يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Bank Of America (BAC) Earnings Growth And 27% Margin Reinforce Bullish Profit Narratives

Bank of America Corp BAC | 55.38 | +1.71% |

Bank of America (BAC) FY 2025 earnings snapshot

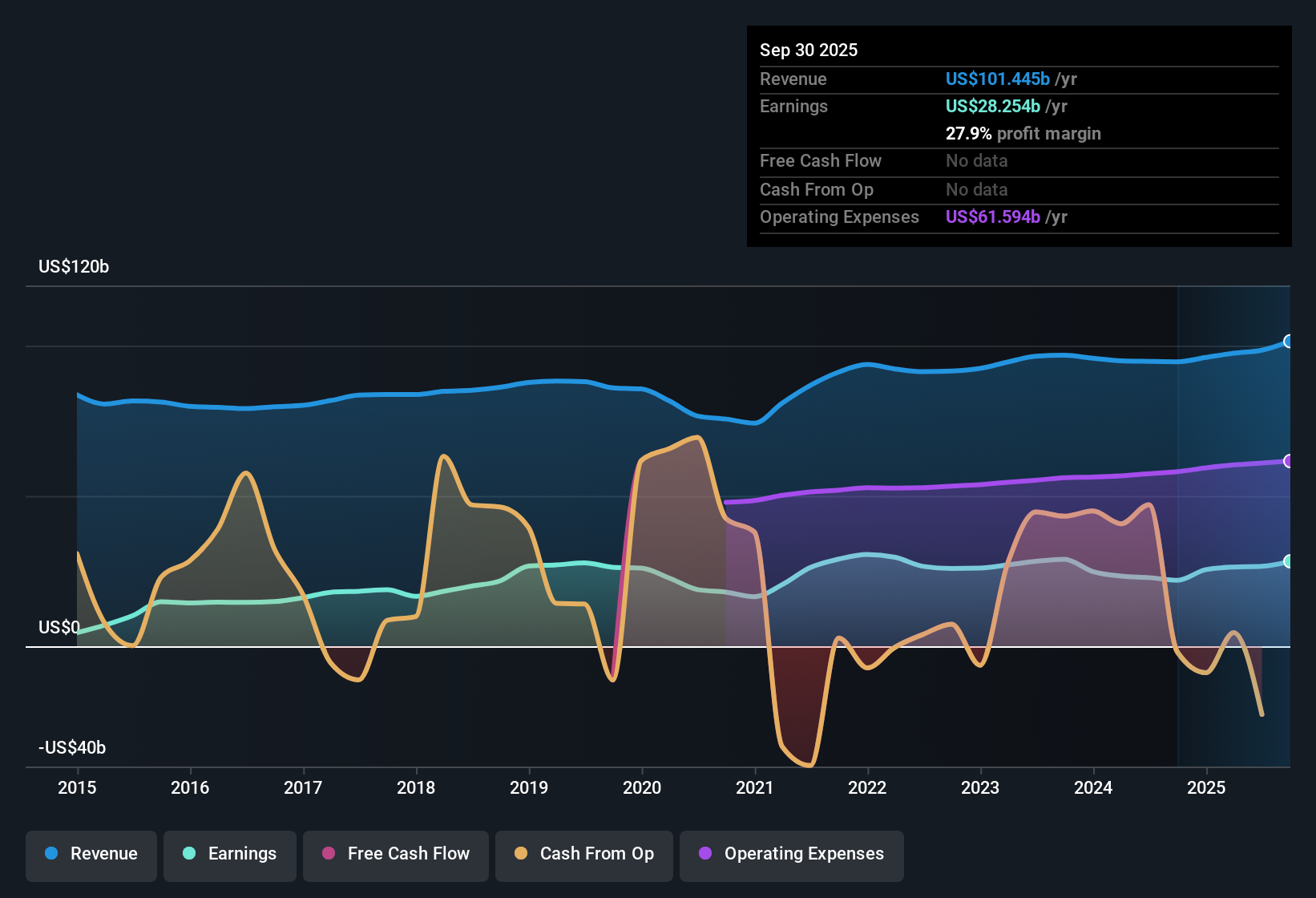

Bank of America (BAC) has wrapped up FY 2025 with fourth quarter revenue of US$27.1b and basic EPS of US$0.99, supported by trailing twelve month revenue of US$107.4b and EPS of US$3.86. The bank has seen revenue move from US$96.1b and EPS of US$3.25 on a trailing basis at the end of 2024 to US$107.4b and US$3.86 respectively, while FY 2025 net income excluding extra items came in at US$29.1b. Together with a trailing net profit margin of 27% and reported one year earnings growth of 13.9%, the latest numbers point to a business where profitability and income remain central to the story investors are watching.

See our full analysis for Bank of America.With the results on the table, the next step is to see how these figures line up against the widely held narratives about Bank of America, highlighting where the story is reinforced and where the numbers push back.

13.9% earnings growth and 27% margin in focus

- Over the last year, Bank of America generated trailing net income of US$29.1b on revenue of US$107.4b, which lines up with a 27% net profit margin and 13.9% earnings growth compared with a 1.8% five year average.

- Analysts' bullish narrative leans on this higher recent earnings growth and margin. The data partly supports that view while also setting a more measured tone:

- The 27% trailing margin and US$3.86 trailing EPS back the idea of solid profit quality. However, forecasts of about 6.4% yearly earnings growth and 5.5% revenue growth suggest a step down from the latest 13.9% pace.

- Quarterly results through FY 2025, such as Q4 net income of US$7.3b on US$27.1b revenue, stay consistent with that 27% margin story rather than pointing to a sharp acceleration.

Loan book and credit quality stay sizeable

- Across the last reported quarters, total loans sat in a tight range around US$1.1t to US$1.17t, while non performing loans moved between roughly US$5.9b and US$6.7b. This gives you a sense of both the scale of lending and the level of problem loans management is working with.

- Critics in the bearish narrative highlight macro and policy risks to credit quality, and the current numbers give mixed signals against that concern:

- Bears point to economic and policy pressures that could affect loan performance. Yet trailing non performing loans in FY 2025 quarters, such as US$5.9b at Q3, do not show a sharp spike versus the US$6.7b figure at the end of 2024.

- At the same time, management’s focus on high quality commercial and consumer loans is part of the bullish case, and the large loan book above US$1.1t provides room for that argument without clearly resolving the risk around future credit costs.

Mixed valuation signals around P/E of 13.2x

- Bank of America trades on a P/E of 13.2x versus a US Banks industry average of 11.9x, while the share price of US$52.48 sits below a DCF fair value of about US$63.17 and below an analyst price target reference of US$62.10.

- Supporters and skeptics both focus on these valuation markers, and the current setup gives each side something to point to:

- The premium to the 11.9x industry P/E and slower forecast growth relative to the broader US market fit the cautious view that the stock is not obviously cheap compared with bank peers.

- On the other hand, the 2.13% dividend yield, earnings growth of 13.9% over the year and a price that is below both the US$63.17 DCF fair value and the US$62.10 analyst target reference all feed into the more optimistic argument that the valuation still leaves room based on the provided models.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bank of America on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to test your own view against the data and shape the story you think fits best, Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Bank of America.

Explore Alternatives

For all the strengths in Bank of America’s earnings and margins, the premium 13.2x P/E versus peers and slower forecast growth leave valuation looking less compelling.

If that trade off makes you cautious about paying up for this kind of profile, use our these 884 undervalued stocks based on cash flows to quickly focus on companies where pricing and cash flow models look more aligned.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.