يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Can Mirion Technologies' (MIR) Renewed Profitability Shift Its Long-Term Growth Narrative?

Mirion Technologies, Inc. Class A MIR | 26.85 | +1.17% |

- Mirion Technologies recently reported third quarter 2025 results, showing a return to profitability with US$223.1 million in revenue, and reaffirmed its full-year guidance for revenue growth of 7.0%–9.0% including acquisition and foreign exchange benefits.

- A key insight is the company's transition from a net loss to net income year-over-year, signifying strengthening operations while maintaining confidence in its outlook amid integration of recent acquisitions and favorable currency trends.

- We'll examine how Mirion Technologies' reaffirmed guidance and improved profits influence its investment narrative and future growth assumptions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Mirion Technologies Investment Narrative Recap

To be a Mirion Technologies shareholder, one must believe in the company’s ability to capitalize on increased nuclear power investment and recurring demand for its radiation monitoring solutions, while carefully managing the integration of recent acquisitions. The third quarter results, showing improved profitability and steady revenue expansion, reinforce the business outlook, but do not materially alter the most important short-term catalyst, order growth from global nuclear modernization, or the key risk, which remains execution risk around acquisition integration and sustained momentum in core nuclear markets.

Among recent announcements, the reaffirmed 2025 revenue growth guidance stands out as especially relevant, as it signals management’s ongoing confidence in momentum across both organic and acquisition-related initiatives. This guidance, which accounts for foreign exchange tailwinds and recent acquisitions, is central to investor expectations regarding both short-term growth potential and management’s ability to deliver on integration promises.

By contrast, investors should be aware that while Mirion is making the most of nuclear sector tailwinds, its reliance on ongoing modernization spending poses challenges if...

Mirion Technologies' narrative projects $1.1 billion revenue and $105.2 million earnings by 2028. This requires 7.9% yearly revenue growth and a $95.2 million earnings increase from $10.0 million today.

Uncover how Mirion Technologies' forecasts yield a $31.29 fair value, a 14% upside to its current price.

Exploring Other Perspectives

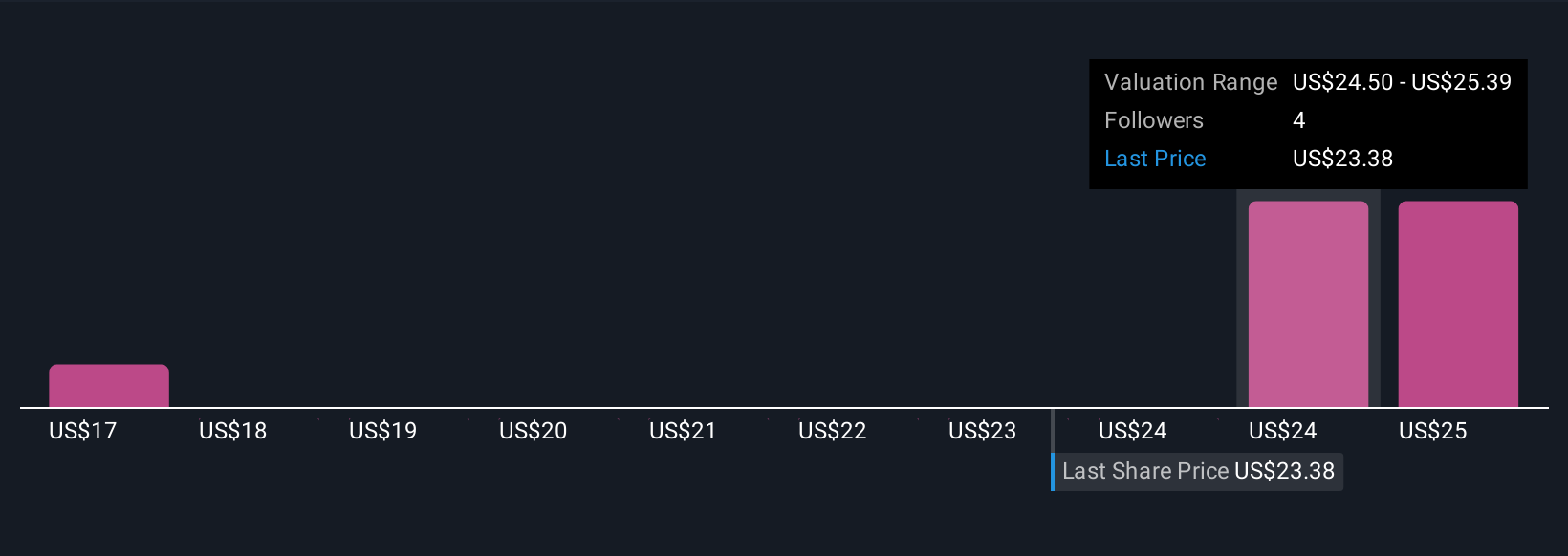

Fair value estimates from three Simply Wall St Community members range from US$17.35 to US$34.10 per share. Given ongoing acquisition integration is a central risk, these differing opinions highlight the importance of considering multiple viewpoints as you assess Mirion’s prospects.

Explore 3 other fair value estimates on Mirion Technologies - why the stock might be worth as much as 24% more than the current price!

Build Your Own Mirion Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mirion Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mirion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mirion Technologies' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.