يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

ATI Earnings Growth Story Tied To Aerospace Defense And Energy Contracts

ATI Inc. ATI | 143.93 | +2.95% |

- ATI (NYSE:ATI) reported strong performance in aerospace and defense, highlighting growth in next generation jet engines, missile programs, and specialty energy contracts.

- Management pointed to expanding long term agreements and accelerating defense stockpile replenishment as key drivers of improved profitability.

- The company also called out scaling opportunities in specialty energy as an important contributor to future business mix.

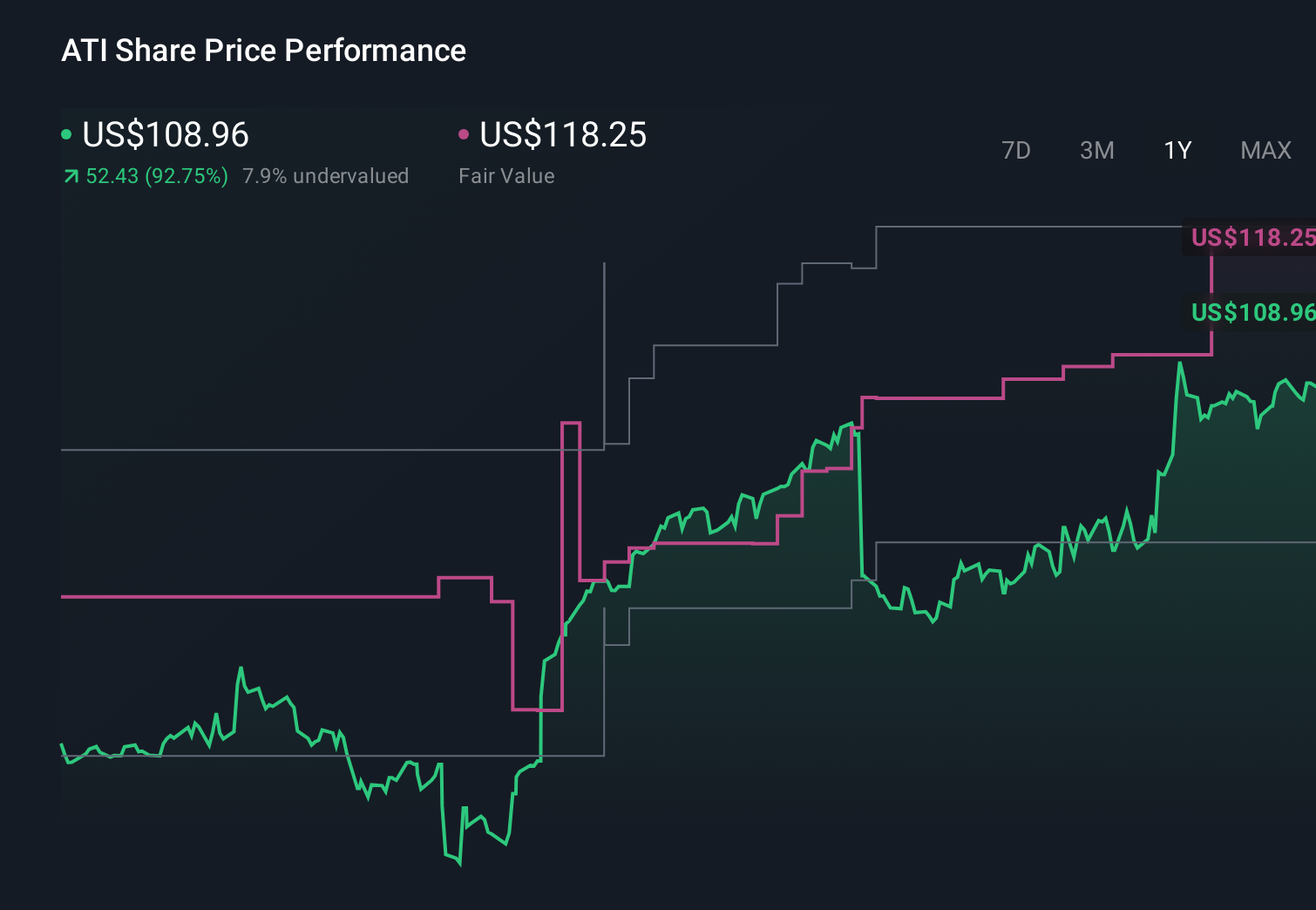

ATI, trading at $138.72, is coming off a very large 5 year share price gain, with the stock up 642.6% over that period. Returns have also been strong more recently, up 8.8% over the past week, 12.4% over the past month, and 16.4% year to date, with a 128.2% gain over the past year.

For you as an investor, the latest update centers on how much of ATI’s current momentum is tied to aerospace, defense, and specialty energy contracts. Management’s comments about next generation engines, missile programs, defense stockpile replenishment, and scaling specialty energy provide more detail on where future activity could concentrate within the business.

Stay updated on the most important news stories for ATI by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on ATI.

ATI’s latest update tells you a few things about how the story is evolving. Fourth quarter sales were essentially flat at US$1,177.1m versus US$1,172.7m a year earlier, while net income for the quarter moved to US$96.6m from US$137.1m, so the headline GAAP numbers do not fully reflect the strength management is pointing to in aerospace and defense. For the full year, ATI reported higher sales of US$4,587.4m versus US$4,362.1m and net income of US$404.3m compared to US$367.8m, which suggests the business is still building earnings capacity. Management’s commentary that non GAAP profitability was stronger than expected, helped by proprietary alloys and richer product mix in next generation jet engines and missile programs, helps explain why the market may be focusing more on margins and contract quality than the quarter on quarter revenue line. The completed buyback of 8,343,988 shares, or about 6% of the company, indicates ATI has already been returning a material amount of capital to shareholders, even though there were no repurchases in the latest reported tranche. Put together, this mix of steady full year profits, defense and aerospace momentum, and past buyback execution can be an important signal for how investors frame ATI’s current valuation and risk profile.

