يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Viridian Therapeutics (VRDN) Valuation After FDA Priority Review For Veligrotug

Viridian Therapeutics, Inc. VRDN | 27.44 | -2.35% |

Viridian Therapeutics (VRDN) is in focus after the FDA accepted its Biologics License Application for veligrotug in thyroid eye disease under Priority Review, while multiple late stage programs and pipeline updates continue to attract investor attention.

Despite a softer patch recently, with a 30 day share price return of 4.62% and a 7 day share price return of 2.54%, Viridian’s 90 day share price return of 44.50% and 1 year total shareholder return of 58.38% suggest momentum has been building around the FDA Priority Review news and the broader pipeline updates.

If this kind of catalyst driven move interests you, it could be worth widening your search to other healthcare stocks that are also being shaped by clinical and regulatory newsflow.

With Viridian trading at US$30.33, an intrinsic value estimate suggesting a sizeable discount, and analysts targeting US$41.71, you have to ask: is this a genuine mispricing, or is the market already baking in future growth?

Price-to-Sales of 40.9x: Is it justified?

At US$30.33 per share, Viridian is trading on a P/S of 40.9x, which screens as expensive compared with both its own fair ratio and the wider biotech group.

P/S looks at how much investors are paying for each dollar of revenue and is often used for companies that are not yet profitable, like many biotech names.

Viridian’s P/S of 40.9x is far above the US Biotechs industry average of 12.1x and also above the peer average of 17.1x. This suggests the market is pricing in much stronger revenue traction than is currently typical for the group. Against an estimated fair P/S ratio of 0.1x, the current multiple is also materially higher than the level the SWS fair ratio model points to as more grounded in fundamentals.

Result: Price-to-Sales of 40.9x (OVERVALUED)

However, you also have to weigh execution risks, including veligrotug’s regulatory and commercial outcomes, as well as Viridian’s current net loss of US$245.318 million.

Another angle on valuation

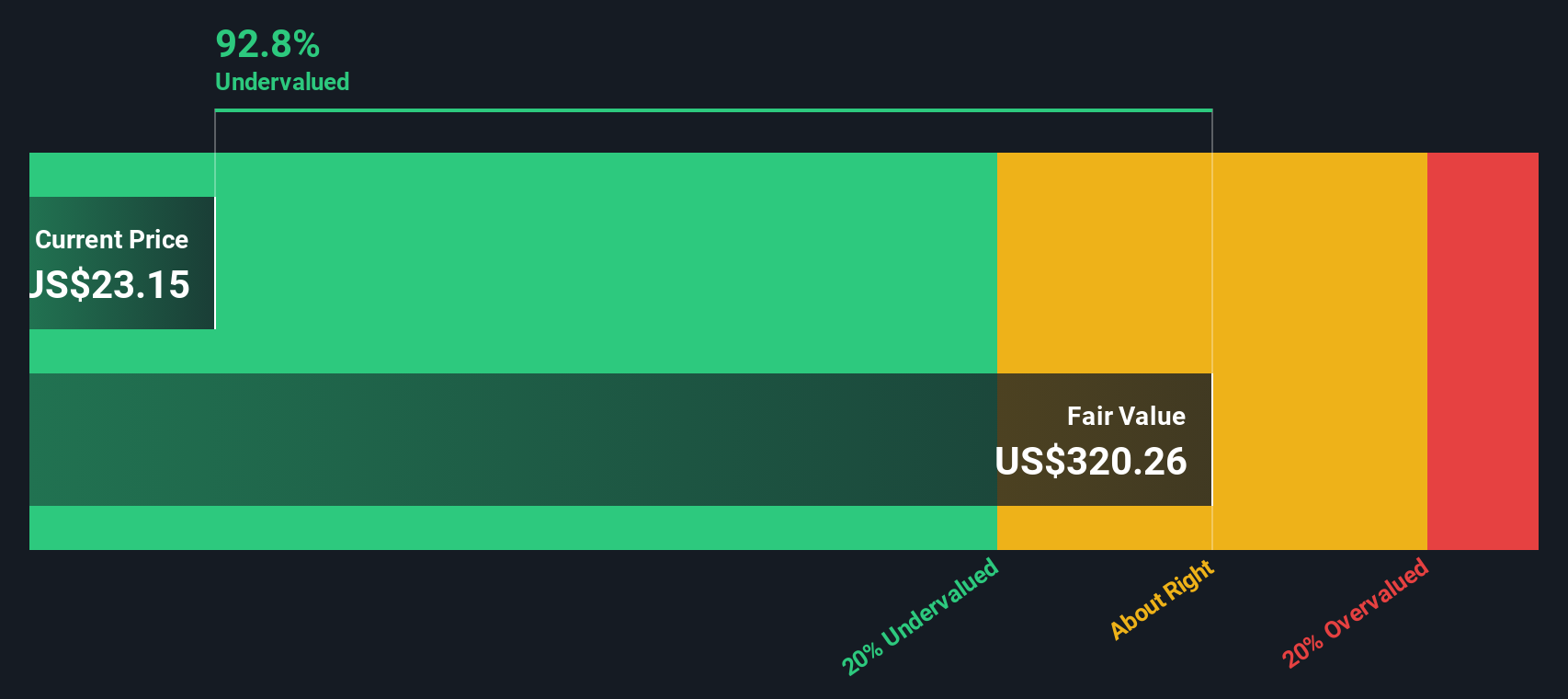

The P/S of 40.9x paints Viridian as expensive, but our DCF model tells a very different story, with a fair value estimate of US$159.36 per share, around 81% above the current US$30.33 price. So is the share price stretched? Or is the market underestimating the long term cash flow potential?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Viridian Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Viridian Therapeutics Narrative

If you interpret the numbers differently, or prefer to test your own assumptions against the data, you can build a personalised view in just a few minutes by starting with Do it your way.

A great starting point for your Viridian Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock thesis; broaden your watchlist with focused screens that surface companies matching the kind of opportunities you care about most.

- Target potential value candidates by scanning these 881 undervalued stocks based on cash flows that appear cheap compared to their cash flow profiles.

- Zero in on income potential by reviewing these 11 dividend stocks with yields > 3% that could complement a portfolio focused on regular payouts.

- Lean into emerging themes by checking out these 79 cryptocurrency and blockchain stocks positioned around digital assets and blockchain related trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.