يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Bio-Rad Laboratories (BIO): Evaluating Valuation as Exclusive Gencurix Deal and Growth Moves Renew Investor Interest

Bio-Rad Laboratories, Inc. Class A BIO | 303.91 | -1.37% |

Bio-Rad Laboratories (NYSE:BIO) attracted investor attention after announcing a new deal to exclusively distribute Gencurix’s oncology testing kits across Europe. This expansion comes in addition to steady financial growth and upgraded revenue guidance.

Bio-Rad’s latest moves, including the exclusive Gencurix partnership and a string of new product launches, have helped renew investor optimism. The 26.8% 90-day share price return hints at building momentum. However, the 1-year total shareholder return remains negative, reflecting a challenging longer-term backdrop.

If you’re watching breakthroughs in diagnostics like this, you might want to see which other healthcare leaders are showing strong growth signals. See the full list for free.

With recent momentum and analyst price targets that still suggest some upside, investors may wonder if Bio-Rad’s current valuation underestimates its future or if the market is already factoring in all the good news. Is there a buying opportunity here, or has the market priced in the growth ahead?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Bio-Rad Laboratories’ recent closing price is almost exactly in line with its latest consensus fair value estimate, reflecting little room for significant valuation surprises. This close gap underscores how analyst expectations have shifted to become more cautious as the market prices in moderating growth and margin headwinds.

Recent launch and expansion of the QX Continuum and QX700 Series ddPCR platforms, alongside the acquisition of Stilla Technologies, positions Bio-Rad to accelerate its share capture as demand grows for advanced molecular diagnostics and precision medicine tools. This is expected to drive ddPCR revenue growth and improve margins through higher consumable pull-through and broader assay adoption.

Want to see what’s really fueling this fair value? The narrative hinges on ambitious product launches, evolving sales mix, and a controversial profit forecast. Find out which bold assumptions analysts are betting on and what could upend their entire thesis. Peel back the numbers driving the latest price target.

Result: Fair Value of $310 (ABOUT RIGHT)

However, if weak demand for instruments persists or if pressure from changing healthcare policies increases, Bio-Rad’s growth outlook could encounter stronger headwinds.

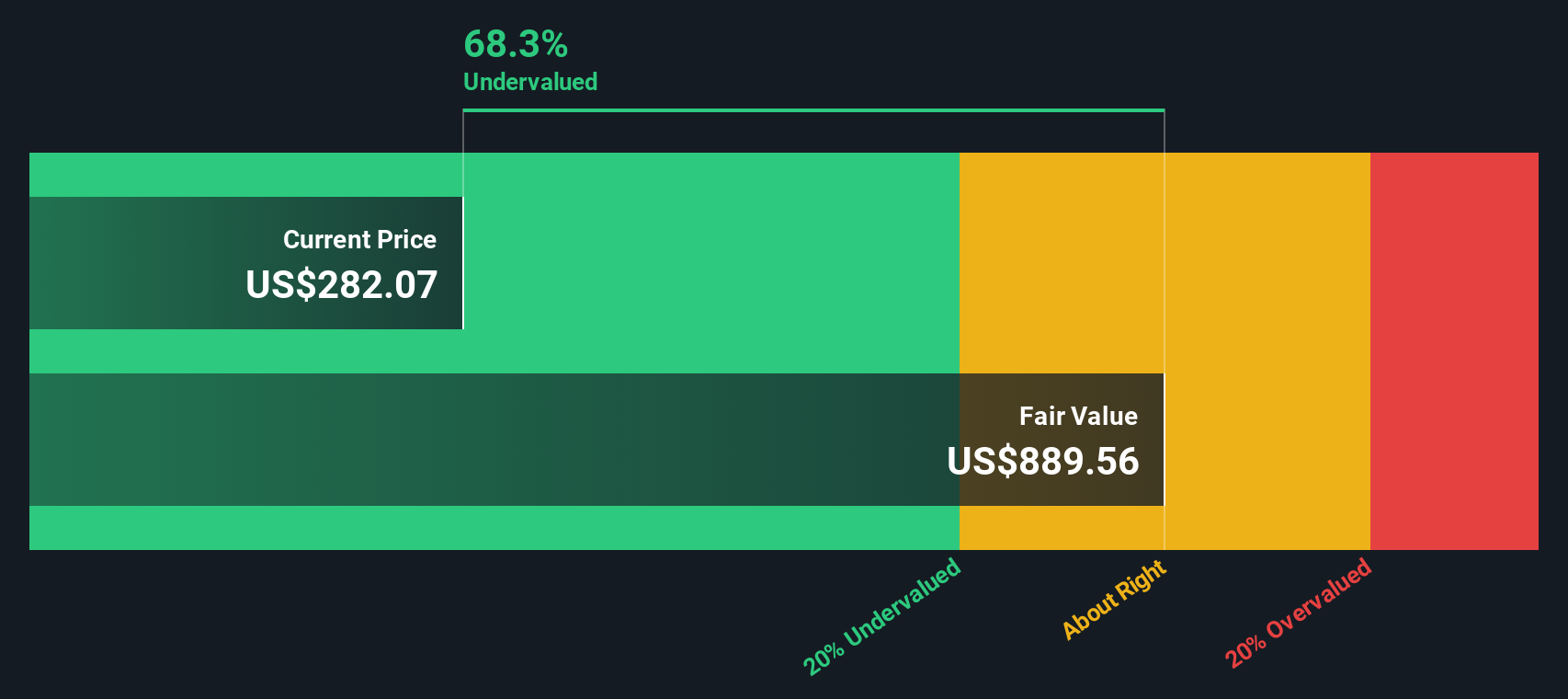

Another View: DCF Model Suggests Major Undervaluation

While analysts believe Bio-Rad is fairly valued based on earnings multiples, our SWS DCF model comes to a very different conclusion. It values Bio-Rad shares at $880, which is far above the current market price. Can this significant disconnect between models reveal an overlooked opportunity, or does it indicate unjustified optimism in future cash flows?

Build Your Own Bio-Rad Laboratories Narrative

If you have a different view or want to follow your own path, exploring the numbers and generating your own story takes just a few minutes. Do it your way

A great starting point for your Bio-Rad Laboratories research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Expand your investing toolkit and stay ahead of the crowd by using powerful screeners that help match your strategy with companies primed for growth or strong financials.

- Target income potential and uncover companies rewarding shareholders with impressive yields by starting with these 20 dividend stocks with yields > 3%.

- Spot emerging technologies early by tapping into these 24 AI penny stocks, which are shaping entire industries with artificial intelligence innovation.

- Find value opportunities others might miss by checking out these 873 undervalued stocks based on cash flows and track stocks trading below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.