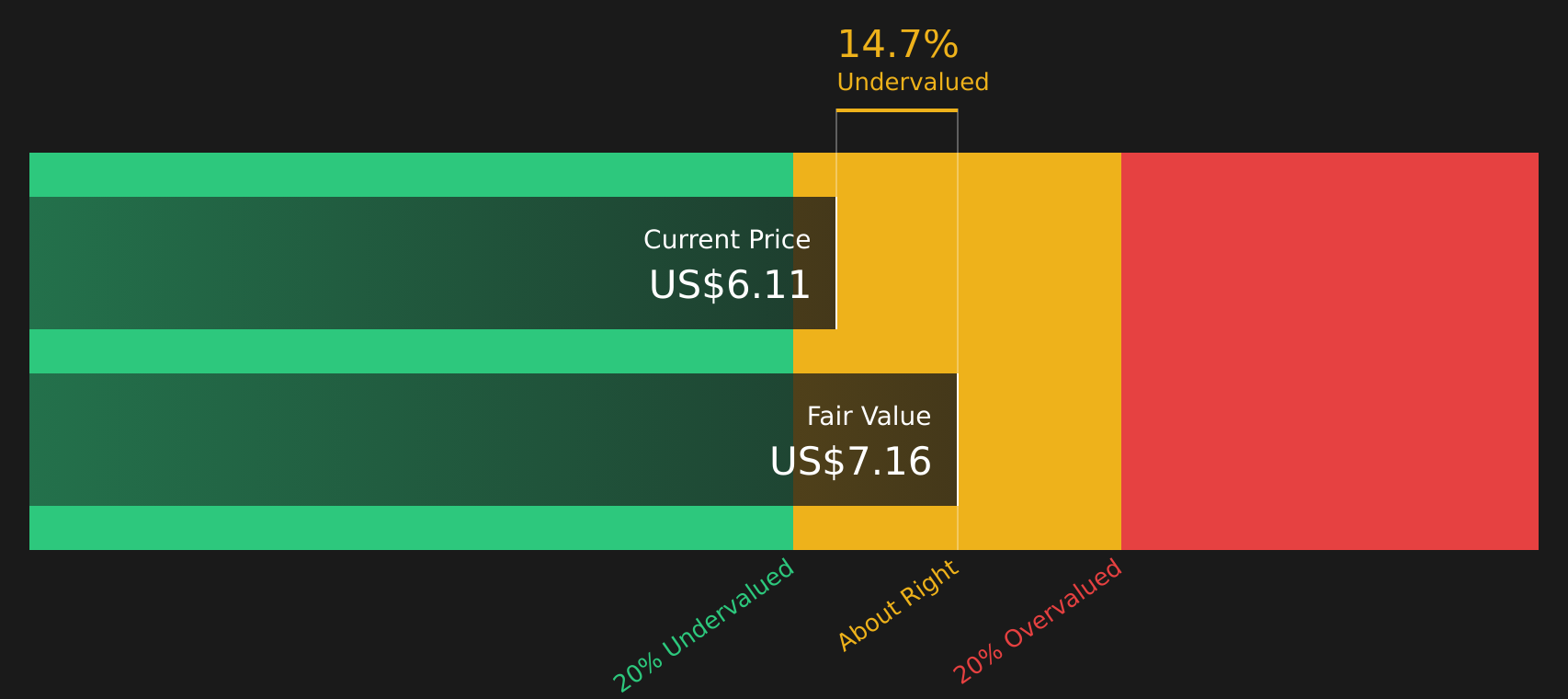

With RPC trading at US$5.77, an implied intrinsic discount of about 33% and only a modest gap to analyst targets, investors now have to ask: is there genuine value here, or is the market already pricing in future growth?

Most Popular Narrative: 2% Overvalued

RPC’s narrative fair value of $5.66 sits just below the last close at $5.77, which raises a tight valuation debate rather than a clear bargain signal.

RPC's rapid adoption and expansion of technologically advanced tools (such as the new A10 downhole motor, UnPlug technology, and the largest U.S. coiled tubing unit) positions the company to capitalize on increased digitalization and automation in oilfield operations, likely driving higher differentiation, improved operating efficiency, and potential margin expansion.

Curious what kind of revenue run rate and margin profile this story assumes for the next few years? The narrative leans on stronger earnings power and a richer future earnings multiple than the sector norm. If you want to see how those moving parts stack up against today’s $5.77 price, the full narrative lays out the math behind that $5.66 fair value call.

Result: Fair Value of $5.66 (OVERVALUED)

However, persistent pricing pressure in pressure pumping and wireline, along with heavier capital spending that weighs on free cash flow, could quickly challenge this upbeat narrative.

Another View: DCF Points to a Different Story

While the narrative fair value of US$5.66 frames RPC as slightly overvalued at US$5.77, our DCF model comes out very differently. On those cash flow assumptions, fair value sits at US$8.56, which makes the current price look more like a discount than a premium. Which set of assumptions do you trust more: the earnings narrative or the cash flow math?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RPC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RPC Narrative

If you look at this and want to stress test the assumptions yourself, you can plug in your own views, rebuild the story and Do it your way in just a few minutes.

A great starting point for your RPC research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with one stock, you could miss other opportunities that fit you even better, so use this moment to widen your research and pressure test your convictions.

- Start with value by scanning our list of 52 high quality undervalued stocks that combine quality fundamentals with prices that may not fully reflect their underlying strength.

- Prioritize resilience by checking out 82 resilient stocks with low risk scores, focused on companies with lower risk scores that may suit a more cautious approach.

- Hunt for under the radar opportunities with the screener containing 24 high quality undiscovered gems, where solid fundamentals meet limited market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.