يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Calix Launches New Platforms As Valuation Suggests Upside Despite Weak Momentum

Calix, Inc. CALX | 55.61 | +1.35% |

- Calix (NYSE:CALX) has introduced HomeOfficeIQ for SmartHome, designed to keep home internet connections secure and running with cellular failover during outages.

- The company also released the next generation of Engagement Cloud, adding more advanced marketing automation, segmentation, and in-app engagement tools for service providers.

Calix, trading at $52.02, sits in the communications equipment sector with a mixed return profile, including a 27.8% return over the past year and a 51.0% return over five years. Shorter term performance has been more muted, with a 2.7% return over the past week, a 4.3% decline over 30 days, and a 2.9% decline year to date, which provides context as the company rolls out these new platform features.

For investors tracking NYSE:CALX, these product launches relate to current demand for reliable home connectivity, secure remote work setups, and more data driven engagement by service providers. As adoption and real world use cases develop, the focus will be on how these tools influence customer relationships, platform stickiness, and subscriber behavior over time.

Stay updated on the most important news stories for Calix by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Calix.

Quick Assessment

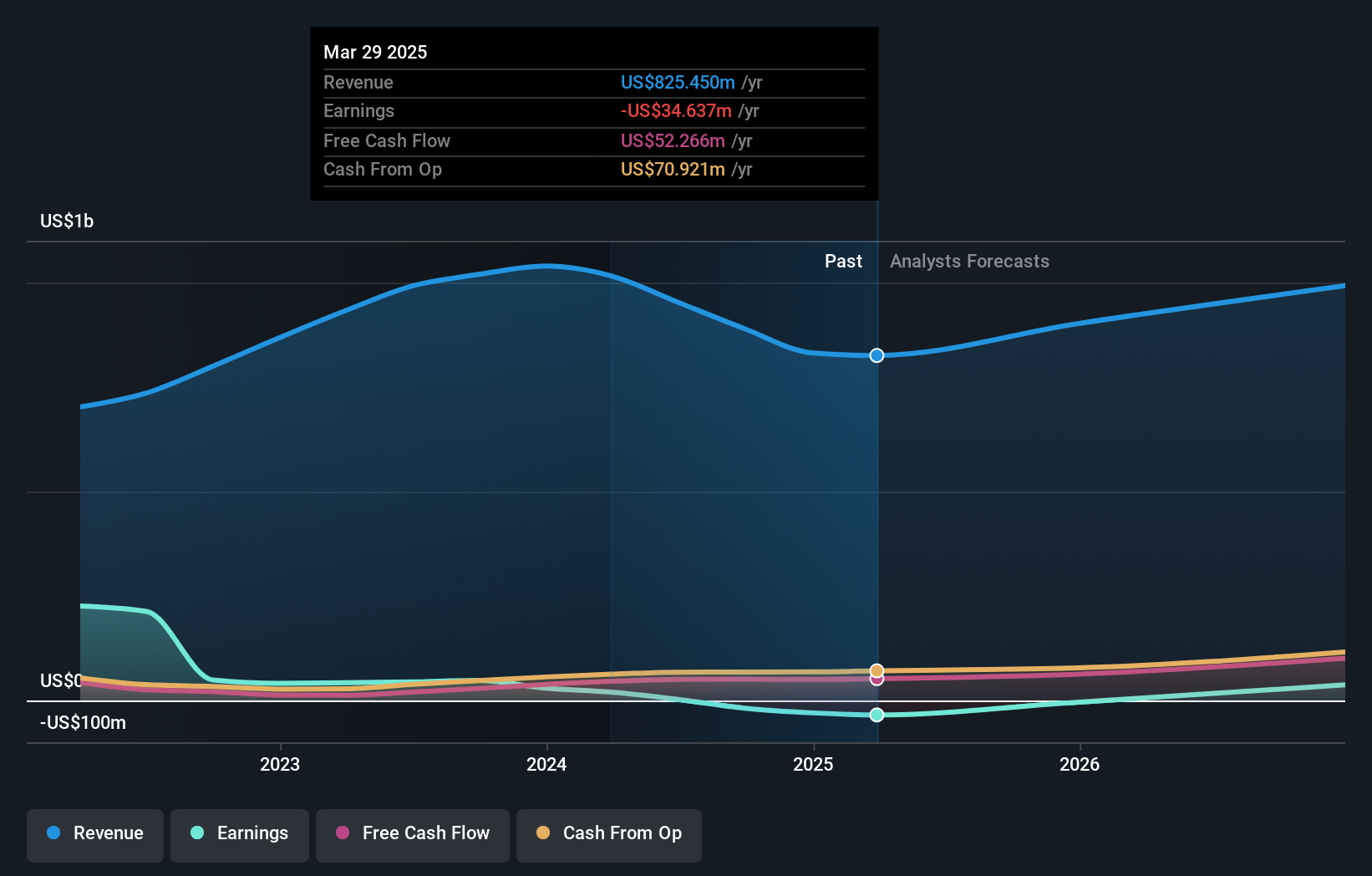

- ✅ Price vs Analyst Target: Calix trades at US$52.02 versus a US$75.00 analyst target, roughly 30% below consensus.

- ✅ Simply Wall St Valuation: Our model flags the shares as trading about 53% below estimated fair value.

- ❌ Recent Momentum: The 30 day return is a 4.3% decline, so the stock has been under short term pressure.

To explore whether it may be the right time to buy, sell or hold Calix, head to Simply Wall St's company report for the latest analysis of Calix's Fair Value.

Key Considerations

- 📊 HomeOfficeIQ and the upgraded Engagement Cloud tie Calix more tightly into service providers' workflows, which can influence contract longevity and upsell potential.

- 📊 Given a P/E of about 193 and a forward P/E near 75, many investors will watch how quickly subscription usage, revenue and EPS track toward the higher earnings forecasts.

- ⚠️ With a high earnings multiple and recent 30 day share price weakness, execution risk on these new products is key if sentiment turns on growth expectations.

Dig Deeper

For the full picture, including more risks and rewards, check out the complete Calix analysis. Alternatively, you can visit the community page for Calix to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.