يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Bank First (BFC) Net Interest Margin Near 3.9% Tests Premium Valuation Narrative

Bank First Corp BFC | 148.27 148.27 | +0.03% 0.00% Pre |

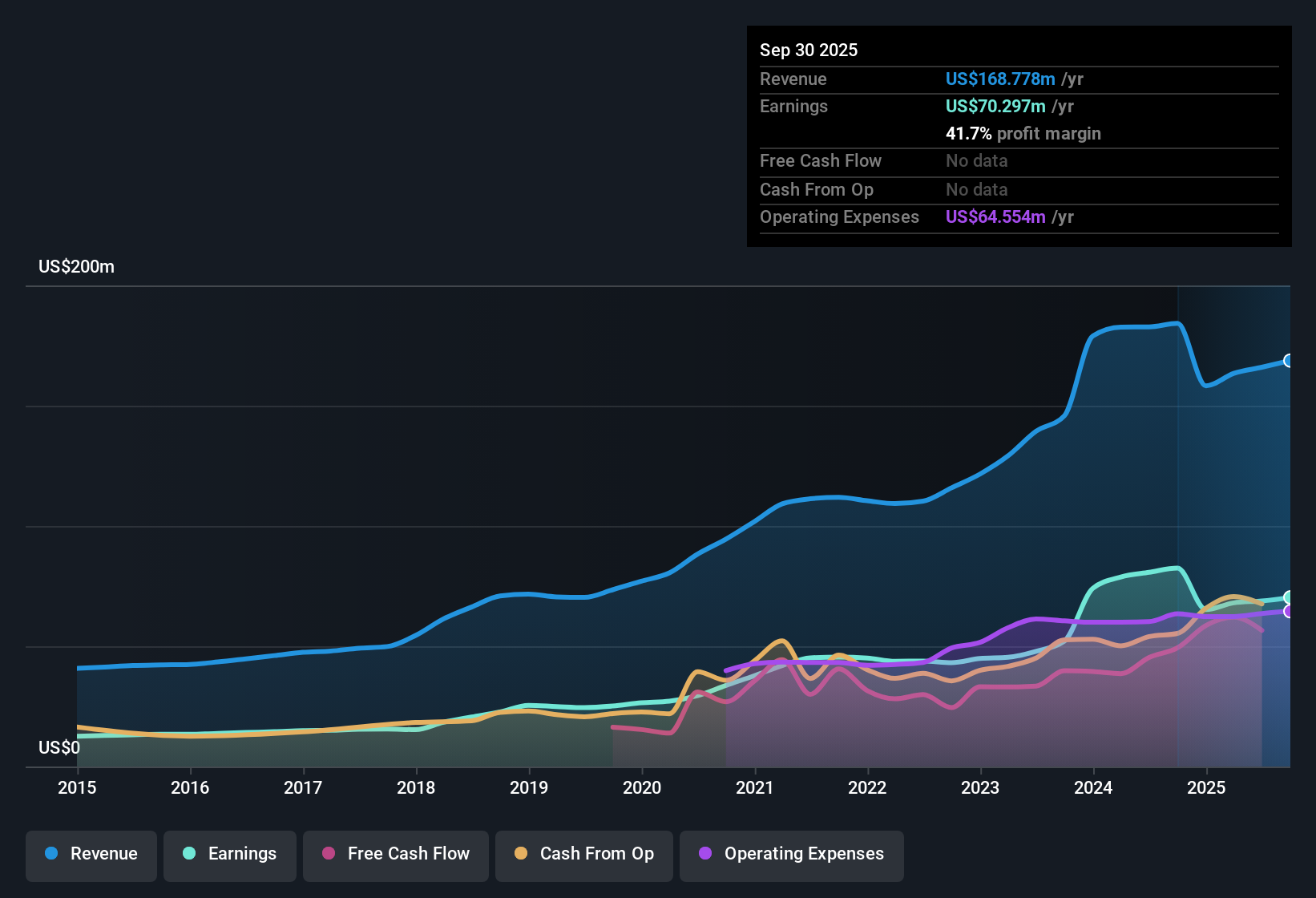

Bank First (BFC) has wrapped up FY 2025 with fourth quarter revenue of US$44.9 million and basic EPS of US$1.87, while trailing twelve month figures show revenue of US$172.6 million and EPS of US$7.23. Over recent periods, revenue has moved from US$41.1 million in Q4 FY 2024 to US$44.9 million in Q4 FY 2025, with quarterly EPS ranging between US$1.65 and US$1.87, and trailing EPS shifting between US$6.50 and US$7.23. With a trailing net profit margin of 41.4% slightly above last year’s 41.2% and a focus on sustaining that level of profitability, investors will be weighing how these results relate to the company’s growth narrative in the next phase.

See our full analysis for Bank First.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the widely followed growth and profitability narratives that have been building around Bank First over the past year.

Loan Book Edges Higher With Stable Credit Quality

- Total loans moved from US$3,518.9 million in Q4 FY 2024 to US$3,631.1 million by Q3 FY 2025, while non performing loans in that period ranged between US$6.8 million and US$13.9 million.

- What stands out for a bullish view is that loan balances and non performing loans are reported together, which lets you see that a loan book around US$3.6b is being managed alongside non performing loans in the low tens of millions. Fans of the bank can point to scale plus detailed credit disclosures, while cautious investors may still watch that non performing loans stayed in double digit millions across several quarters.

- Supporters can highlight that non performing loans of US$13.9 million in Q3 FY 2025 sit against total loans above US$3.6b, which frames problem credits as a relatively small slice of the overall book.

- On the other hand, critics may focus on the fact that non performing loans appeared more than once in the teens of millions in the trailing data, keeping credit quality firmly on the checklist rather than an automatic tick.

Net Interest Margin Around The High 3% Level

- Across the last reported periods, net interest margin sits in a band between 3.65% and 3.88%, with the most recent quarterly figure given at 3.88% in Q3 FY 2025.

