يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

CareTrust REIT’s Record Investments Test A More Complex Growth Model

CareTrust REIT, Inc. CTRE | 40.05 | +0.28% |

- CareTrust REIT (NYSE:CTRE) reported a record US$1.8b of investments in its latest fiscal year.

- The company entered the UK care home market through the acquisition of Care REIT plc.

- CareTrust completed its first seniors housing operating (SHOP) sector deal, expanding its business model.

- The REIT reported nearly doubled net income and growth in normalized FFO, while doubling its professional team.

CareTrust REIT, a healthcare focused real estate investment trust, is leaning further into senior care and post acute facilities with a larger capital commitment and broader footprint. Alongside its core US portfolio, the company now has exposure to the UK care home market through the Care REIT plc acquisition and has added an operating component with its first SHOP transaction. For investors following healthcare real estate, this combination of new geography, asset types, and operating structure represents a notable shift in how NYSE:CTRE is positioning itself.

With a bigger balance sheet commitment, a larger team, and new operating relationships, CareTrust REIT now has more levers it can use as the senior housing and care sector evolves. For investors, key questions from here include how effectively the REIT integrates its UK platform, manages SHOP exposure alongside triple net leases, and funds future transactions without stretching its financial profile.

Stay updated on the most important news stories for CareTrust REIT by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on CareTrust REIT.

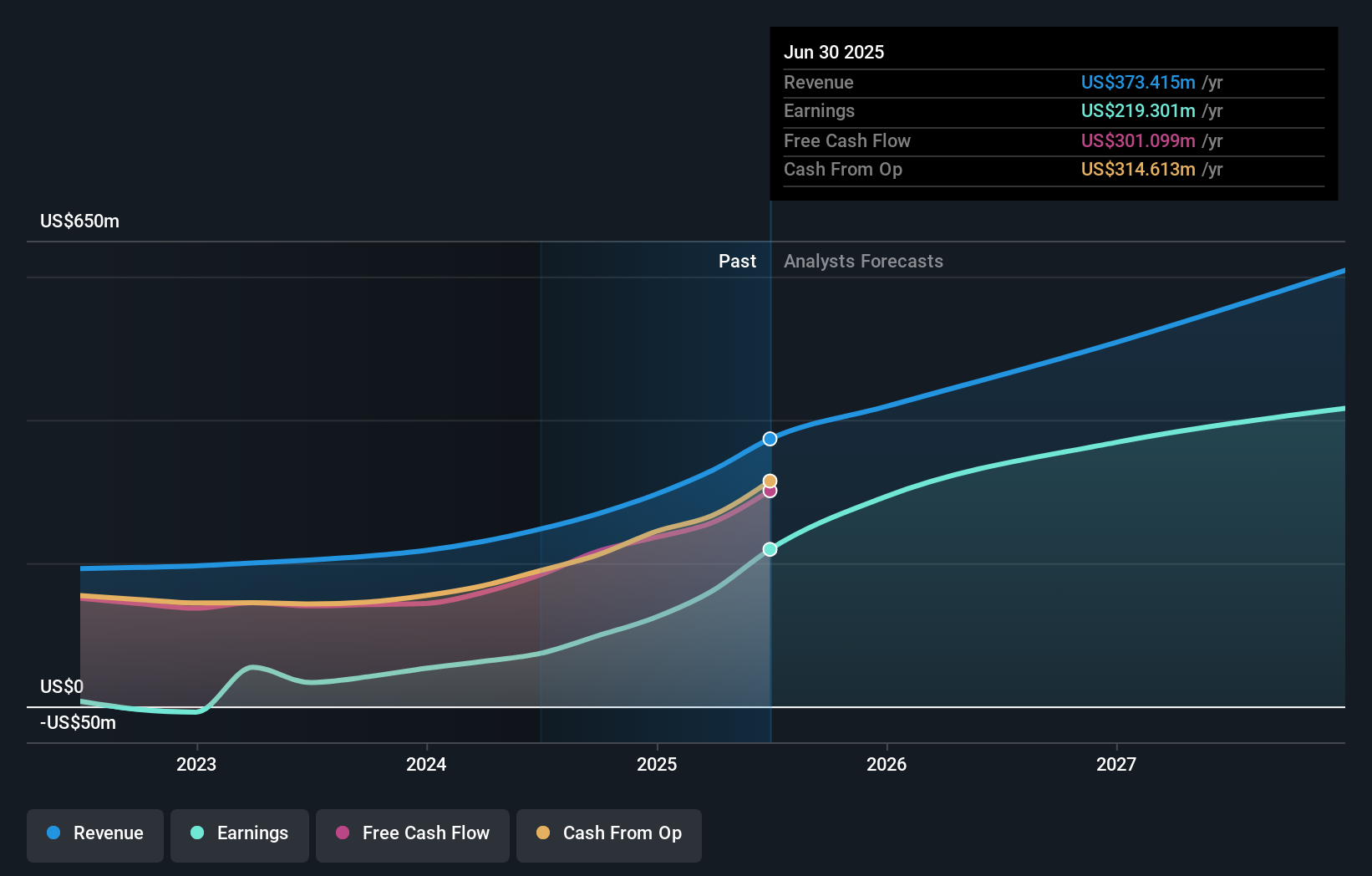

This update is really about CareTrust shifting from a relatively simple triple net landlord model toward a more complex, multi platform healthcare REIT. The US$1.8b of 2025 investments, entry into UK care homes, and first seniors housing operating (SHOP) deal give it more ways to grow income but also introduce more moving parts. The 2025 results show higher revenue, net income and funds from operations, and management is guiding to US$1.90 to US$1.95 FFO per share and US$1.45 to US$1.50 in net income per share for 2026. At the same time, some commentary points out that the 2026 FFO range sits below market expectations and that valuation metrics are already near historical highs. For you as an investor, the key question is whether the larger, more diversified platform and US$500m investment pipeline can justify that richer pricing given execution, regulatory and integration risks.

How This Fits Into The CareTrust REIT Narrative

- The record investment year, UK entry and SHOP platform all align with the narrative that acquisitions, portfolio diversification and a deeper team can support future growth in senior care and post acute assets.

- The faster expansion, higher upfront costs and larger exposure to regulated care markets echo the narrative’s concern that integration missteps, reimbursement changes or competition for assets could pressure earnings and margins.

- The move into SHOP operations and the scale of the current UK pipeline add operating and geographic complexity that may not be fully captured in earlier expectations focused more heavily on triple net leases.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for CareTrust REIT to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Dividend yield of 3.35% is flagged as not well covered by earnings, which could limit dividend flexibility if growth slows or costs rise.

- ⚠️ Shareholders have been diluted over the past year, and continued capital raising to fund acquisitions could further dilute per share outcomes.

- 🎁 CareTrust is flagged as trading at a discount to an estimate of fair value, which some investors may see as a potential margin of safety.

- 🎁 Earnings growth has been strong over the past year and is forecast to continue growing, supported by a larger portfolio across skilled nursing, senior housing and UK care homes.

What To Watch Going Forward

From here, you may want to track how quickly CareTrust stabilizes its new UK assets and the early performance of the Texas SHOP communities, including occupancy and operating margins. The 2026 FFO and income guidance sets a reference point, so any updates to that range will be important. Given comments that valuation sits near historical highs, the price you pay versus those cash flow targets also matters. It can help to compare execution and balance sheet discipline with peers like Welltower, Ventas and Sabra Health Care REIT, which are also active in senior housing and healthcare properties.

To ensure you're always in the loop on how the latest news impacts the investment narrative for CareTrust REIT, head to the community page for CareTrust REIT to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.