يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Central Garden & Pet (CENT) Margin Improvement Reinforces Bullish Profitability Narratives

Central Garden & Pet Company CENT | 39.67 | +1.51% |

Central Garden & Pet Q1 2026 Earnings Snapshot

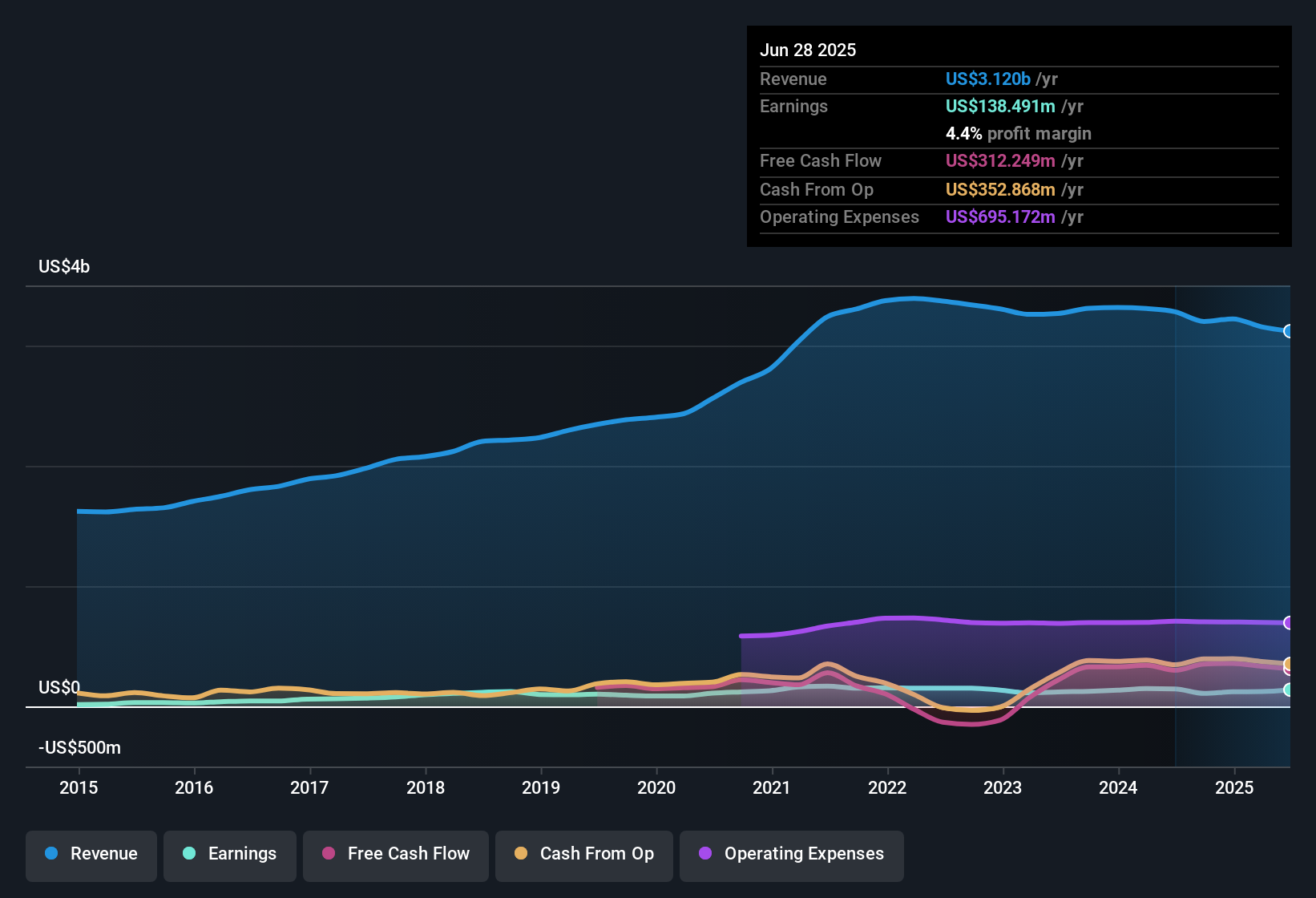

Central Garden & Pet (CENT) opened its 2026 financial year with Q1 revenue of US$617.4 million and basic EPS of US$0.11, against a backdrop of trailing 12 month EPS of US$2.50 on revenue of about US$3.1 billion. Over the past five reported quarters, revenue has moved from US$656.4 million in Q1 2025 to a high of US$960.9 million in Q3 2025 before landing at US$617.4 million this quarter. Quarterly EPS has ranged from a loss of US$0.52 in Q4 2024 to US$1.53 in Q3 2025 and US$0.11 in the latest period. With trailing net profit margins at 5% versus 3.8% a year earlier and earnings growth of 28.2% over the last 12 months, this update puts profitability and margin trends firmly in focus for investors watching how the story develops.

See our full analysis for Central Garden & Pet.With the latest earnings numbers on the table, the next step is to see how they line up against the main market narratives around Central Garden & Pet, highlighting where the data supports those views and where it starts to challenge them.

Margins Stabilize Around 5%

- On a trailing basis, Central Garden & Pet earned US$155.7 million of net income on US$3.1b of revenue, which works out to a 5% net margin compared with 3.8% a year earlier in the risk summary.

- Supporters of the more bullish angle around earnings resilience may point to this 5% margin and 28.2% trailing earnings growth, yet the data also show a five year earnings trend of a 2.3% annual decline, which means:

- The stronger recent margin level lines up with the idea of better profitability today, but the negative multi year earnings trend in the risk summary shows that this has not been a straight line.

- Anyone leaning bullish on profitability has to weigh the current 5% margin against that longer stretch where earnings, on average, moved in the opposite direction.

Valuation Gap Versus DCF Fair Value

- Shares trade at US$36.60 while the DCF fair value cited is US$106.86, and the trailing P/E of 14.6x sits below both peers at 19.6x and the household products industry at 17.6x.

- Backers of the bullish narrative around value often focus on this apparent discount, but the numbers give a more mixed picture:

- The roughly 65.7% gap between the share price and DCF fair value, together with the lower P/E than peers and industry, supports the idea that the market is pricing CENT more conservatively than those valuation markers.

- At the same time, forecasts in the risk summary show earnings growth of about 9.1% per year and revenue growth of 3.5% per year, both below the 10.3% market revenue comparator, which helps explain why a value gap can exist even with improving recent earnings.

Curious how this valuation story fits into the bigger picture for the stock, including growth assumptions and risks that other investors are watching? Curious how numbers become stories that shape markets? Explore Community Narratives

Slower Revenue Outlook Against Market

- Forward looking figures in the analysis show revenue expected to grow about 3.5% per year compared with a 10.3% revenue growth comparator for the wider US market, while earnings are forecast to grow roughly 9.1% per year.

- Investors who lean cautious often highlight this slower revenue profile, and the data give them several points to work with:

- The gap between 3.5% revenue growth and the 10.3% market comparator reflects a business that, based on the inputs, is not projected to expand as quickly as the broader set of US companies referenced.

- Even with 28.2% trailing earnings growth and the 9.1% earnings growth forecast, the five year earnings decline of 2.3% a year in the risk summary shows that headline EPS can move meaningfully without revenue keeping pace over longer stretches.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Central Garden & Pet's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Central Garden & Pet pairs a 5% net margin with slower 3.5% forecast revenue growth and below market expansion expectations, which may limit long term appeal for some investors.

If that slower growth profile has you looking for stronger long term upside potential, check out our 55 high quality undervalued stocks that highlight companies the market currently prices more cautiously than their fundamentals suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.