يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Assessing Vita Coco Company (COCO) Valuation After Strong Sales And Earnings Growth

Vita Coco Company, Inc. COCO | 53.96 | +4.25% |

Recent figures for Vita Coco Company (COCO) have caught investor attention, with unit sales rising 10.8% over the past two years and earnings per share growing 89.3% annually over the last three years.

Despite strong fundamentals, the recent 1 day share price return of a 3.17% decline and 1 week share price return of a 1.74% decline contrast with a 90 day share price return of 31.11% and a 1 year total shareholder return of 43.48%. This suggests momentum has been building over the medium term.

If Vita Coco’s run has you thinking about where growth could come from next, it might be worth scanning 23 top founder-led companies for other potential long term compounders.

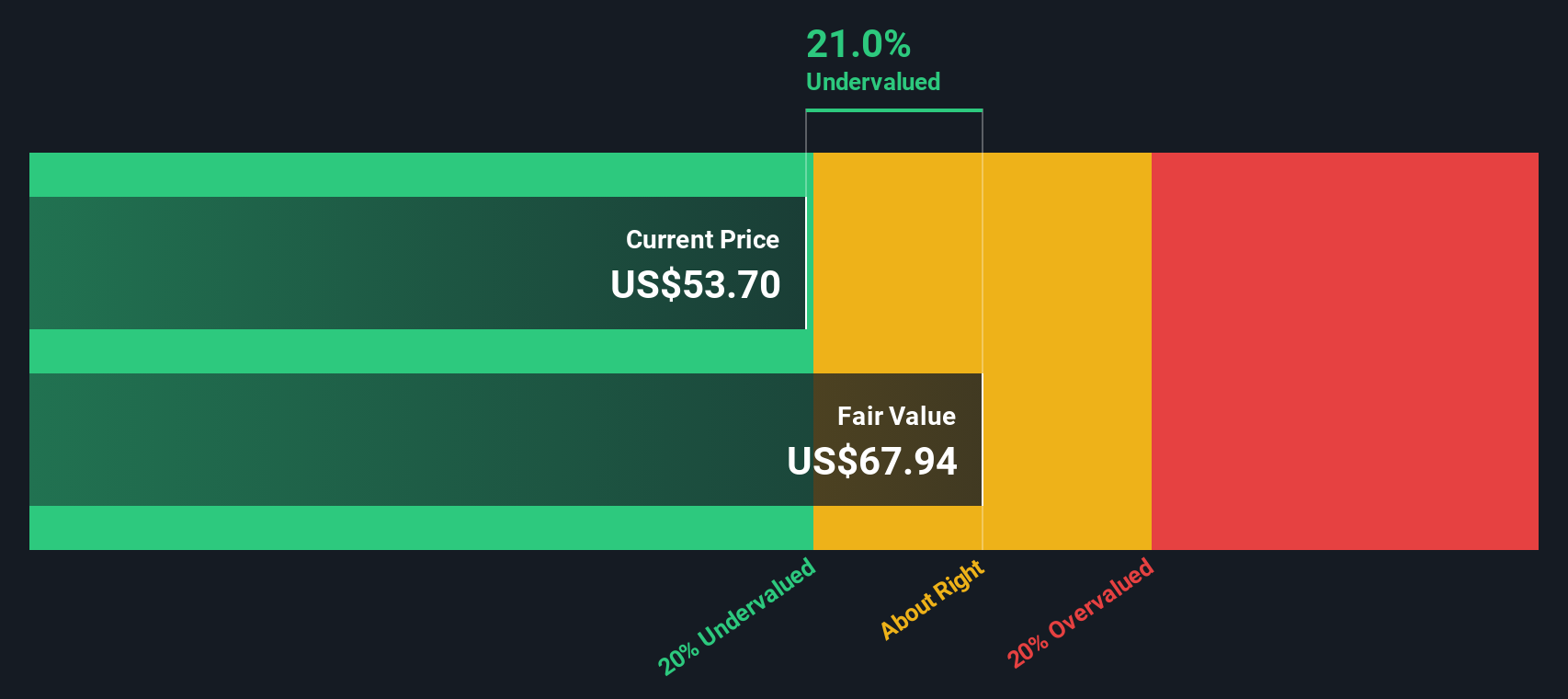

With COCO shares up 31.11% over 90 days and a 1 year total return of 43.48%, yet trading at about a 22.07% discount to one intrinsic estimate, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 94.4% Overvalued

Compared with the last close at $56.56, the most followed narrative, which implies a fair value of $29.10, points to a much richer market price.

Revenue could be in the range of $700 million to $1 billion by 3 to 5 years from now, driven by:

Growing demand for healthy beverages.

Potential success of new product lines.

Geographic expansion.

Profit margins could also improve to 13 to 15% if:

The company effectively manages transportation and raw material costs.

They achieve economies of scale with higher production volume.

They successfully implement premium pricing strategies for branded products.

Want to see how those sales and margin targets translate into that lower fair value? According to WallStreetWontons, the real swing factor is the earnings profile and the profit multiple they think the market might settle on.

Result: Fair Value of $29.10 (OVERVALUED)

However, the story could change quickly if competition in coconut water intensifies, or if higher raw material and transport costs pressure Vita Coco’s margins.

Another Take On Value

The user narrative paints Vita Coco as 94.4% overvalued at $56.56 versus a $29.10 fair value, but our DCF model points in the opposite direction. In our view, the shares trade at about a 22.1% discount to an estimated $72.58 value. This raises the question: which story do you trust more, the market price or the cash flow math?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vita Coco Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 51 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vita Coco Company Narrative

If you see the numbers differently or would rather trust your own work, you can pull the data, test your assumptions, and build a custom view in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vita Coco Company.

Looking for more investment ideas?

If Vita Coco has sharpened your focus, do not stop here. The wider market holds plenty of opportunities you may not want to skip.

- Target quality at a discount by scanning 51 high quality undervalued stocks that combine solid fundamentals with prices that may not fully reflect their underlying strength.

- Strengthen your income stream by reviewing 14 dividend fortresses built around companies offering higher yields backed by resilient cash generation.

- Prioritise resilience by checking 83 resilient stocks with low risk scores that show more stable risk profiles, so your portfolio is not leaning on just one story.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.