يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

BNY Mellon (BK): Assessing Valuation After Launch of $10 Million Carnegie Mellon AI Lab Collaboration

Bank of New York Mellon Corporation BK | 117.03 | 0.00% |

Most Popular Narrative: 6.3% Overvalued

According to the most widely followed narrative, Bank of New York Mellon is considered slightly overvalued relative to its consensus estimate of fair value, based on analyst forecasts and projected fundamentals.

Accelerated investment in digital platforms (including digital asset custody, AI integration, and the NEXEN ecosystem), coupled with strong early adoption, positions BNY Mellon for improved operating leverage and net margin expansion in the coming years. Scalable technology reduces costs and increases cross-selling opportunities.

Curious how forward-looking technology bets and new digital revenue streams are fueling Wall Street’s optimism? What if the driving force behind this valuation is more than just margin math, but also plans for even leaner profit models and bigger cross-selling wins in the future? What assumptions about future growth, margins, and the company’s capital structure are hidden in plain sight? Dive deeper to see what is behind this ambitious fair value call.

Result: Fair Value of $102.27 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing client outflows and increased pressure from passive investment trends could quickly challenge the optimistic outlook for sustained revenue growth.

Find out about the key risks to this Bank of New York Mellon narrative.Another View: The Multiples Approach

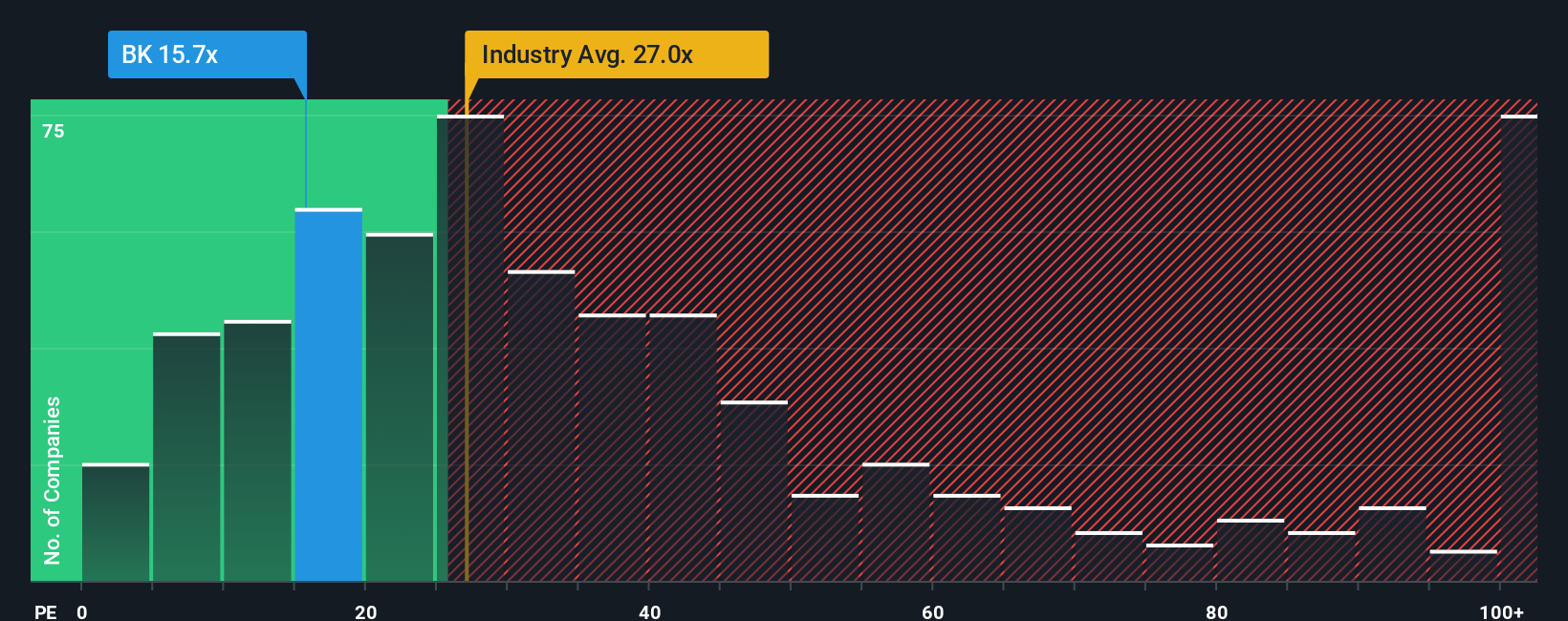

A different perspective comes from comparing Bank of New York Mellon's price-to-earnings ratio with the wider US Capital Markets industry. This approach suggests the company is trading at a better value. Is it possible the market is overlooking something in this case?

Build Your Own Bank of New York Mellon Narrative

Want a different take on the numbers or have your own insights into what drives BNY Mellon's outlook? You can explore the financials and form your own view in just a few minutes. Do it your way

A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let untapped opportunities slip by while the market moves. High-potential stocks are out there for those willing to look beyond the obvious choices.

- Uncover rapid growth potential before the crowd catches on by jumping into penny stocks with strong financials on the brink of making waves.

- Set your sights on future market leaders in artificial intelligence with AI penny stocks designed to transform everything from healthcare to finance.

- Tap into hidden bargains and amplify your portfolio’s value through undervalued stocks based on cash flows that the market hasn’t fully priced in yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.