يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

C&F Financial (CFFI) Margin Improvement Reinforces Bullish Narratives Despite Mixed Long Term Earnings

C&F Financial Corporation CFFI | 80.03 80.03 | -1.19% 0.00% Pre |

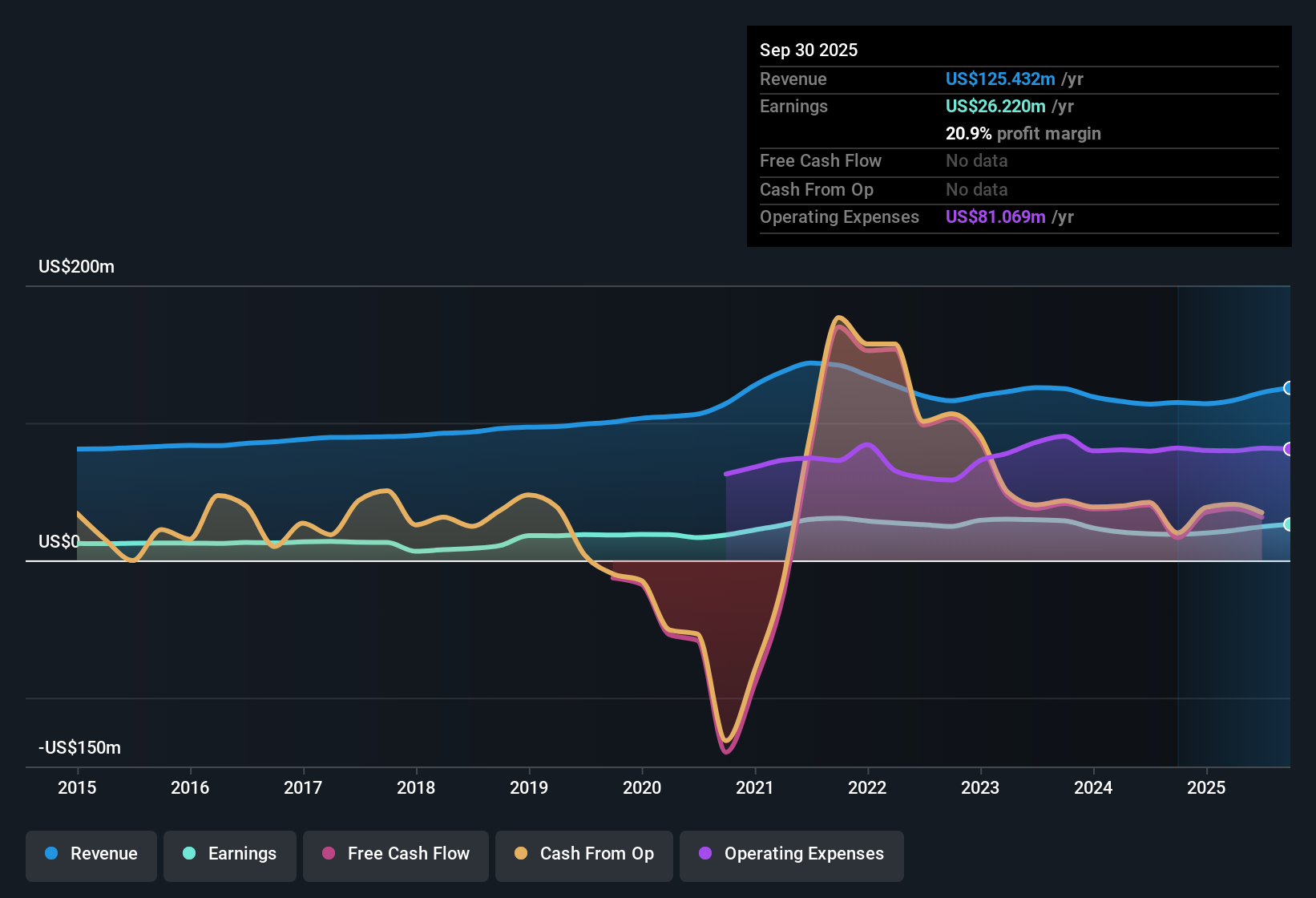

C&F Financial (CFFI) has wrapped up FY 2025 with fourth quarter total revenue of US$32.3 million and basic EPS of US$2.07, while trailing twelve month revenue came in at US$129.3 million and EPS at US$8.34, alongside 36.1% earnings growth over the year. Over recent quarters, total revenue has moved from US$28.5 million in Q4 2024 to US$34.3 million in Q2 2025 before settling at US$32.3 million in Q4 2025, with quarterly EPS ranging from US$1.66 in Q1 2025 to US$2.37 in Q2 2025. With net profit margin improving from 17.4% to 20.9% over the past year, the latest results point to a business where profitability metrics are central to how investors assess the current earnings print.

See our full analysis for C&F Financial.With the numbers on the table, the next step is to see how this profitability story lines up against the widely followed narratives around C&F Financial and where those views might be challenged by the latest data.

Loan book tops US$2.0b with rising TTM profits

- Total loans reached US$2,054.6 million at FY 2025 year end, alongside trailing twelve month net income of US$27.0 million and EPS of US$8.34.

- Supporters of a more optimistic view point to this combination of a larger loan book and higher trailing earnings, while the five year earnings decline of 4.1% a year gives cautious investors a counterpoint.

- On the supportive side, trailing revenue of US$129.3 million and a 36.1% earnings increase over the last year back the idea that recent performance is stronger than the long term average.

- Balancing that, critics focus on the 4.1% annual earnings decline over five years as a sign that the recent uplift may sit against a weaker longer history.

Net interest margin holding around 4.2%

- Net interest margin for FY 2025 quarterly periods ranged from 4.16% to 4.27%, with the trailing twelve month figure at 4.21%.

- Supporters of the optimistic angle argue that keeping margin near this 4.2% level, while total loans moved from US$1,943.3 million in Q1 2025 to US$2,054.6 million in Q4 2025, strengthens the case that recent profit quality is underpinned by core banking spreads rather than just one off factors.

- This view leans on the combination of a 20.9% net profit margin for the last year and US$26.99 million of trailing net income, which both sit above the prior year figures provided.

- At the same time, the 4.1% annualized earnings decline over five years keeps a check on how far that bullish angle can go, because it shows longer term profitability has not followed the same recent pattern.

P/E of 8.6x and 2.57% dividend yield

- The shares trade on a trailing P/E of 8.6x versus about 12x for peers and 11.8x for the US banks industry, with a 2.57% dividend yield and a cited DCF fair value of US$108.35 against a share price of US$71.67.

- What stands out for investors who focus on value is that this lower P/E and the gap between the DCF fair value and the current price sit alongside improved trailing profitability, while those concerned about the 4.1% five year earnings decline question how much weight to give that valuation gap.

- The reported 33.9% difference between the DCF fair value of US$108.35 and the US$71.67 share price, plus earnings growth of 36.1% over the last year, heavily supports the idea that the stock screens as inexpensive on trailing numbers.

- Against that, the same data set flags the multi year earnings decline as a major risk, which means the discounted P/E of 8.6x and the 2.57% dividend yield may be seen as compensation for a mixed growth history rather than a simple bargain.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on C&F Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

C&F Financial pairs recent earnings growth and a larger loan book with a 4.1% annual earnings decline over five years, which raises questions about long term consistency.

If that uneven track record makes you cautious, use our CTA_SCREENER_STABLE_GROWTH to focus on companies that already show steadier revenue and earnings, and consider those ideas.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.