يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Cirrus Logic (CRUS): Assessing Valuation After Recent Momentum in Semiconductor Sector

Cirrus Logic, Inc. CRUS | 122.52 | -2.78% |

Cirrus Logic (CRUS) shares saw movement today following investor reactions to the company’s recent trading activity and performance updates. Many are looking at how its valuation shapes up in light of the latest developments in the semiconductor sector.

Cirrus Logic’s share price has gathered momentum, climbing 9.05% over the last week and up 22.04% in the past three months, signaling a noticeable shift in sentiment among investors. Despite only a modest 1-year total shareholder return of 1.06%, the recent surge hints that optimism is building as the company responds to renewed interest across the semiconductor industry.

If you’re looking for more technology movers, consider checking out leading innovators on our high growth tech and AI stocks list in the following screener: See the full list for free.

With shares gaining traction and optimism building, the key question for investors becomes clear: Is Cirrus Logic still trading at an attractive value, or has the market already factored in its future prospects?

Most Popular Narrative: 40% Undervalued

With Cirrus Logic's fair value estimate set at $126.67, just above the last close price of $126.15, the market is nearly aligned with the latest narrative valuation. However, the reasoning behind this figure reveals why the outlook has shifted.

Cirrus Logic is expanding beyond its core smartphone audio business by increasing the value and breadth of its high-performance mixed signal solutions, particularly in areas like camera controllers, battery/power management, and sensing. This strategic diversification positions the company to capture new revenue streams and reduce customer concentration risk, which can drive higher revenue growth and bolster earnings stability over time.

Curious what underpins this premium? Analysts are betting on big product mix shifts and ambitious earnings projections by 2028 to support the valuation. The specific profit and margin estimates at play might surprise skeptics. Discover exactly how experts justify a price nearly matching today’s highs.

Result: Fair Value of $126.67 (UNDERVALUED)

However, continued dependence on a few major smartphone customers, as well as slower adoption of new AI-driven markets, could challenge Cirrus Logic's bullish outlook.

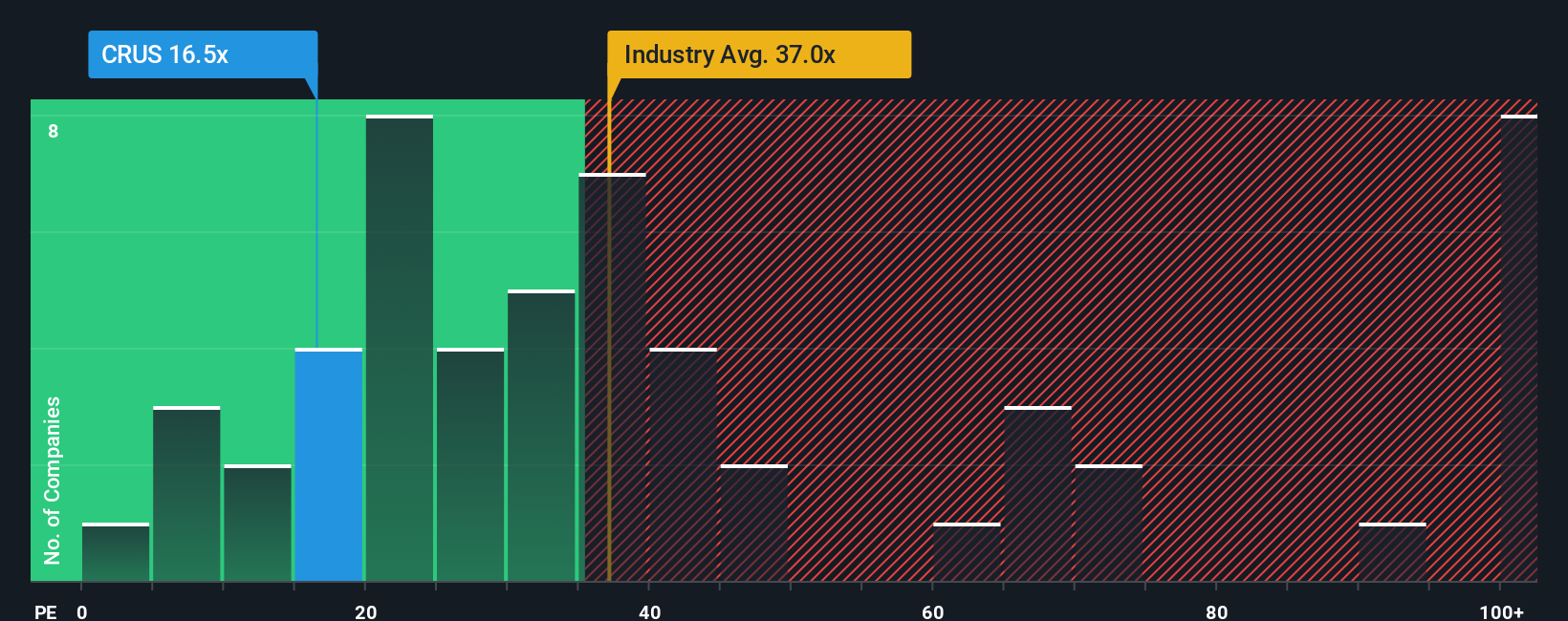

Another View: Comparing Multiples

While fair value estimates point to a slight undervaluation, Cirrus Logic’s price-to-earnings ratio of 18.5x is noticeably lower than both the US semiconductor industry average of 35.9x and the peer average of 51.2x. It is, however, just above its fair ratio of 18.2x. Does the market see hidden risks or could this signal overlooked potential?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cirrus Logic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cirrus Logic Narrative

If you see things differently or want to form your own perspective, you can dive into the details and build a personal thesis in just minutes. Do it your way

A great starting point for your Cirrus Logic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that great opportunities rarely wait. Use these tailored screeners to put yourself ahead of the crowd and uncover markets others may overlook.

- Spot undervalued companies with strong fundamentals by checking out these 878 undervalued stocks based on cash flows. See which stocks might be trading at a rare bargain.

- Target potential long-term income with these 18 dividend stocks with yields > 3%, where reliable payouts and healthy yields could strengthen your portfolio's returns.

- Stay ahead of the next wave in healthcare and artificial intelligence by tracking these 33 healthcare AI stocks. Find stocks innovating in some of the most exciting areas of medicine and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.