يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Avidity Biosciences (RNA): Valuation Insights Following BLA Delay for Lead Therapy

Avidity Biosciences RNA | 71.86 | +0.04% |

Avidity Biosciences (RNA) has pushed back the anticipated Biologics License Application filing for its investigational therapy, del-zota, following a recent pre-BLA meeting with the FDA. The new timeline sets submission for early 2026 and allows more data collection for regulatory review.

Momentum has been substantial for Avidity Biosciences this year, with a 53.6% share price return year-to-date and an impressive 41.9% gain over the past quarter. This reflects increased optimism even as timelines for del-zota shift. However, looking long term, the 1-year total shareholder return remains slightly negative. This suggests some caution lingers despite big gains over the last three years.

If the biotech buzz around Avidity caught your attention, you might want to see which other innovators are on the move – See the full list for free.

With a delay factored in and shares rallying sharply this year, the key question for investors now is whether Avidity Biosciences is still undervalued or if the market has fully priced in its next chapter of growth.

Price-to-Book of 5.8x: Is it justified?

Avidity Biosciences currently trades at a price-to-book ratio of 5.8x, which is well above the average for its sector peers. With the share price closing at $47.89, investors appear willing to pay a significant premium over biotechs with similar book values.

The price-to-book ratio measures how much investors are paying for a company’s net assets. In biotech, where tangible assets and intangible value can vary widely, a high ratio may reflect market expectations for outsized growth or innovative potential.

For Avidity, this premium cannot be justified by strong profitability or consistent earnings growth. The company is unprofitable, with losses increasing at a notable annual pace over the past five years. Compared to the US Biotechs industry average price-to-book of 2.5x, Avidity’s valuation stands out as expensive. While the company’s ratio is lower than some direct peers (average peer P/B is 9.7x), it is well above the broader industry, suggesting stretched expectations that are not yet supported by financial results.

Result: Price-to-Book of 5.8x (OVERVALUED)

However, risks remain if regulatory delays extend further or if upcoming data fails to meet expectations. This could potentially challenge the current optimism around Avidity's valuation.

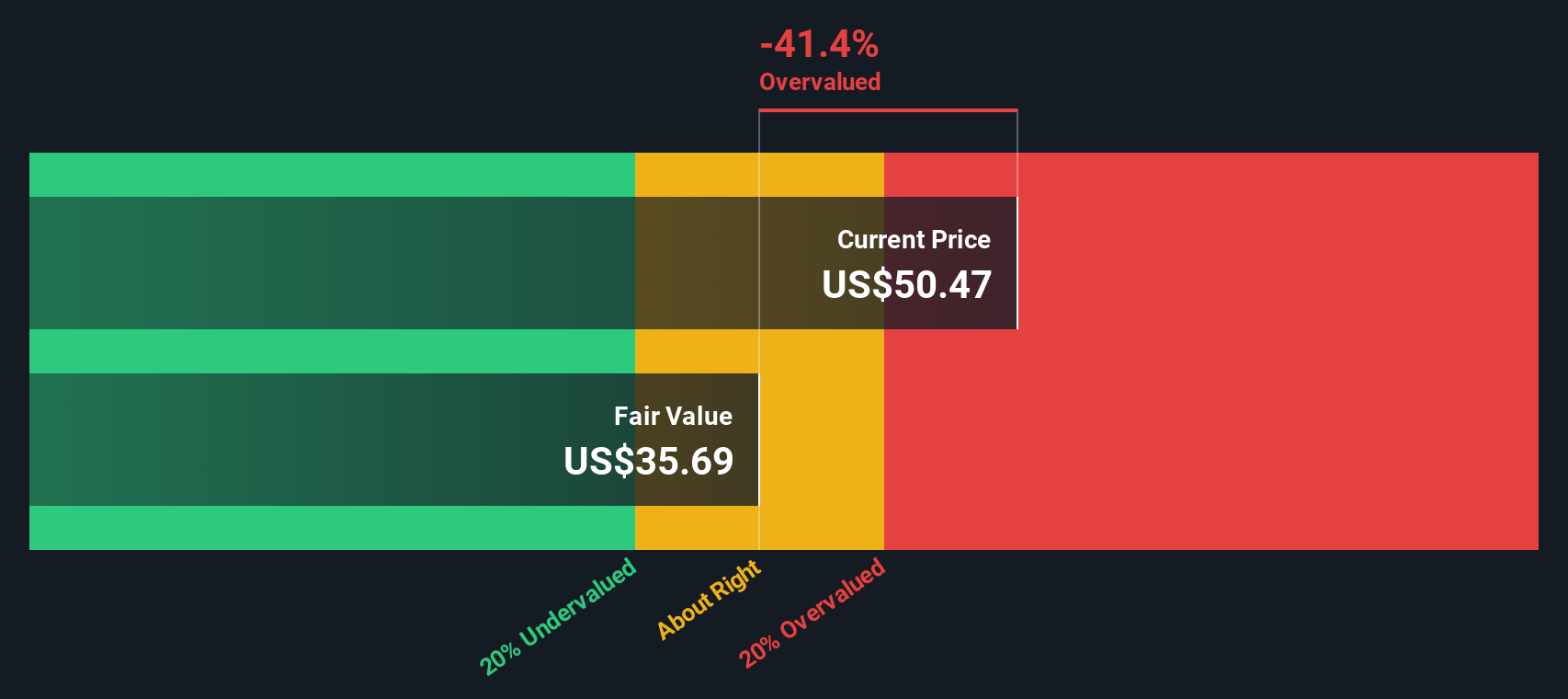

Another View: What Does Our DCF Model Say?

Taking a different approach, our DCF model estimates Avidity Biosciences’ fair value at $35.24, which is below its current trading price of $47.89. This suggests that shares are overvalued based on future cash flow projections and raises questions about whether the recent surge truly reflects intrinsic worth. Could expectations be running ahead of reality?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avidity Biosciences for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avidity Biosciences Narrative

If you want to go deeper or arrive at your own conclusions, it's easy to review the numbers yourself and shape your own view in just a few minutes, Do it your way.

A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the right opportunities don’t wait. Take charge and uncover stocks primed for growth, stability, or breakthrough innovation with these handpicked screeners:

- Capitalize on high-potential tech by tapping into these 24 AI penny stocks, which are shaping the future with groundbreaking artificial intelligence advances and rapid adoption across industries.

- Seize value where others might overlook it and check out these 878 undervalued stocks based on cash flows, which have strong fundamentals yet attractive price points.

- Boost your long-term returns by scoping out these 18 dividend stocks with yields > 3%, offering reliable dividend yields above 3% and proven income consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.