- What is interesting for bullish arguments is that this margin range holds close to the 3.65% level cited a year earlier. Supporters can say the bank has kept its core lending spread resilient, while more cautious voices may point out that a margin under 4% still leaves limited room for error if funding costs or credit costs move against it.

- Backers can link the 3.88% net interest margin in Q3 FY 2025 with the trailing net profit margin of 41.4%, arguing that the bank converts a solid spread into high bottom line profitability.

- More guarded investors may pair that same 3.88% figure with one year earnings growth of 9.6%, which is below the 14.3% per year five year rate, and question how much more margin support they can reasonably factor in.

Premium 21.5x P/E Versus DCF Fair Value Gap

- The shares trade on a 21.5x P/E, above both peer and US banks averages, while a DCF fair value of about US$181.93 sits above the current share price of US$137.32.

- What is striking for bullish commentary is that high quality trailing earnings and forecast earnings growth of about 23.9% per year are being measured against a DCF fair value that is higher than today’s price. Supporters point to a gap between a premium multiple and an even higher DCF fair value, while skeptics focus on the fact that the 21.5x P/E is still well above the 11.2x peer level and 12.1x for the wider US banks group.

- Fans of the stock can argue that trailing net profit margin of 41.4% and five year earnings growth of 14.3% per year help explain why the DCF fair value of US$181.93 comes in above the current US$137.32 share price.

- Those taking the other side may highlight that one year earnings growth of 9.6% lags that five year pace, which for them makes the 21.5x P/E look demanding compared with peers on 11.2x even with the implied upside to the DCF fair value.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bank First's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Bank First’s premium 21.5x P/E, slower one year earnings growth of 9.6% versus the 14.3% five year rate, and below peer multiples may leave some investors questioning the value on offer.

If that mix of a high multiple and cooling earnings momentum gives you pause, use these 864 undervalued stocks based on cash flows to quickly focus on companies where pricing looks more compelling right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.