How This Fits Into The ATI Narrative

- The earnings commentary around higher margin aerospace, defense, and specialty energy work aligns with the narrative’s focus on long term contracts, advanced alloys, and capacity investments as earnings catalysts.

- The quarterly net income of US$96.6m versus US$137.1m a year earlier may challenge the view of a smooth margin expansion path and highlights execution and end market sensitivity that the narrative flags as potential pressure points.

- The update that the buyback program is effectively complete, with 6% of shares already repurchased, adds a shareholder return element that is not fully captured in the narrative’s emphasis on contracts, capex, and segment growth.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for ATI to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Quarterly net income moved to US$96.6m from US$137.1m, which may point to earnings volatility even as management talks up non GAAP profitability.

- ⚠️ Heavy dependence on aerospace and defense customers, alongside high capital needs for capacity projects, leaves ATI exposed if order timing or large programs change.

- 🎁 Full year sales of US$4,587.4m versus US$4,362.1m and net income of US$404.3m compared with US$367.8m indicate ATI is still growing its profit base.

- 🎁 Completed repurchases of about 6% of shares for US$580.16m and management’s emphasis on richer product mix in next generation jet engines and missile programs point to both capital returns and higher value work in key end markets.

What To Watch Going Forward

From here, you may want to track whether ATI can translate strong demand for next generation jet engine and missile materials into consistent GAAP earnings growth and cash flow while it funds capacity expansion. Keep an eye on the mix of commercial aerospace versus defense orders, any updates to long term agreements with large customers such as Boeing, Airbus, and major engine makers, and how much of specialty energy growth shows up in reported margins. The cadence of future buybacks or other capital allocation choices will also matter, especially after completing a meaningful 6% share reduction. Together, these datapoints will shape how investors judge the durability of ATI’s current momentum.

To ensure you're always in the loop on how the latest news impacts the investment narrative for ATI, head to the community page for ATI to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.